6 Proven Tips for Effective Vendor Risk Management and Mitigation

As businesses become more reliant on third-party vendors for essential goods and services, the risks tied to these vendor relationships grow in complexity. These risks span a range of areas, from cybersecurity threats, where a data breach at a vendor could compromise sensitive data, to financial instability, where a vendor's financial troubles could disrupt your entire production line.

For industries like financial services, healthcare, and education, where data privacy and regulatory compliance are paramount, the stakes are even higher.

This article will explore practical, advanced strategies for managing vendor risk, focusing on the specific tactics that Chief Information Security Officers (CISOs) and decision-makers in these sectors need to implement an effective risk management framework to secure their supply chains and ensure business continuity.

Key Takeaways

Identify and evaluate risks at every stage of the supply chain, from financial health to cybersecurity, to stay ahead of potential issues.

Reduce dependency on single vendors by diversifying across regions and vendors, minimizing the impact of disruptions caused by geopolitical, financial, or operational risks.

Use KPIs and digital tools to continuously monitor vendor performance, ensuring compliance and early detection of emerging risks.

Establish well-defined contingency plans for supply chain disruptions, including backup vendors, alternative logistics, and crisis communication strategies.

Develop transparent communication with vendors, aligning on expectations and risk mitigation strategies to ensure smooth operations even when challenges arise.

What is Vendor Risk Management?

Vendor risk management involves identifying, assessing, and mitigating risks from vendors, such as financial instability, cybersecurity vulnerabilities, regulatory non-compliance, and reputational damage. Risk Management ensures vendors meet obligations without introducing risks to your organization’s stability, security, or reputation.

In industries like financial services and healthcare, risk management is crucial for mitigating risks like data breaches, regulatory fines, and service disruptions. By incorporating risk management into your strategy, you enhance decision-making, protect customer trust, and ensure smoother operations. It's a continuous process that requires regular monitoring and adaptation to new risks.

As you implement the strategies for effective vendor risk management, ensuring compliance across all contracts is critical. Auditive’s Contract Monitor makes this easy by extracting key contract details and automatically flagging discrepancies or hidden risks. With real-time updates and proactive renewal reminders, you can stay on top of contract compliance and avoid unexpected issues.

Also Read: Banking Risk Management Framework (RMF) - Definition and Components

Now that we understand vendor risk management, let's explore why it's more essential than ever in today's supply chain environment.

Why Supply Chain Risk Management Is Important for Vendors

With the increasing complexity and interdependence of global supply chains, risk management is more important than ever. Here’s why:

1. Globalization and Interconnectedness

As businesses expand into new markets, their supply chains grow more complex and interconnected. One disruption in the supply chain, like natural disasters, political instability, or financial instability, can ripple across the entire organization.

2. Cybersecurity Threats

As businesses digitize their operations, they also open themselves up to cybersecurity risks. A vendor’s system can be a weak link in your cybersecurity chain.

3. Financial Stability of vendors

The financial health of a vendor is in today’s volatile market. Vendors facing financial difficulties may struggle to meet contractual obligations or go bankrupt, leading to supply disruptions.

Also Read: Creating a Third-Party Security Policy Guide

Vendor risks are becoming more complex, and in order to effectively manage them, it's important to understand their components.

4 Core Components of a Strong Vendor Risk Management Framework

A robust vendor Risk Management framework is the backbone of an effective risk management strategy. The following four components are essential for building a comprehensive approach:

1. Risk Identification and Assessment

Identify potential risks in your supply chain, including geopolitical instability, cybersecurity, and financial health. Assessing these factors ensures proactive risk management before issues arise.

2. Risk Evaluation and Prioritization

After identifying risks, evaluate their potential impact. Prioritize based on severity to ensure that risks like cybersecurity breaches are managed first, protecting your business from major consequences.

3. Risk Mitigation and Response

Develop strategies to mitigate risks, such as diversifying vendors or negotiating better contract terms. In the event of disruptions, having backup plans, such as different providers, guarantees business continuity.

4. Vendor Performance Management and Monitoring

Continuously monitor vendor performance through KPIs, audits, and evaluations. Tracking metrics like On-Time Delivery and Financial Health ensures ongoing compliance and identifies potential risks early, reducing the chance of disruptions.

Also Read: Understanding Common Security Frameworks: Examples and Types

With a solid framework in place, it's essential to understand the different types of vendor risks you may encounter.

9 Types of Vendor Risks with Examples

Vendor risks come in various forms, each with its own potential impact. Understanding and identifying these risks is vital to mitigating them effectively. Below are key types of vendor risks:

1. Cybersecurity Risk

Vendors with weak cybersecurity practices expose your organization to data breaches and cyberattacks. These vulnerabilities can compromise sensitive information or disrupt your operations.

Example: If a vendor’s system is breached, attackers could gain access to sensitive information or compromise your infrastructure, leading to potential data leaks or business interruptions.

2. Reputational Risk

Vendors involved in unethical practices can damage your brand’s reputation. Negative media coverage or public backlash can erode customer trust and harm your company’s image.

Example: A vendor's involvement in a high-profile scandal can result in negative media coverage and public backlash, ultimately damaging customer trust in your brand.

3. Concentration Risk

Relying heavily on a single vendor increases exposure to risk if that vendor faces disruptions. A supply chain issue with one vendor can significantly affect your business.

Example: During the 2020 semiconductor shortage, companies dependent on one vendor faced massive delays in production, disrupting their operations and affecting their bottom line.

4. Strategic Risk

When a vendor’s goals do not align with your company’s strategy, it can hinder your growth. A vendor’s inability to innovate may limit your market competitiveness.

Example: A vendor failing to innovate or adapt to market trends can hinder your company's competitiveness, causing delays in product development or outdated offerings.

5. Compliance Risk

Non-compliant vendors expose your business to legal and regulatory penalties. Vendors violating GDPR or HIPAA can cause legal issues and damage your reputation.

Example: A vendor violating GDPR or HIPAA regulations can lead to costly fines, legal disputes, and significant reputational damage, putting your business at risk of penalties and loss of credibility.

Also Read: PCI Audit Requirements and Preparation Steps

6. Operational Risk

Vendors who fail to meet delivery deadlines or quality standards create operational disruptions. These delays can affect your product timelines and impact customer satisfaction.

Example: A vendor failing to meet lead times could cause delays in your own production process, affecting your product launch dates or customer commitments.

7. Financial Risk

Financially unstable vendors may fail to meet their obligations or go bankrupt. This can halt production or delay supply, creating significant operational and financial challenges.

Example: A vendor experiencing financial instability may fail to deliver goods or services on time, causing delays or even halting production if they go bankrupt.

8. Contractual Risk

Ambiguous or unenforceable contract terms can lead to disputes and delays. Clear, well-defined agreements are essential to avoid misunderstandings and ensure smooth vendor relationships.

Example: Ambiguous clauses regarding delivery timelines or payment terms can lead to disputes and misunderstandings, ultimately damaging the vendor relationship and causing delays.

9. Geopolitical Risk

Vendors operating in politically unstable regions are exposed to risks from government changes or trade restrictions. These disruptions can halt supply or affect pricing, increasing uncertainty in the supply chain.

Example: A vendor operating in a politically unstable region may face interruptions due to civil unrest, government regulations, or trade restrictions, disrupting your supply chain and increasing uncertainty.

One of the most effective strategies for vendor risk mitigation is developing transparent relationships with your suppliers. Auditive’s Partner Trust Exchange allows you to access real-time, risk-relevant data from your entire supplier network. With continuous updates and tailored Trust Profiles, you can make better, more informed decisions about your vendor relationships, improving your overall risk management.

Once risks are understood, effective segmentation is key to managing them efficiently.

Vendor Risk Segmentation and Categorization

Effective vendor risk management requires categorizing vendors based on the level of risk they pose to your organization. This helps prioritize risk mitigation efforts and allocate resources accordingly. Common segmentation categories include:

High-Risk vendors: Vendors with high-risk exposure, requiring ongoing monitoring and contingency plans.

Medium-Risk vendors: vendors with moderate risk exposure, needing periodic assessments and performance checks.

Low-Risk vendors: vendors with minimal risk, generally stable, and requiring less frequent evaluations.

Also Read: ISO 27001 vs NIST: Key Differences Explained

Now that we’ve segmented vendor risks, let’s look at how to measure their impact using specific KPIs.

5 Key Vendor Risk Management KPIs You Need to Track

Key Performance Indicators (KPIs) are essential for tracking vendor risk and performance. Here’s an overview of the main KPIs for managing vendor risk:

1. Process KPIs

Order Processing / Cycle Time: Measures how efficiently a vendor processes orders from receipt to delivery.

Order Accuracy: Tracks the accuracy of orders, ensuring vendors fulfill the right quantity and quality of products.

2. Performance KPIs

On-Time Delivery Rate: Evaluates how reliably a vendor delivers products on schedule.

Vendor Lead Time: Assesses the time a vendor takes to fulfill an order, helping manage inventory and production planning.

3. Compliance KPIs

Regulatory Compliance Rate: Tracks vendor adherence to industry regulations, ensuring they meet legal and compliance standards.

Audit Findings: Measures the outcomes of vendor audits, highlighting areas of non-compliance.

4. Risk KPIs

Vendor Risk Score: A numerical score reflecting the overall risk posed by a vendor based on various risk factors.

Financial Health Indicators: Measures the financial stability of vendors, including debt ratios and profitability.

5. CSR/ESG KPIs

Sustainability Performance: Assesses the vendor’s environmental impact and adherence to sustainability practices.

Ethical Sourcing Rate: Tracks the percentage of materials sourced ethically, ensuring compliance with labor and environmental standards.

Also Read: How to Implement a Vendor Risk Management Program

With KPIs in hand, businesses can focus on addressing the most urgent aspects of vendor risk management.

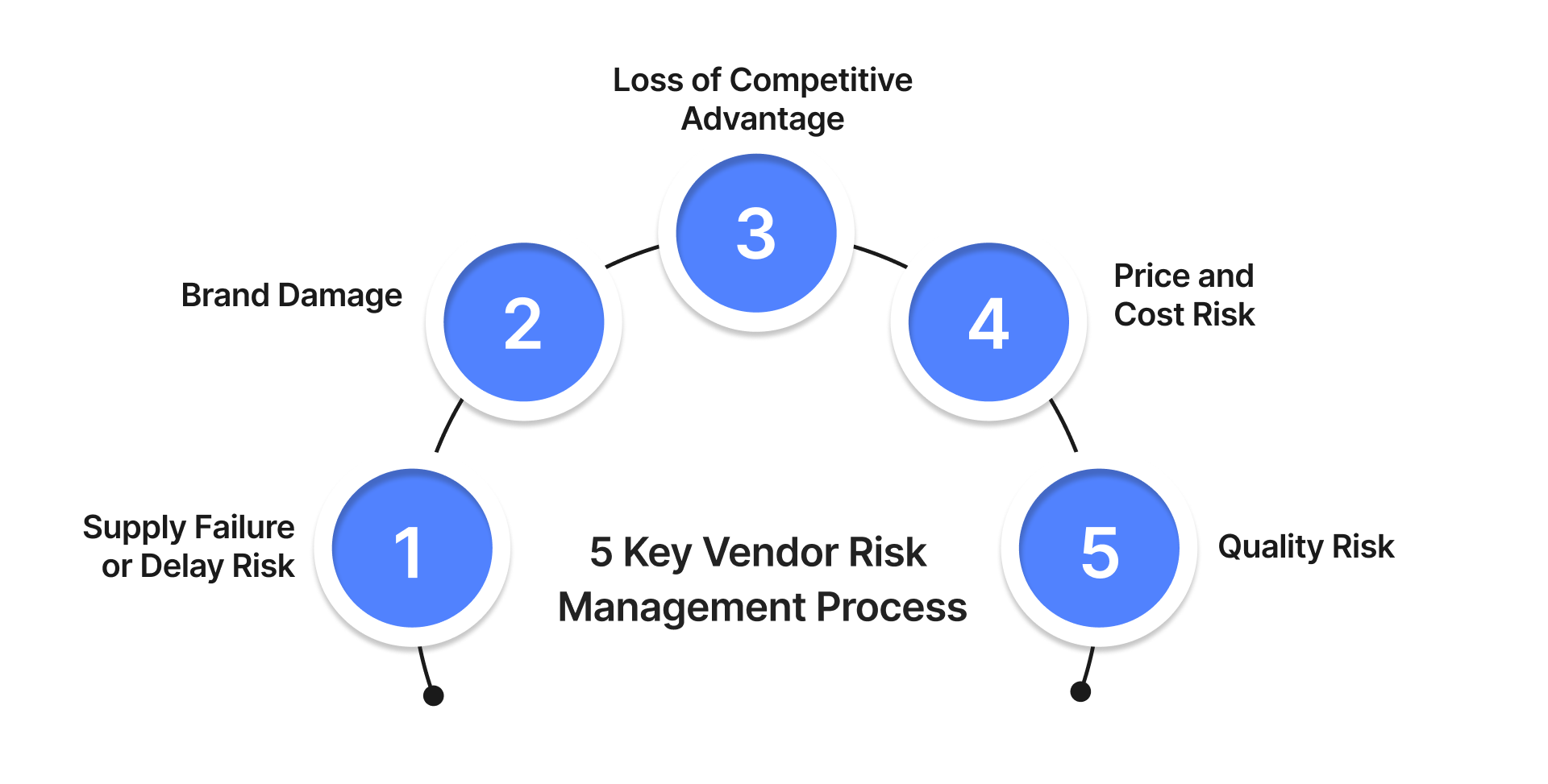

5 Key Vendor Risk Management Process Areas to Focus On

Vendor risk management focuses on mitigating key process risks that could disrupt operations:

1. Supply Failure or Delay Risk

Supply chain disruptions can significantly impact your production schedule. Managing vendor delays or failures involves having contingency plans, backup vendors, and clear communication channels in place.

2. Brand Damage

A vendor’s unethical practices can damage your brand. Regular audits and clear contractual obligations ensure that vendors align with your ethical standards, protecting your reputation.

3. Loss of Competitive Advantage

Over-relying on a single vendor can limit your innovation potential. Diversifying vendors ensures you access a variety of technologies and products, keeping your business competitive.

4. Price and Cost Risk

Fluctuating vendor prices can affect your margins. Negotiating long-term contracts with fixed pricing can help mitigate the risk of cost increases.

5. Quality Risk

Inconsistent product quality from vendors can impact your brand’s integrity. Establishing quality control measures and clear performance expectations ensures vendors meet your standards.

Also Read: Understanding Third-Party Vendor Risk Management

To tackle these challenges, businesses need a structured process for managing vendor risks.

6-Step Guide to Managing Vendor Risks

Managing vendor risk requires a systematic, proactive approach to identify, assess, and address potential threats that can disrupt your business operations. By following a structured process, you ensure that risks are effectively mitigated and your supply chain remains resilient.

1. Identify Risks

Evaluate each vendor's potential risks, including financial, operational, and compliance-related factors. Consider risks related to cybersecurity, geopolitical instability, and environmental sustainability, as these factors may impact the overall supply chain stability.

2. Evaluate and Prioritize

Assess each risk based on its potential impact on your operations and prioritize accordingly. Focus on the most serious risks, such as those that could cause significant financial loss or regulatory violations, and allocate resources to mitigate them first.

3. Mitigate Risks

Develop strategies such as diversifying vendors, negotiating contracts, and setting up contingency plans to mitigate identified risks. Also, include risk-sharing mechanisms, like insurance or performance bonds, in contracts to protect against potential vendor defaults or disruptions.

4. Monitor Performance

Continuously monitor vendor performance using KPIs, audits, and regular reviews to track compliance and identify emerging risks. Implement automated monitoring tools to track real-time performance metrics and flag potential deviations early.

5. Engage in Regular Communication

Establish frequent communication channels with vendors to stay updated on changes that could impact performance, such as financial instability or operational challenges. This helps you anticipate risks and adjust your strategy accordingly.

6. Establish Clear Risk Ownership

Assign responsibility for risk management to specific team members or departments. Ensure that everyone involved understands their role in identifying, assessing, and mitigating risks to ensure a coordinated and proactive approach.

Also Read: SOC vs SOX: Understanding Key Differences

Next, let's explore strategies that can further mitigate supply chain risks.

6 Strategies to Mitigate Vendor Risk and Strengthen Your Supply Chain

Mitigating supply chain risks involves implementing targeted strategies that address specific vulnerabilities and strengthen your overall supply chain. To effectively mitigate supply chain risks, consider these strategies:

1. Diversify Your Vendor Base

Avoid over-reliance on any single vendor to reduce concentration risk. Expanding your vendor network across different geographic regions and industries helps protect your supply chain from local disruptions or vendor-specific issues.

2. Strengthen Relationships

Build strong, transparent relationships with key vendors to enhance communication and collaboration. Regularly engage with your vendors to understand their challenges, align on expectations, and jointly work on solving potential issues before they escalate.

3. Use Technology

Make use of digital tools to automate risk monitoring and performance tracking, ensuring quick responses to emerging issues. Implementing advanced technologies such as AI-driven predictive analytics can help identify risks before they impact your operations.

4. Create Contingency Plans

Develop contingency plans for supply chain disruptions, including alternative vendors and backup inventory. Having a clear action plan for unexpected events, such as natural disasters or geopolitical conflicts, ensures business continuity.

5. Implement vendor Audits

Conduct regular vendor audits to assess compliance with regulatory requirements and internal policies. Auditing vendor processes, from security practices to financial health, helps identify weaknesses that could lead to potential disruptions or legal issues.

6. Establish Risk Tolerance Levels

Set clear thresholds for acceptable risk levels in vendor relationships. This helps to quickly evaluate which vendors pose a greater risk to your business and prioritize mitigation actions accordingly.

Also Read: 5-Step Guide to Vendor Due Diligence and Risk Assessment

To bring these strategies to life, using the right tools can make all the difference.

How Can Auditive Help Your Vendor Risk Strategy and Strengthen Your Supply Chain Security

Auditive offers a comprehensive Third-Party Risk Management (TPRM) platform designed to help businesses assess, monitor, and mitigate vendor risks at scale. By integrating real-time risk monitoring and transparency into your supply chain risk management strategy, Auditive makes it easier to ensure your vendors meet your security and compliance standards.

Here’s how Auditive helps implement practical tactics to manage supply chain risks:

Contract Monitor: Auditive’s Contract Monitor ensures supplier adherence to contracts by flagging discrepancies, missed SLAs, and regulatory deviations, allowing you to stay proactive in managing risks across your vendor network.

Partner Trust Exchange: With the Partner Trust Exchange, you gain access to a dynamic, real-time network where suppliers create Trust Profiles, offering continuous updates and transparency, ensuring informed decision-making during vendor evaluations.

Accelerated Intake Form: The Accelerated Intake Form automates the onboarding of new vendors, instantly measuring their inherent risk exposure and streamlining the data collection process for faster, more efficient supplier evaluations.

Questionnaire Copilot: Auditive’s Questionnaire Copilot uses AI to automatically complete RFPs and risk questionnaires with high accuracy, reducing time spent and ensuring thorough responses from vendors for more effective risk assessments.

Supplier Risk Assessment Agent: The Supplier Risk Assessment Agent speeds up risk evaluations, automating the review of third-party documentation and providing actionable insights to identify and mitigate potential risks faster and more accurately.

Supply Chain Continuous Monitoring: Auditive’s Supply Chain Continuous Monitoring tracks real-time incidents and updates your risk exposure, ensuring ongoing management of supply chain risks and allowing quick responses to disruptions or security threats.

Discover how Auditive helped Checkr save hours of work, allowing them to focus on high-priority tasks with ease; access the full case study here.

By using these Auditive solutions as part of your vendor risk management and mitigation strategy, you can ensure a more secure, resilient, and compliant supply chain while minimizing risks associated with third-party vendors.

Conclusion

Effective vendor risk management is non-negotiable for organizations looking to mitigate risks and ensure smooth business operations. By identifying and evaluating potential risks, from cybersecurity vulnerabilities to regulatory non-compliance or financial instability, organizations can take proactive steps to reduce the likelihood of disruptions.

To truly implement effective vendor risk management, integrating continuous monitoring and transparent vendor evaluations is key. With Auditive, you can track contract compliance in real time and gain continuous access to risk-relevant information from your entire vendor network. Our solutions provide the proactive monitoring and insights you need to stay ahead of potential risks, ensuring that every vendor relationship is secure.

Reach out to Auditive today to implement these practical tactics for mitigating supply chain risks and improving your overall risk management framework.

FAQs

1. How can I evaluate the cybersecurity posture of a vendor in the financial services sector?

Assess a vendor’s security certifications, encryption standards, breach history, and response protocols. Ensure compliance with industry-specific regulations like PCI-DSS or SOC 2.

2. What are the key financial health indicators to assess during vendor risk management in healthcare?

Look at profitability, debt-to-equity ratio, cash flow stability, and regulatory fines. Assess if a vendor can withstand financial pressures without disrupting services.

3. How do I assess the geopolitical risk of a vendor based in an unstable region?

Evaluate the vendor’s contingency plans, their exposure to local political events, and potential trade barriers. Consider alternative vendors to mitigate risks from regional instability.

4. What operational risk management strategies should I use for a vendor heavily reliant on third-party logistics?

Assess their logistics partners’ reliability, backup plans for transportation disruptions, and inventory management strategies. Diversify logistics providers to reduce dependency on one channel.

5. How can I monitor vendor compliance with GDPR regulations in a cross-border supply chain?

Ensure vendors sign Data Processing Agreements (DPAs), verify compliance with GDPR principles, and conduct regular audits to confirm adherence to data protection standards.