Third-Party Risk Management Market Size and Growth Trends

Vendor ecosystems have expanded faster than most organizations can monitor, bringing new efficiencies but also layers of operational, financial, and security risk. As businesses continue to rely on external partners for core operations, third-party risk management (TPRM) has moved from a checklist activity to a strategic requirement.

The market growth reflects this shift clearly. The global TPRM market was valued at approximately USD 7.42 billion in 2023, and the demand for scalable, technology-driven risk management solutions continues to accelerate through 2030.

This blog breaks down the numbers, trends, and forces shaping the Third-Party Risk Management Market Size and Growth Trends, giving you a clear view of where the market is heading, and why enterprises must reassess how they manage vendor-related risks.

Core Message

The third-party risk management market is growing rapidly, with forecasts reaching USD 33.5B by 2035.

Key drivers: cybersecurity threats, digital transformation, and AI/ML innovations.

Common challenges: high implementation costs and data privacy concerns.

Modern TPRM solutions like Auditive provide real-time monitoring, automated assessments, and centralized vendor intelligence.

Moving from reactive to proactive risk management is critical for operational resilience and strategic advantage.

Current Market Size: What the Numbers Say

The third-party risk management (TPRM) market has reached a critical inflection point, backed by fast-growing vendor ecosystems and tighter regulatory oversight. While market valuations vary across research firms, they all point to the same conclusion: TPRM is scaling rapidly.

The market between USD 7.42 billion and USD 8.57 billion in 2023–2024, reflecting strong enterprise spending on vendor oversight, cloud security, and compliance automation. This is one of the most widely referenced baselines because it accounts for major global verticals, including BFSI, healthcare, and IT.

Other analyzes present slightly different estimates to highlight different methodologies and perspectives: some place the market at around USD 6.1 billion in 2023, emphasizing rising cyber-risk exposure and regulatory pressures, while others estimate closer to USD 5.4 billion in 2024, considering broader enterprise risk management adoption cycles.

These differences aren’t contradictions, they highlight how research firms use different methodologies, industry scopes, and forecasting variables. Even with the variance, the data consistently shows a multi-billion-dollar market accelerating year over year, reinforcing the growing need for structured third-party risk programs.

CAGR & Growth Projections, What Different Analysts Forecast

Different research firms project strong but varied growth for the global Third-Party Risk Management (TPRM) market, and the spread in these numbers says a lot about how analysts view the pace of adoption across industries.

Grand View Research estimates a 15.7% CAGR between 2024 and 2030, reflecting steady demand as organizations shift from manual vendor oversight to structured, tech-enabled risk programs.

Technavio projects a faster curve with an 18.5% CAGR from 2025 to 2029, driven largely by increased reliance on digital supply chains and the adoption of automated risk-scoring tools. Their model leans heavily on technology-led demand acceleration, which explains the sharper growth line.

On the conservative side, Market Research Future (MRFR) forecasts a 6.21% CAGR between 2025 and 2035. MRFR uses a broader time horizon and incorporates slower-moving sectors and emerging markets into its modeling, resulting in a more tempered estimate.

Research Nester falls close to Grand View, projecting ~15.3% CAGR from 2026 to 2035, with the TPRM market expected to reach USD 33.55 billion by 2035. Their analysis gives more weight to long-term regulatory tightening and increasing vendor-related cyber incidents.

For additional perspective, Future Market Insights anticipates a 12.9% CAGR through 2035, slotting their estimate in the mid-range and aligning with gradual but consistent enterprise-wide adoption.

Why These Differences Matter

Each firm’s projection reflects the assumptions behind its model:

Time horizons vary, shorter forecasts often show faster acceleration.

Sector weighting differs, tech-driven markets show higher growth than industries still modernizing.

Adoption readiness plays a role, some analysts factor in rapid AI-based platform adoption; others expect slower transitions.

Geographic emphasis shifts findings, regions with stronger regulatory pressure skew higher in CAGR.

Understanding these differences gives organizations a clearer view of the market’s trajectory. Despite the spread in numbers, all models point to the same conclusion: TPRM is moving from a compliance checkbox to a core operational requirement, and the market will continue expanding as vendor ecosystems grow more complex.

Key Growth Drivers: Why the Third-Party Risk Management Market Is Expanding

1. Escalating Risk Exposure Across Vendor Ecosystems

Enterprises are expanding their vendor footprint across SaaS platforms, IT partners, cloud providers, outsourced operations, and niche service suppliers. This expansion widens the attack surface dramatically.

Data breaches linked to third parties continue to rise, pushing companies to adopt structured TPRM programs.

Regulatory expectations around vendor oversight have tightened across sectors like BFSI, healthcare, and government.

Organizations are now responsible not just for their own security posture but also for the posture of every connected entity.

This surge in external dependency as one of the strongest catalysts driving the demand for centralized, automated TPRM solutions.

2. Adoption of AI-Driven and Automated Risk Intelligence

Manual vendor assessments and spreadsheet-based tracking cannot keep up with modern risk velocity. This is why the market is shifting heavily toward advanced technologies:

AI and machine learning models are now widely used for continuous monitoring, automated risk scoring, vendor profiling, and anomaly detection.

NLP-based tools are being used to scan documents, contracts, and certifications to flag potential compliance or security issues.

Predictive analytics helps businesses anticipate vendor failures, cyber vulnerabilities, and reputational risks before they escalate.

AI-enabled TPRM is a core engine behind the market’s multi-year growth momentum.

Must Read: Guide to Effective Reputation Risk Management and Mitigation

3. Acceleration Toward Cloud-Based TPRM Platforms

Cloud deployments are outpacing on-premises adoption for several reasons:

Faster implementation and easier scaling

Lower total cost of ownership (TCO)

Ability to integrate seamlessly with ERP, GRC, IAM, SIEM, and workflow tools

Continuous updates and automated functionality improvements

Cloud delivery models are gaining double-digit growth because enterprises want flexible, centralized platforms that support global vendor networks.

4. Intensifying Supply Chain Networks and Multi-Layer Vendor Environments

Modern supply chains involve a complex web of:

Third parties

Fourth parties (vendors of vendors)

Fifth parties (sub-outsourced layers)

Every added layer creates new visibility gaps. Businesses need tools that can trace dependencies, map vendor relationships, and track risk propagation across interconnected ecosystems.

This complexity is a major reason TPRM solutions are shifting from periodic assessments to real-time monitoring frameworks, which significantly increases market demand.

Learn more about: AI in Supply Chain Risk Management Strategies

Market Segmentation Trends

The third-party risk management market is expanding across multiple segments, shaped by rising AI/ML adoption, cloud migration, and stronger regulatory expectations.

By Component

Solutions remain the dominant segment, driven by the need for automation, real-time monitoring, and centralized risk workflows.

Services continue to grow as companies look for support in scaling vendor due-diligence and ongoing monitoring.

By Deployment Mode

Cloud deployments lead the market as organizations prefer scalability, faster updates, and lower infrastructure overhead.

On-premises adoption persists mainly in highly regulated or legacy-bound environments.

By Organization Size

Large enterprises account for the biggest share due to complex vendor ecosystems and stringent risk requirements.

SMEs are accelerating adoption as digital operations broaden their exposure to third-party risks.

By Industry Vertical

BFSI, healthcare, IT & telecom, and retail remain the highest-adopting sectors, reflecting their large vendor networks and sensitivity to data breaches, reputational impact, and operational disruptions.

| Segment Type | Key Categories | Market Share (%) | Notes |

|---|---|---|---|

| Component | Solutions | 59 | Dominates TPRM adoption |

| Component | Services | 41 | Growing due to advisory needs |

| Deployment | Cloud | 55 | Faster adoption, scalable |

| Deployment | On-Premises | 45 | Used by traditional enterprises |

| Industry | BFSI | 28 | Early adopter, high risk focus |

| Industry | Healthcare | 22 | Critical data & compliance needs |

| Organization | Large Enterprises | 65 | Leading adoption |

| Organization | SMEs | 35 | Rapidly increasing |

Between 2024–2029, the market is expected to grow heavily due to AI and machine learning capabilities that enhance real-time risk scoring and automated assessments. While open-source tools offer cost advantages, they often lack advanced features and can limit risk-mitigation effectiveness, pushing companies toward more mature, enterprise-grade solutions.

The market is moving fast toward cloud-first, automated, and AI-enabled risk oversight. Auditive supports this shift with real-time monitoring and scalable, automated vendor-risk workflows.

Regional Market Views

The demand for third-party risk management varies across regions, but the growth pattern is consistent: organizations everywhere are expanding their vendor ecosystems and tightening their oversight frameworks.

North America

North America continues to hold the largest share of the global TPRM market, accounting for roughly 38–39% of the total market. Mature regulatory structures, higher adoption of automated GRC platforms, and the presence of established TPRM vendors drive this dominance.

Europe

Europe shows stable growth supported by stringent data governance requirements and sector-specific oversight in financial services, healthcare, and critical infrastructure. The region’s regulatory environment drives organizations to adopt structured, auditable TPRM frameworks.

Asia-Pacific

Asia-Pacific is the fastest-growing region, fuelled by rapid digitization, cloud adoption, and increasingly complex supply chains. As businesses scale across borders, demand for real-time vendor monitoring and standardized risk programs continues to rise.

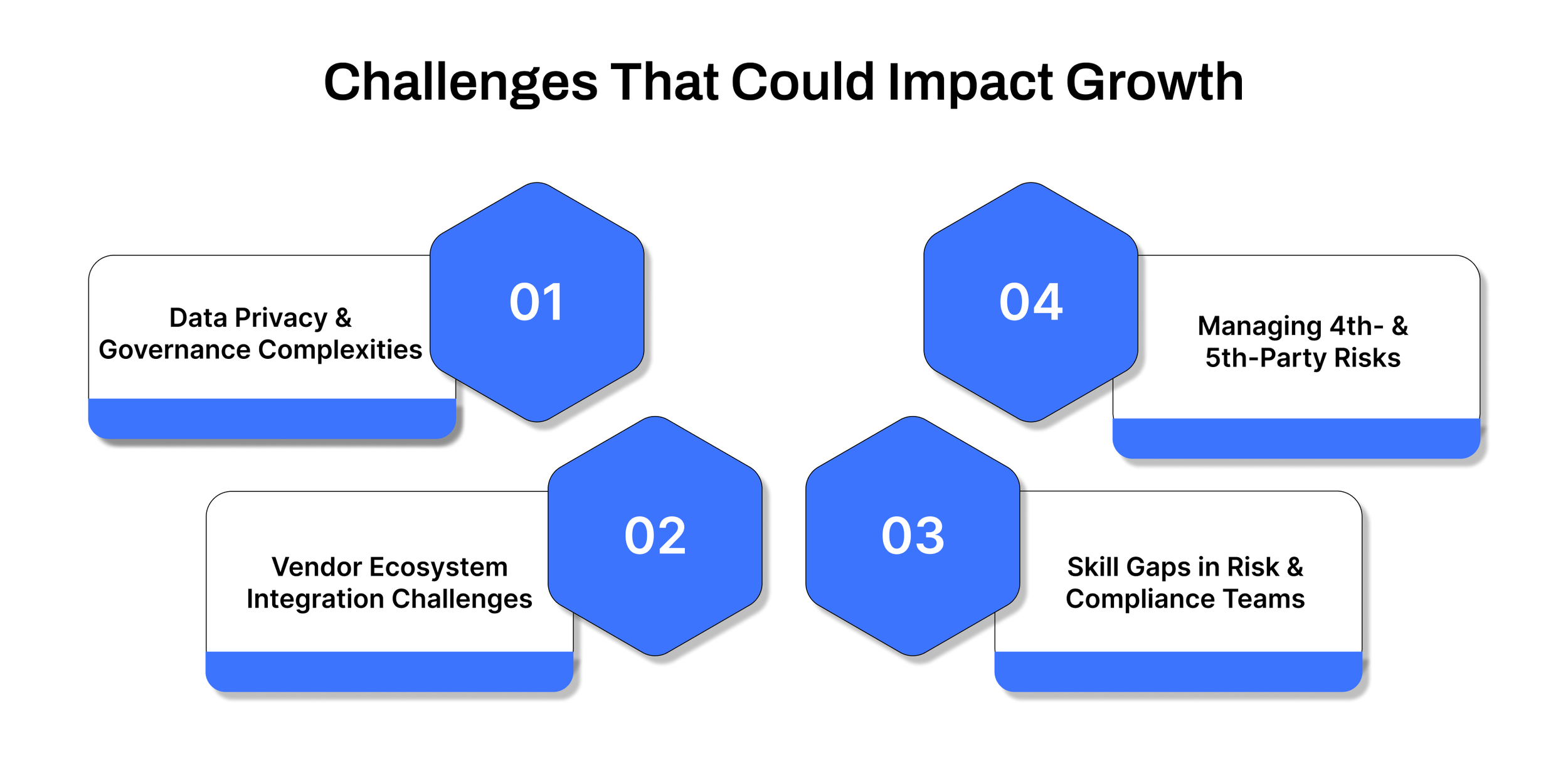

Challenges That Could Impact Growth

Even with strong demand and rising adoption, the third-party risk management market faces several structural challenges that influence how fast organizations can scale their programs.

1. Data Privacy and Governance Complexities

With vendors handling sensitive customer and operational data, businesses must navigate evolving privacy rules, consent requirements, and jurisdictional restrictions. Many organizations still lack a unified method to evaluate how vendors store, process, and protect data, creating friction in TPRM adoption.

Also read: Understanding Data Leak Prevention: Key Benefits and Practices

2. Integration Difficulties Across Diverse Vendor Ecosystems

Companies today rely on dozens or even hundreds of partners. Each uses different systems, compliance standards, and risk reporting formats. This fragmentation creates integration bottlenecks, slowing the implementation of centralized TPRM platforms and limiting data visibility across the supply chain.

3. Skill Gaps in Risk and Compliance Teams

A shortage of trained TPRM professionals makes it difficult for organizations to build mature programs. Many teams operate with limited resources while dealing with increasing regulatory pressure, expanding vendor lists, and more sophisticated threat vectors. This operational strain is a major barrier to rapid TPRM market growth.

4. Managing 4th- and 5th-Party Risks

Most organizations still struggle to identify and monitor downstream vendors. These opaque, multi-layered relationships create blind spots, from subcontractors handling critical workflows to external service dependencies buried deep in the supply chain. Research Nester highlights this complexity as one of the most persistent challenges slowing TPRM maturity.

These challenges highlight why organizations need a platform that brings clarity to fragmented vendor ecosystems.

Auditive bridges this gap with centralized visibility, continuous risk monitoring, automated assessments, and a single source of truth for vendor oversight, helping teams overcome the operational hurdles that traditionally slow TPRM growth.

Market Opportunities & Future Trends

The third‑party risk management market is rapidly evolving, with innovation driven by technologies that do more than simply track compliance. Key trends shaping future growth include:

1. AI and Predictive Analytics

AI is transforming risk management from reactive to proactive by:

Identifying potential vendor risks before they materialize

Prioritizing mitigation actions based on predictive modeling

Spotting complex patterns across multiple data sources

Advanced analytics enable teams to stay ahead of threats rather than responding after an incident, improving decision-making and operational resilience.

2. Blockchain and Automated Compliance Workflows

Blockchain and automation are enhancing transparency and efficiency:

Creating tamper-proof audit trails for vendor certifications

Streamlining onboarding and compliance verification

Reducing manual errors in workflow processes

These technologies simplify audits and make regulatory verification faster and more reliable.

3. Real-Time Risk Monitoring Platforms

Continuous monitoring is replacing periodic assessments by:

Delivering live insights into vendor performance and risk signals

Allowing immediate action on emerging threats

Integrating threat intelligence feeds for dynamic oversight

This approach ensures organizations respond swiftly to changes across increasingly complex vendor networks.

4. Integration with Broader GRC and Enterprise Risk Platforms

Third-party risk management works best when connected to enterprise-wide systems:

Unified dashboards for enterprise and third-party risk visibility

Consolidated reporting for faster decision-making

Seamless workflow integration with procurement, audit, and compliance teams

This integrated approach supports holistic risk management across the organization.

Auditive leverages these innovations to deliver real-time, actionable insights with AI-driven assessments and automated workflows.

Third-Party Risk Management Market Snapshot

| Attribute | Details |

|---|---|

| Base Year | 2023 / 2025 |

| Market Size (Base Year) | USD 6.1 Billion (2023) / USD 8.08 Billion (2025) |

| Forecast Period | 2024–2032 / 2026–2035 |

| CAGR (Forecast Period) | 15% (2024–2032) / 15.3% (2026–2035) |

| Market Size (Forecast Year) | USD 22.4 Billion (2032) / USD 33.55 Billion (2035) |

| Key Growth Drivers |

|

| Pitfalls & Challenges |

|

| Regional Scope |

|

How Auditive Enhances Third‑Party Risk Management

As organizations scale their vendor ecosystems, static checklists and manual reviews no longer provide the visibility or speed needed to manage third‑party risk effectively. Auditive tackles these challenges with a modern, AI‑driven approach designed for real‑time insight, continuous oversight, and streamlined workflows.

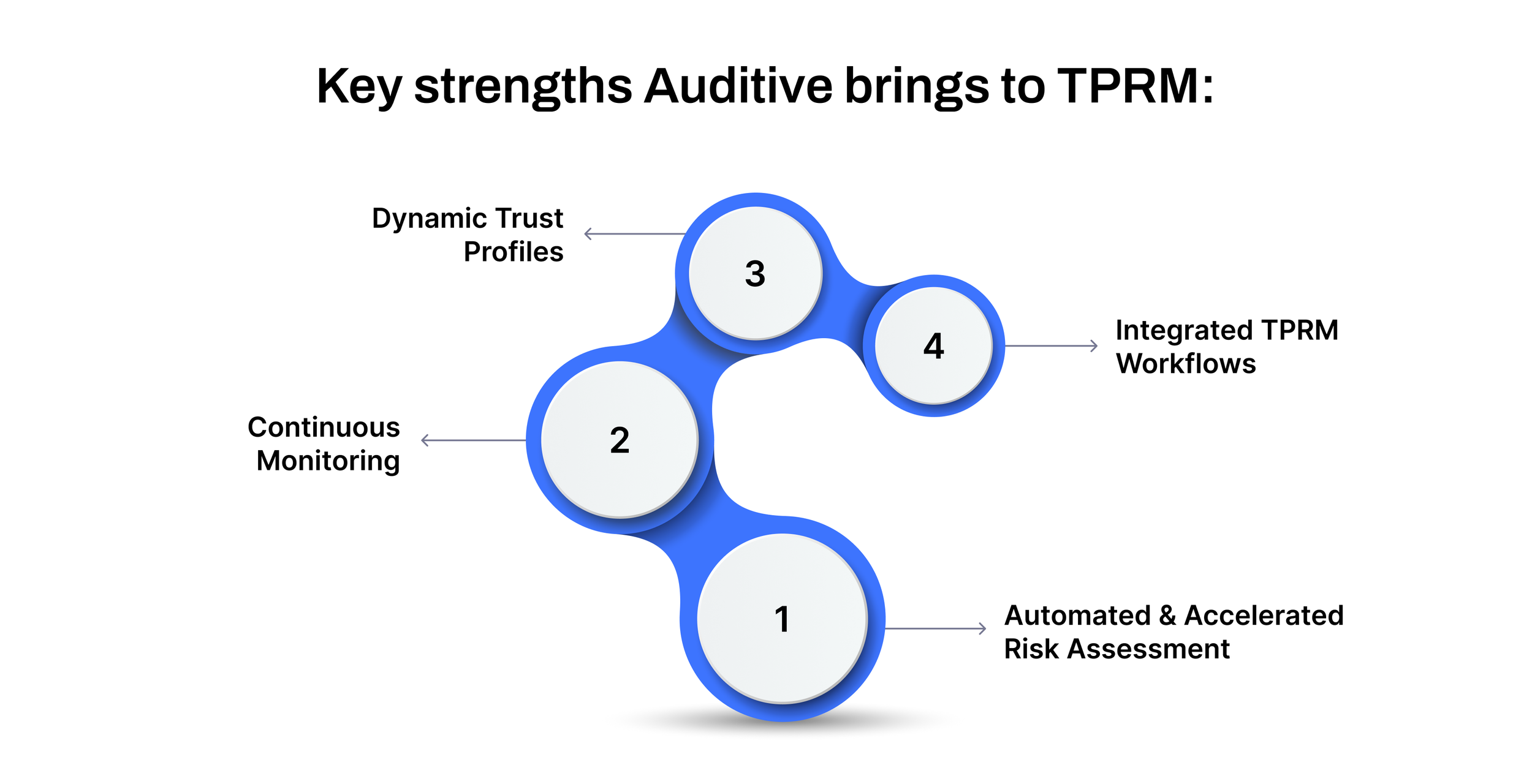

Key strengths Auditive brings to TPRM:

Automated and Accelerated Risk Assessment: Auditive’s AI‑powered risk assessment agent evaluates third parties against your specific controls and compliance frameworks, delivering insights up to 4× faster than traditional manual processes.

Continuous Monitoring Throughout the Vendor Lifecycle: Rather than point‑in‑time snapshots, Auditive continuously monitors vendors and third-party signals, alerting teams to posture changes, incidents, and compliance shifts in real time.

Dynamic Trust Profiles: Every vendor gets a living trust profile that updates automatically with new evidence, certifications, and risk signals, helping reduce manual follow‑ups and giving teams a single source of truth for vendor health.

Integrated TPRM Workflows: Auditive fits seamlessly with existing procurement and risk processes, enabling faster onboarding, centralized documentation, and richer vendor engagement without overhauling internal systems.

These capabilities align directly with the market’s evolution toward proactive risk strategies, where automation, continuous insight, and integration across enterprise systems are becoming essential.

Summary

The third-party risk management landscape is growing faster than ever, driven by complex vendor ecosystems, rising cybersecurity threats, and the need for real-time insights. Organizations that continue relying on manual assessments risk exposure, inefficiencies, and missed opportunities for proactive risk mitigation.

Adopting modern, AI-driven solutions is no longer optional, it’s essential to stay ahead of evolving threats. Platforms like Auditive enable businesses to continuously monitor vendors, automate risk assessments, and centralize intelligence, transforming third-party risk from a reactive burden into a strategic advantage.

Schedule a demo with Auditive today to see how your organization can streamline vendor oversight, improve operational resilience, and gain confidence in your third-party risk posture.

FAQs

1. What is third-party risk management (TPRM)?

TPRM is the process of identifying, assessing, and mitigating risks associated with vendors, suppliers, and other external partners to protect the organization from operational, financial, or compliance issues.

2. Why is TPRM critical for organizations today?

With growing digital ecosystems and complex supply chains, unmonitored vendor risk can lead to data breaches, regulatory fines, and operational disruptions.

3. How is the TPRM market evolving?

The market is expanding rapidly, driven by AI-driven automation, real-time monitoring platforms, and integration with broader enterprise risk and compliance systems.

4. What challenges do organizations face in TPRM?

High implementation costs, fragmented data, privacy concerns, and manual processes make traditional TPRM approaches inefficient and risky.

5. How can Auditive help with TPRM?

Auditive automates risk assessments, continuously monitors vendors, centralizes intelligence in dynamic trust profiles, and integrates seamlessly with enterprise workflows, turning risk management into a proactive strategic function.