SOC vs SOX: Understanding Key Differences

In 2024, over 35.5% of global data breaches were traced back to third-party vendors or partner systems, a steep uptick from previous years.

With vendor risk now accounting for more than one in three breaches, organizations face mounting pressure to choose the right governance path: one focused on financial statement accuracy and internal controls, or one built around data security, vendor oversight, and operational hygiene.

This comparison of SOC vs. SOX cuts through marketing noise to clearly outline which framework fits which business realities, helping leaders map risk, audit readiness, and vendor dependencies to the right standard.

Core Takeaways

SOC evaluates data security and operational controls; SOX validates financial reporting integrity.

SOC is optional but widely requested; SOX is mandatory for public U.S. companies.

Each framework serves a distinct purpose, depending on the business model and industry.

Strong vendor oversight is key for both, especially when third parties influence controls.

A unified trust and risk platform makes SOC vs SOX execution more efficient.

SOC Reports Explained

SOC (System and Organization Controls) reports, developed by the AICPA, provide a structured way to evaluate whether a service organization’s internal controls operate as intended. These reports help verify security, reliability, and financial reporting safeguards, making them a key component of any common security framework used by organizations to assess risk and vendor assurance.

SOC reporting is grouped into three categories, each serving a distinct purpose:

SOC 1

SOC 1 focuses on internal controls that directly influence a client’s financial reporting. Auditors rely on SOC 1 findings to understand how a service provider’s processes could affect the accuracy of financial statements.

SOC 2

SOC 2 evaluates how well an organization protects systems against risks tied to security, availability, processing integrity, confidentiality, and privacy. The assessment verifies whether controls are designed and operating effectively, not just documented on paper.

SOC 3

SOC 3 covers the same trust service categories as SOC 2 but delivers the findings in a simplified, publicly shareable format. Organizations often use SOC 3 reports to demonstrate a baseline commitment to secure and reliable operations without revealing sensitive control details.

Why SOC Compliance Matters: Core Benefits Organizations Actually Use

SOC reports aren’t just audit documents; they are operational proof points that show whether a business can be trusted with financial data, customer information, and system integrity.

Voluntary Framework with Real Impact:

Unlike SOX, which is mandatory, SOC compliance is voluntary. This gives organizations flexibility while still proving they operate with disciplined internal controls.

Clear Evidence of Internal Controls:

SOC reports provide verifiable proof of how an organization governs access, manages risks, and secures operational processes. This documentation strengthens credibility with customers, auditors, and partners.

Supports SOX-Driven Clients:

SOC 1 reports benefit clients who fall under SOX audit scrutiny. By showing reliable control design and operating effectiveness, service providers reduce friction for publicly traded customers.

Critical for Tech & SaaS Providers:

SOC 2 compliance is particularly relevant for cloud platforms, SaaS companies, and technology service providers that store, process, or transmit customer data. It signals operational maturity and reliable security practices.

Strengthens Customer Trust:

Clients interpret SOC 2 certification as evidence of disciplined security controls. It reassures buyers that their data is handled with integrity and that risks are actively minimized.

Reduces Operational & Security Risks:

Strong SOC-aligned controls help prevent data theft, fraud, unauthorized access, and system misuse. This reduces exposure to both financial and reputational damage.

Most teams struggle not with SOC controls but with the ongoing audit readiness required to maintain them. Auditive solves this by centralizing evidence, tracking control ownership, and giving teams continuous visibility into gaps, without forcing them into new workflows.

Also read: Complete Guide to SOC 2 Compliance and Audits

SOX Compliance Explained

SOX compliance refers to a company’s obligation to follow the requirements set by the Sarbanes-Oxley Act of 2002, a U.S. federal law created after major accounting failures such as Enron and WorldCom. The Act, enforced by the Securities and Exchange Commission (SEC), requires public companies to establish and maintain verifiable internal controls over financial reporting, supported by independent external audits.

Unlike broader security frameworks, SOX compliance focuses specifically on the accuracy, integrity, and traceability of financial data. External auditors evaluate whether financial controls are designed and operating effectively and whether businesses can produce evidence that supports each control throughout the audit period.

This makes SOX fundamentally different from SOC, which evaluates trust, security, and system controls rather than financial reporting accuracy.

Key Benefits of SOX Compliance: Why It Matters More Than Ever

A clear SOX program strengthens financial accuracy, protects investors, and reduces reporting risks, making it essential when discussing SOC vs SOX in any audit-driven environment.

1. Accountability and Legal Consequences

SOX directly holds executives, auditors, and financial leaders responsible for the accuracy of financial disclosures. Penalties, including fines and potential imprisonment, ensure accountability at every level.

2. Guidance for Precise Financial Reporting

While SOX does not prescribe how records must be maintained, it outlines strict expectations for internal controls. This empowers GRC teams to establish accurate and verifiable reporting structures.

3. Mandatory Internal Control Structure (Section 404)

Section 404 requires management to build, document, and maintain a formal internal control system for financial reporting, validated annually through an independent audit.

4. Documentation and Verification Requirements

During SOX audits, companies must demonstrate Internal Controls for Financial Reporting (ICFR) with complete, verifiable documentation. This ensures transparency and reduces reporting inconsistencies.

5. Data Governance and Security Policies

SOX mandates standardized policies for protecting financial data, ensuring it remains accurate, accessible, and secure throughout all reporting cycles.

6. Stronger Governance and Investor Protection

By enforcing controls and consistent procedures, SOX strengthens corporate governance and protects shareholder confidence, critical for any public or pre-IPO organization.

SOX demands continuous evidence, control visibility, and audit-ready documentation, areas where teams often lose time and accuracy. Auditive centralizes financial controls, automates evidence collection, and maintains a live record of system activity, making SOX and SOC readiness significantly easier to sustain without manual effort or scattered spreadsheets.

SOC vs SOX: A Clear Distinction Across Critical Control Parameters

To understand how SOC and SOX diverge in purpose, scope, and operational impact, here is a clean comparison across the core parameters every organization evaluates when assessing a common security framework or regulatory requirement.

1. Purpose and Scope

SOX (Sarbanes-Oxley Act, 2002) is a regulatory mandate for U.S. publicly traded companies. Its purpose is to protect investors by enforcing accurate financial reporting. It requires organizations to establish and validate internal controls that govern the integrity of financial statements.

SOC (System and Organization Controls), developed by the AICPA, focuses on evaluating controls around security, confidentiality, availability, processing integrity, and privacy. Unlike SOX, SOC is not limited to financial reporting. It is designed for service organizations that must demonstrate operational reliability and strong data-protection controls.

Bottom line: SOX is about financial accuracy; SOC is about system trust and security assurance.

2. Use Cases

SOC reports are used across industries where data handling and system trust are central, including healthcare providers, financial institutions, tax firms, data centers, SaaS platforms, and managed service providers.

SOX is applicable to public companies, private firms preparing for IPO, non-U.S. companies publicly traded in the U.S., and wholly-owned subsidiaries of public entities, all required to meet SOX obligations to maintain financial reporting integrity.

3. Regulatory Focus

SOC focuses on validating whether an organization’s internal controls support consistent, accurate, and secure operations, particularly where customer data is involved.

SOX is a federal statute designed to minimize financial fraud and increase transparency across public companies. It was enacted after major accounting scandals to restore investor confidence.

4. Applicability

SOC applies to any service organization handling sensitive data, regardless of size or industry. It is often used to signal maturity, reliability, and adherence to a recognized common security framework.

SOX applies only to U.S. public companies or entities submitting financial statements to the SEC.

5. Reporting Requirements

SOX requires annual SEC filings that include management’s assessment of internal controls related to financial reporting.

SOC reports are generated by independent auditors using the AICPA Trust Services Criteria. These reports provide customers and partners with assurance that the organization has appropriate controls to protect sensitive data and maintain operational resilience.

6. Levels of Assurance

SOC offers multiple assurance levels:

SOC 1 → Controls tied to financial reporting

SOC 2 → Controls for security, availability, confidentiality, privacy, and processing integrity

SOC 3 → High-level, publicly shareable assurance summary

SOX provides investors with full confidence in the accuracy and reliability of a public company’s financial statements.

Learn more about: Understanding Data Leak Prevention: Key Benefits and Practices

SOC vs SOX: The Clear Breakdown You Actually Need

Understanding the SOC vs. SOX difference starts with looking at how each framework shapes risk oversight; one focuses on service-level security controls, and the other governs financial reporting integrity. The table below lays out the distinction, so your team can quickly determine where the common security framework responsibilities fall.

SOC vs SOX: Comparison Table

| Aspect | SOC Compliance | SOX Compliance |

|---|---|---|

| Relevance | Voluntary; applies to service providers and organizations handling client data. | Mandatory for all publicly traded companies in the United States. |

| Key Objective | Demonstrate data security and privacy controls to clients and stakeholders. | Improve transparency and accuracy in financial reporting for investor confidence. |

| Report Types | Three reports: SOC 1, SOC 2, and SOC 3, each with distinct focus areas. | No separate report types. |

| Supervised By | American Institute of Certified Public Accountants (AICPA). | Securities and Exchange Commission (SEC). |

| Frequency of Compliance | Assessed annually or as required by service agreements. | Continuous requirements: Section 404 includes mandatory annual assessments. |

Both frameworks address control assurance but serve different purposes. SOC helps validate operational and security controls for customer trust, while SOX is tied directly to financial reporting obligations. Your applicability depends on whether your risk exposure is driven by service operations, financial oversight, or both.

SOC vs SOX: Choosing the Right Framework for Your Organization

A practical breakdown to help you decide between SOC and SOX, based on scope, audit requirements, and business objectives, especially when evaluating the real differences between SOC and SOX.

The decision between SOC and SOX depends entirely on what your organization is trying to protect or prove. SOX is statutory for all publicly listed U.S. companies and enforces strict internal controls to ensure the integrity of financial reporting. These controls include transaction-level monitoring, accurate record-keeping, and structured internal audit cycles to validate how financial information is prepared and maintained.

SOC, on the other hand, is voluntary and primarily relevant for service providers that handle customer data. A SOC examination assesses how your organization processes, stores, and transmits data, giving partners or customers a verified view of your security posture during due-diligence checks. For non-public companies, SOX can still strengthen financial discipline, while SOC reports help reinforce trust in data-sensitive service operations.

For most organizations, the dividing line is straightforward:

Public company → SOX is mandatory.

Service organization handling sensitive data → SOC is expected.

Engaging legal or audit specialists can help clarify which framework aligns with your regulatory and operational requirements.

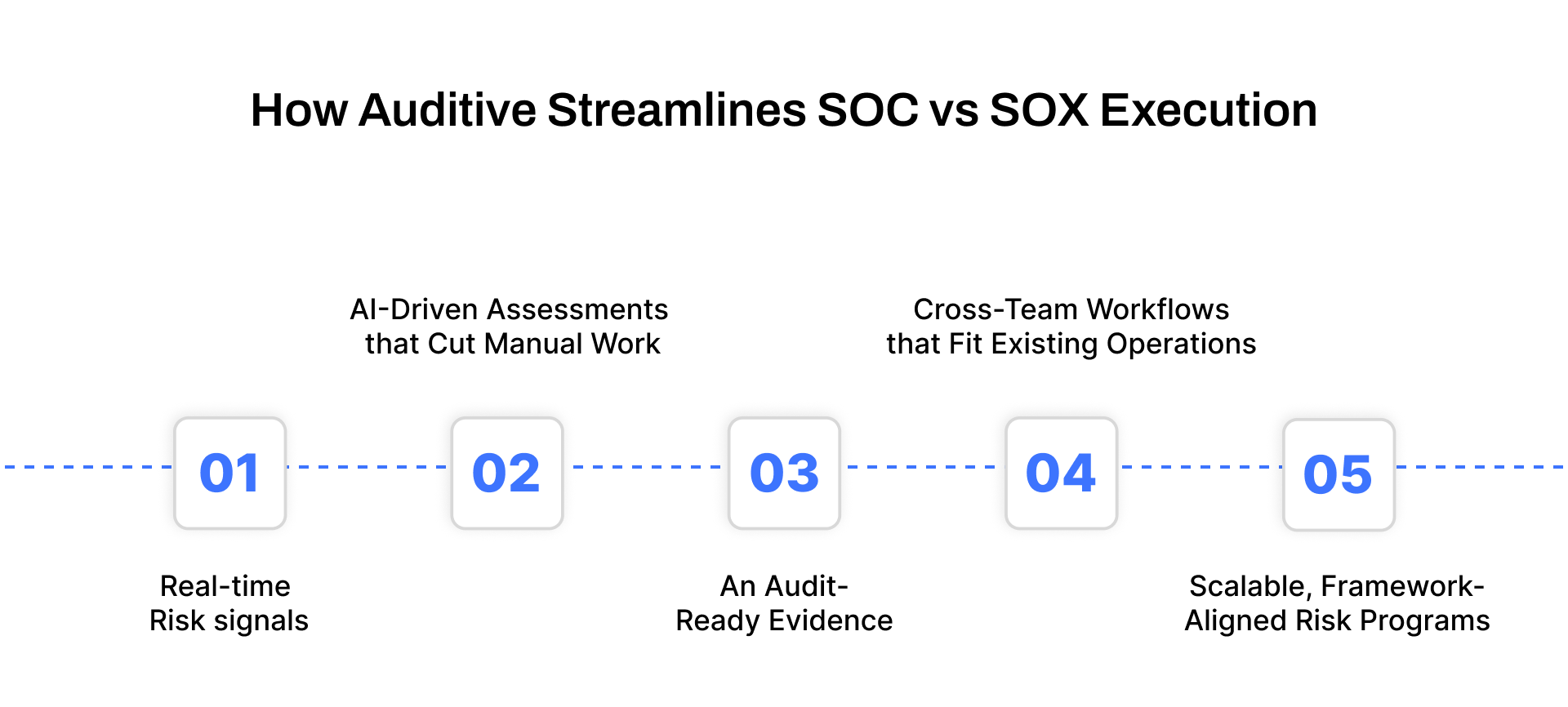

How Auditive Streamlines SOC vs SOX Execution

Deciding between SOC and SOX is only the first step; keeping controls current, vendors monitored, and evidence audit-ready is where the real operational load sits. Auditive closes that gap with practical, verifiable capabilities.

Real-time risk signals

AuditiveX continuously updates vendor posture, including certificates, security controls, incidents, and disclosures, so teams can catch shifts that can affect SOC or SOX integrity.

AI-driven assessments that cut manual work

The platform parses documents, validates controls, and auto-reviews questionnaires in minutes, helping teams handle vendor baselines and reassessments at scale.

An audit-ready evidence

All vendor documents, attestations, and controls live in one place, eliminating scattered spreadsheets and email threads during SOC or SOX reviews.

Cross-team workflows that fit existing operations

Security, procurement, legal, and finance work from the same verified vendor data, with integrations into tools like Slack, JIRA, and Salesforce.

Scalable, framework-aligned risk programs

AuditiveX supports large vendor inventories and aligns easily with SOC 2, ISO 27001, and SOX-relevant oversight needs.

Auditive turns vendor oversight and audit readiness into an always-on process, reducing risk, saving time, and strengthening whichever path you choose in the SOC vs SOX landscape.

Final Thoughts

Choosing between SOC and SOX comes down to what your organization must prove: operational trust or financial accuracy. SOC helps demonstrate the strength of your data safeguards, while SOX ensures your financial controls can stand up to scrutiny. Both frameworks demand structured oversight, reliable evidence, and consistent verification across vendors and internal processes.

This is where a unified risk and trust layer becomes essential. Centralized visibility, continuous vendor assurance, and audit-ready documentation remove friction from whichever framework your organization adopts. By strengthening these foundations, you reduce uncertainty and make your governance posture easier to scale.

If you want to streamline vendor oversight and keep SOC or SOX documentation always ready, Auditive brings the structure and automation needed to support both paths.

Schedule a demo to see how Auditive simplifies verification, vendor monitoring, and trust reporting.

FAQs

1. Is SOC mandatory like SOX?

No. SOC is voluntary, but many service providers pursue it because customers require validated controls before onboarding, especially in data-sensitive industries.

2. Can a company be required to follow both SOC and SOX?

Yes. Public companies offering outsourced services often need SOX for financial controls and SOC reports to prove security and availability to clients during due diligence checks.

3. Does SOC help with investor confidence the same way SOX does?

Not directly, but SOC reports strengthen trust with enterprise customers by showing operational rigor, something that indirectly supports business growth and market perception.

4. Which is more resource-intensive: SOC or SOX?

SOX is typically heavier because it requires year-round testing of financial controls, but SOC can become equally demanding for high-volume service providers with complex systems.

5. Do SOC reports reduce vendor risk?

They help, but they aren’t a standalone solution. SOC reports validate internal controls, while ongoing vendor monitoring is still required to manage evolving third-party risks.