Operational Risk Management: Overview and Guide

Every business faces risks that go beyond numbers, system outages, process failures, compliance gaps, or supply chain disruptions. These are operational risks, and managing them is vital to resilience and trust.

Operational Risk Management (ORM), or oprisk, provides a structured way to identify, assess, and mitigate risks tied to people, processes, systems, and external events. Unlike financial risks, these are embedded in daily operations, making them harder to predict but crucial to control.

With rising regulatory scrutiny, interconnected digital ecosystems, and higher customer expectations, the cost of neglecting operational risk can be severe, financial loss, reputational damage, and compliance penalties. A strong ORM program not only prevents disruptions but also fosters accountability and long-term resilience.

This guide breaks down what ORM is, why it matters, its process, benefits, challenges, and tools, along with how Auditive helps organizations strengthen their approach to oprisk.

Before we dive in:

Operational risk management (ORM) safeguards businesses from losses caused by internal failures or external disruptions.

Effective ORM involves identifying risks, assessing impact, and implementing controls.

Vendor risk management is critical, as third-party relationships are often the weakest link.

Tools like heat maps, KRIs, and trust centers strengthen visibility and transparency.

Platforms like Auditive turn risk management into a strategic advantage through automation, compliance insights, and resilience-building.

What Is Operational Risk Management?

Operational risk refers to the risk of loss arising from ineffective or failed internal processes, people, systems, or external events that disrupt the flow of business operations. Unlike market or credit risks, which are more predictable, operational risks are embedded in everyday activities, making them harder to anticipate yet critical to manage.

These risks can lead to both direct and indirect financial impacts. For instance:

A poorly trained employee mishandling a transaction may directly cost the company revenue.

Poor customer service may indirectly damage reputation, eroding trust and long-term profitability.

Operational risk is not just about identifying disruptions; it also includes the management processes organizations use to implement controls, train staff, and enforce policies to mitigate such risks.

Think of operational risk as a chain reaction: overlooked issues and control failures, even small ones, can compound into larger incidents. Over time, this may result in organizational breakdowns, reputational harm, and financial loss.

While Operational Risk Management (ORM) is part of broader enterprise risk management, it specifically focuses on unsystematic risks, those tied to daily operations, excluding strategic, reputational, financial, and market risks.

Know more about: Understanding RiskOps Guide

In short, ORM (oprisk) equips businesses with the framework to identify vulnerabilities, apply controls, and build resilience against risks that arise from the core of operations.

The Importance of ORM and How It Works

Operational Risk Management (ORM) is not a one-time exercise; it’s a continuous framework that runs through every layer of an organization. Because operational risks are embedded in daily processes, the aim is not to eliminate them entirely, but to control and reduce them to acceptable levels.

At its core, ORM follows a structured cycle of:

Risk Identification – spotting potential threats tied to people, processes, technology, or external events.

Risk Assessment & Measurement – evaluating the likelihood and potential impact of those risks.

Mitigation – implementing measures such as controls, policies, or technologies to reduce exposure.

Monitoring & Reporting – tracking risks in real time and ensuring accountability through transparent reporting.

This process is guided by four key principles:

Accept risk when the benefits outweigh the cost.

Avoid unnecessary risks.

Anticipate and manage risk through proactive planning.

Make risk decisions at the right organizational level.

Why ORM Matters

Proactive Risk Management – ORM empowers organizations to anticipate issues rather than just react, protecting business continuity.

Better Decision-Making – risk-informed insights strengthen leadership decisions across operations and strategy.

Operational Efficiency – streamlined processes minimize waste, delays, and costly disruptions.

Stakeholder Protection – customers, employees, and investors gain confidence in the organization’s resilience.

Regulatory Compliance – especially in finance, firms must show good ORM to meet PCI DSS, Basel III, GDPR, and other regulatory standards, avoiding penalties and reputational harm.

In short, operational risk management transforms uncertainty into structured control, giving businesses both resilience and a competitive advantage.

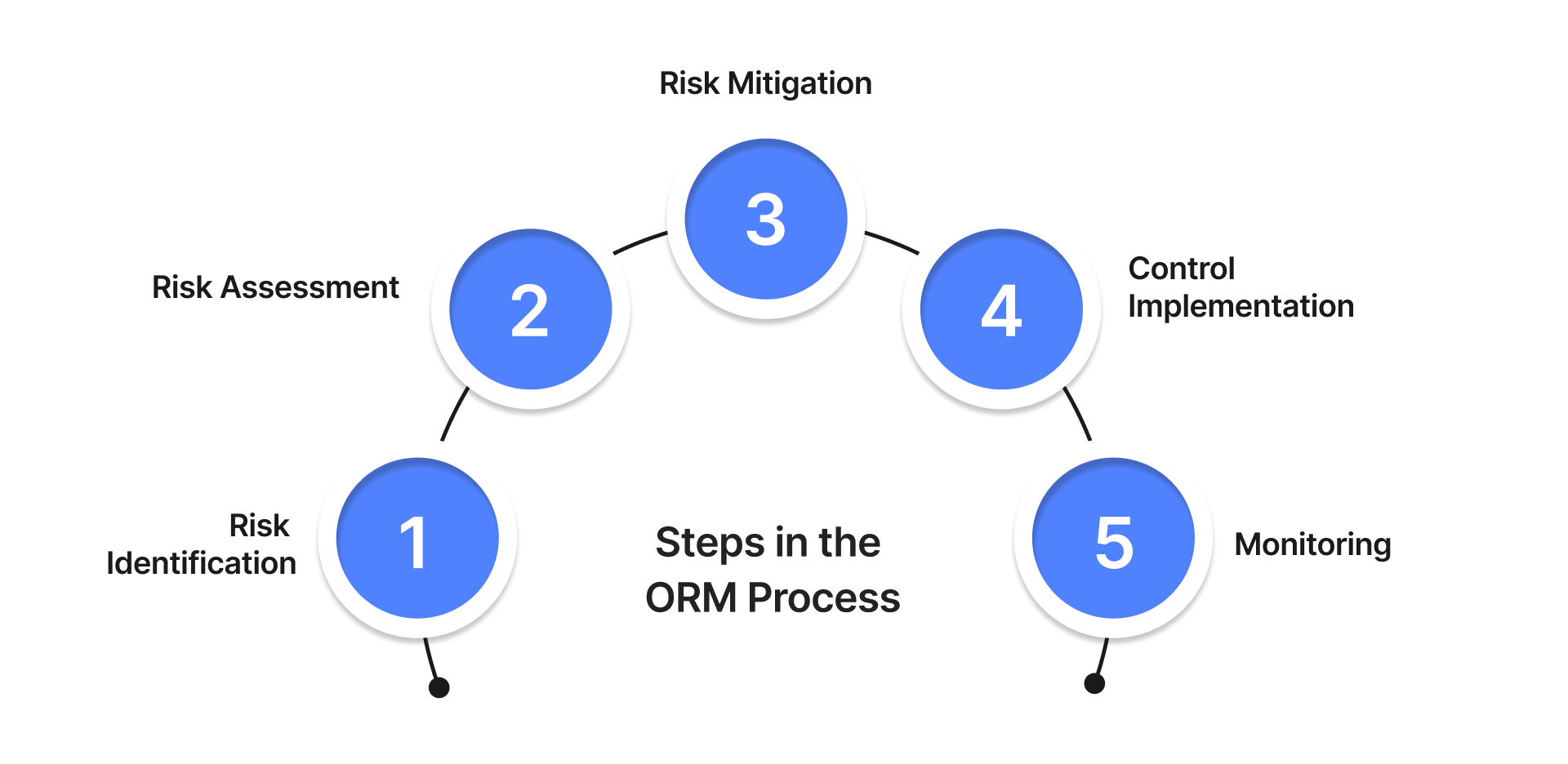

Steps in the ORM Process

Operational Risk Management (ORM) is most effective when followed as a structured, five-step cycle. Each stage builds on the previous one, ensuring risks are not only identified but also evaluated, managed, and continuously monitored.

Step 1: Risk Identification

The first step is pinpointing potential risks that could hinder business objectives. This involves both internal and external analysis:

Process Analysis: Examine workflows across production, IT, HR, and customer service to spot vulnerabilities.

Loss Data Review: Study past incidents, financial losses, breaches, and compliance failures to identify recurring threats.

Workshops & Interviews: Engage employees across levels for on-the-ground insights into risks and gaps.

External Event Analysis: Factor in industry shifts, regulations, or geopolitical changes.

Scenario Planning: Simulate “what-if” events to assess resilience against high-impact, low-probability risks.

Step 2: Risk Assessment

Once identified, risks are assessed based on likelihood and impact. The outcome is a risk register, a prioritized list with assigned risk owners and mitigation strategies. Prioritization is critical since not all risks demand equal attention. Audit reports, historical findings, and compliance reviews often enrich this step.

Step 3: Risk Mitigation

After assessment, organizations must decide how to address each risk. The four common approaches are:

Transfer: Shift the financial impact to third parties (e.g., outsourcing, insurance).

Avoid: Steer clear of risk-heavy vendors, markets, or processes.

Accept: Tolerate the risk if mitigation costs outweigh the impact.

Mitigate: Implement controls (e.g., VPNs for remote work) to reduce likelihood or severity.

Since complete elimination is rare, organizations must always account for residual risk, which is what remains after controls are applied.

Step 4: Control Implementation

This step is about turning decisions into action. Controls must be well-documented, communicated, and designed to be preventive first, with detective or corrective measures as backup. Examples include:

Additional approval layers for sensitive transactions.

Automated checks in IT systems.

Policy enforcement for compliance-driven industries.

Regular reviews ensure existing controls remain relevant as business and risk environments evolve.

Step 5: Monitoring

Risks and controls are never static. Continuous monitoring ensures effectiveness and early detection of new threats. This is often achieved through Key Risk Indicators (KRIs), which serve as warning signals. For instance:

Customer satisfaction scores dropping may indicate deeper service quality issues.

Unusual financial ratios could highlight hidden fraud or compliance risks.

In industries like banking, real-time monitoring systems with KRIs are standard, but the approach is widely applicable across sectors.

This cycle is not linear but iterative. Effective ORM means continuously feeding lessons from monitoring back into risk identification, ensuring organizations stay proactive, not reactive.

Each step of the ORM process becomes far more effective when supported by automation and continuous monitoring, Auditive integrates these seamlessly into daily operations.

Learn more about: How to Manage Risk in New Business Strategies

Benefits of a Strong Operational Risk Management Program

An effective Operational Risk Management (ORM) program does more than just prevent disruptions, it builds resilience, instills confidence, and positions a business for long-term success. By systematically identifying and addressing risks, organizations can not only safeguard day-to-day operations but also unlock strategic advantages.

Here are the key benefits of a strong ORM program:

Better C-Suite Visibility

Executives gain clear insight into the organization’s operational health, enabling more informed decision-making and alignment with long-term strategic objectives.

Stronger Business Risk-Taking

With reliable risk data, organizations can take calculated risks, such as entering new markets or adopting new technologies, without fear of blind spots.

Enhanced Product Performance and Brand Reputation

Proactive risk management minimizes service disruptions and quality issues, leading to stronger product performance and greater trust in the brand.

Deeper Customer and Stakeholder Trust

Demonstrating preparedness for crises reassures clients, partners, and regulators, building stronger relationships across the ecosystem.

Improved Investor Confidence

Transparency and accountability in managing operational risks attract investors by showcasing the organization’s resilience and governance strength.

Effective Performance Reporting

With structured frameworks in place, performance data becomes more reliable, helping leaders track improvements and identify gaps.

Sustainable Financial Forecasting

By reducing the likelihood of costly loss events, organizations can generate more accurate, long-term financial projections.

Beyond these tangible benefits, ORM fosters a culture of resilience. It equips teams with the mindset and tools to adapt to evolving threats, optimize processes, and continuously improve. The result is a business that isn’t just reacting to risks, it’s anticipating them and turning potential disruptions into opportunities for efficiency and growth.

Organizations that embrace operational risk management as a strategic priority, rather than a compliance requirement, gain a competitive edge. Platforms like Auditive support this shift by delivering real-time monitoring, trust-building tools, and transparent risk reporting, enabling businesses to showcase operational resilience while building stakeholder confidence.

Challenges and Shortcomings of Operational Risk Management

Despite its importance, Operational Risk Management (ORM) often struggles to achieve the same level of maturity as financial or strategic risk programs. Many organizations still view ORM as a compliance necessity rather than a value driver, which limits its potential impact.

Below are some of the most pressing challenges businesses face in implementing effective oprisk strategies:

Resource Constraints

Many companies lack the budget, skilled personnel, or technology needed to properly invest in ORM or broader Enterprise Risk Management (ERM). As a result, risk initiatives remain underdeveloped and reactive.

Limited Awareness and Communication

Without clear education around the importance of operational risk, employees and executives may fail to understand how process breakdowns or system failures directly impact revenue, compliance, and reputation.

C-Suite and Board Disconnect

While executives recognize financial and market risks, operational risks often receive less attention. This lack of executive sponsorship undermines ORM’s ability to gain traction across the organization.

Inconsistent Risk Methodologies

Measuring and assessing operational risks is notoriously difficult. Organizations often use fragmented approaches, making it hard to maintain an accurate, enterprise-wide risk profile.

Lack of Standardized Risk Language

Without a unified risk taxonomy, Risk and Control Self-Assessments (RCSAs) lose consistency and effectiveness. Misalignment across teams can lead to gaps in coverage and missed risks.

Complex, Evolving Processes

Rapid changes in technology, automation, and digital transformation create complex operational environments. These evolving processes make it challenging to establish consistent controls.

Overlapping Functions

ORM is often absorbed into compliance, audit, or IT functions. While integration is valuable, it can dilute ORM’s strategic focus and reduce accountability.

Reactive, Manual Systems

Many ORM programs have been developed as reactive responses to regulatory requirements. As a result, they rely on manual processes, spreadsheets, or disconnected tools, leading to inefficiency, redundancy, and limited visibility.

The shortcomings of ORM are not just technical, they are cultural. Without buy-in from leadership, alignment across departments, and the right tools, ORM risks becoming a “check-the-box” exercise rather than a driver of resilience and trust.

Organizations often struggle with visibility into third-party risks. Auditive solves this by offering continuous monitoring rather than one-off audits.

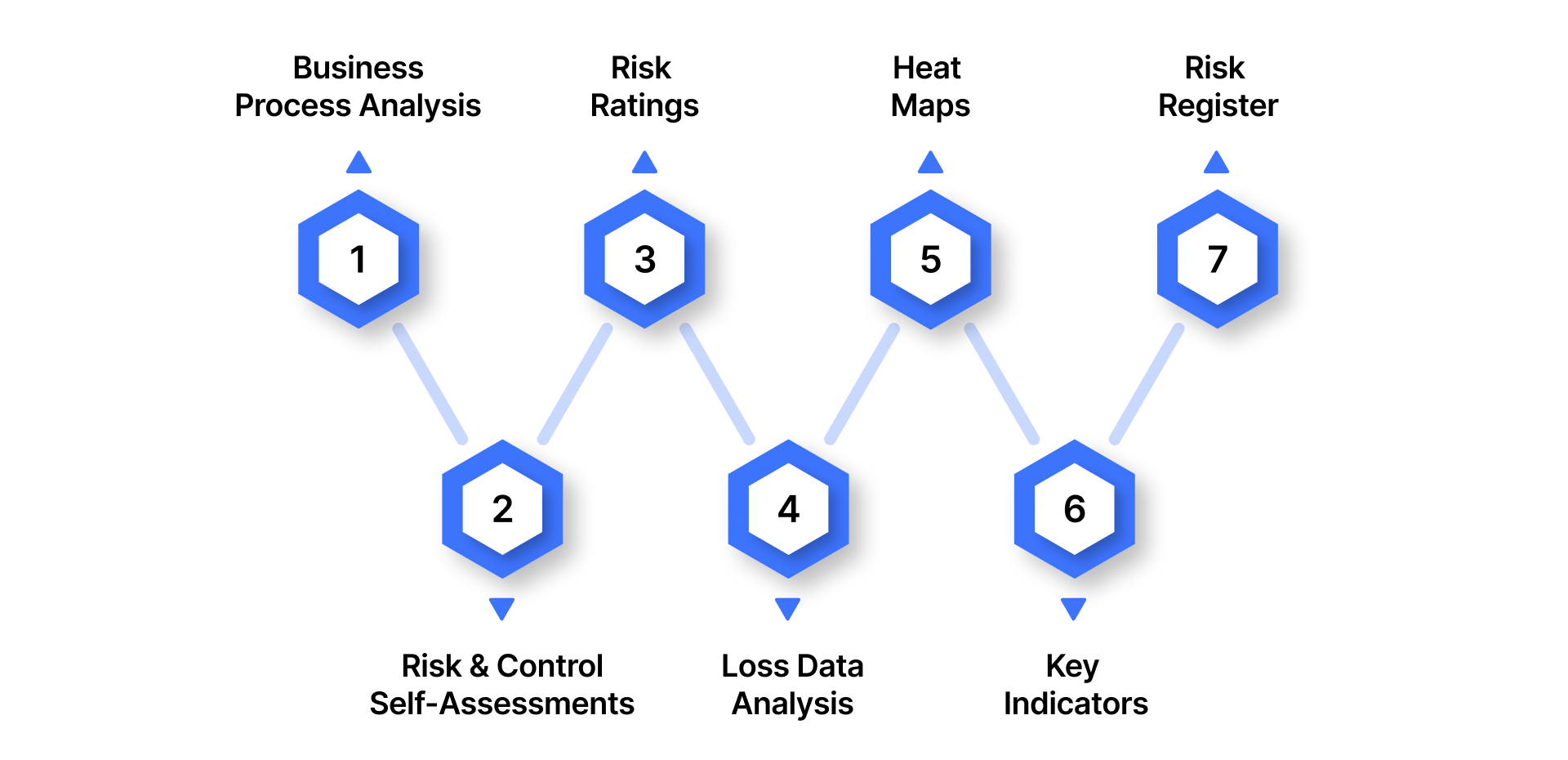

Operational Risk Management Tools and Techniques

To move operational risk management (ORM) from theory into practice, organizations need the right tools and techniques. These frameworks and technologies enable businesses to identify, evaluate, and monitor risks systematically, ensuring that risk isn’t just acknowledged but actively managed.

Below are some of the most widely used ORM tools and techniques:

Business Process Analysis (BPA):

BPA maps out existing or planned processes to highlight inefficiencies, bottlenecks, and vulnerabilities. By understanding how processes function end-to-end, organizations can pinpoint potential failure points before they result in costly incidents.

Risk and Control Self-Assessments (RCSAs):

RCSAs allow teams to provide subjective assessments of their own risk exposures and the strength of current controls. While qualitative, these assessments bring frontline perspectives into the ORM program and help identify blind spots that might be missed by top-down reviews.

Risk Ratings:

Risks are often rated on a low, medium, or high scale based on objective thresholds such as potential monetary losses, regulatory consequences, or reputational damage. These ratings provide a clear hierarchy of which risks require immediate attention versus ongoing monitoring.

Loss Data Analysis:

Past incidents provide valuable lessons. By analyzing loss data, including the nature of the event, its root cause, and financial impact, organizations can better predict the likelihood of future risks and strengthen preventive measures.

Heat Maps:

A widely used visualization tool, heat maps plot risks based on likelihood and impact. This offers leadership a clear snapshot of the most pressing risks, making prioritization straightforward.

Key Indicators:

Monitoring tools like Key Risk Indicators (KRIs), Key Performance Indicators (KPIs), and Key Control Indicators (KCIs) act as early warning systems. If an indicator surpasses predefined thresholds, it signals that risks are escalating and may require immediate intervention.

Risk Register:

The risk register acts as a central repository for all identified risks. It includes each risk’s probability, impact, planned mitigation measures, responsible owners, and timelines. This structured documentation ensures accountability and provides a living record of risk management efforts.

Read more about: Continuous Risk Monitoring Practices Techniques

Together, these tools provide a comprehensive risk management framework, blending data-driven insights with practical monitoring and accountability. When combined with modern technology, they enable organizations to transition from reactive responses to proactive, predictive risk management.

How Auditive Elevates Operational Risk Management

Operational risk today is fast-moving and interconnected. Traditional ORM methods, static reports, manual checklists, and siloed reviews, fall short in a world where risks shift by the hour. What organizations need is a transparent, real-time, and intelligent approach that not only detects threats but also strengthens resilience. This is where Auditive makes the difference.

Real-Time Oversight – Identify 80% of risk exposure instantly with automated vendor and process visibility.

Continuous Monitoring – 24/7 tracking ensures risks are flagged before they escalate.

Trust Center – Centralized, transparent space for vendors, regulators, and clients.

AI-Powered Automation – Faster onboarding, smarter risk scoring, and 4x efficiency gains.

Resilience by Design – Align ORM directly with long-term growth and compliance goals.

With Auditive, ORM transforms from a reactive burden into a strategic advantage. By combining automation, compliance insights, and transparent collaboration, Auditive empowers businesses to move beyond risk avoidance and toward trust, resilience, and growth.

Wrapping Up

Operational risk management is no longer just about minimizing potential losses; it’s about building trust, resilience, and adaptability in an unpredictable environment. Organizations that adopt structured ORM processes gain the ability to anticipate threats, strengthen controls, and make informed decisions under pressure.

But success requires more than internal processes. The ecosystem of vendors, partners, and third parties plays a critical role. This makes vendor risk management and transparent reporting essential parts of modern ORM strategies. Tools like a trust center not only demonstrate compliance but also build confidence with regulators, stakeholders, and customers.

By embracing intelligent platforms like Auditive, businesses can go beyond checklists and manual processes. With automation, real-time insights, and integrated compliance, Auditive turns operational risk into a foundation for sustainable growth, trust, and competitive strength.

Explore how Auditive’s platform helps you strengthen trust, streamline vendor risk management, and future-proof your operations.

FAQs

1. What is operational risk management in simple terms?

Operational risk management (ORM) is the process of identifying, assessing, and controlling risks that come from internal processes, people, systems, or external events that could disrupt business operations.

2. Why is ORM important for businesses?

Because unmanaged risks, like system failures, compliance breaches, or human errors, can lead to financial loss, reputational damage, or regulatory penalties. ORM builds stability and resilience.

3. How does ORM connect with vendor risk management?

Vendors and third parties often introduce risks related to data security, compliance, or service continuity. Vendor risk management ensures these external risks are tracked, monitored, and mitigated.

4. What tools are commonly used in ORM?

Heat maps, risk registers, risk ratings, key risk indicators (KRIs), and loss data analysis are widely used, alongside advanced platforms offering automation and real-time monitoring.

5. How does a trust center support ORM?

A trust center provides a centralized, transparent hub where businesses share their security and compliance posture with vendors, regulators, and customers, building credibility and trust.