Understanding RiskOps: An Overview and Guide

Risk is no longer a side conversation; it’s at the center of how modern organizations operate. But as digital ecosystems expand and regulatory demands increase, traditional risk management models fall short. That’s where RiskOps comes in.

RiskOps, or Risk Operations, is an emerging discipline that brings risk management into the operational core of an organization. It blends governance, risk, compliance (GRC), and security into streamlined workflows, fostering real-time awareness and rapid response. Unlike older models that treat risk as a siloed function, RiskOps is about breaking down barriers between departments, tools, and data to deliver a cohesive, agile, and scalable approach.

This guide explores what RiskOps is, why it matters, how it differs from traditional frameworks, and what you need to implement it effectively.

Overview

RiskOps unifies security, risk, and compliance into a single operational model for faster, smarter decision-making.

It’s proactive and continuous, moving beyond periodic audits and siloed reviews.

A successful RiskOps model involves collaboration, automation, and real-time risk visibility.

Best practices include executive buy-in, cross-functional KPIs, integrated workflows, and cultural alignment.

Auditive accelerates RiskOps with continuous monitoring, shared vendor assessments, and a Trust Center to centralize third-party risk intelligence.

What Is RiskOps?

RiskOps, short for Risk Operations, is a modern operational framework that integrates risk management directly into business workflows, tools, and decision-making processes. Think of it as the DevOps of risk: it unifies traditionally fragmented risk functions (compliance, security, privacy, legal) and embeds them within daily operations across teams.

Rather than relying on periodic risk assessments or manual audits, RiskOps emphasizes continuous monitoring, real-time collaboration, and automation to manage risks at the speed of business.

At its core, RiskOps is about three things:

Visibility: Real-time insight into internal and third-party risks.

Agility: Fast, proactive risk response through automation and cross-functional workflows.

Alignment: Seamless integration of risk strategy with business goals, teams, and tech.

RiskOps vs. traditional risk management

| Feature | Traditional Risk Management | RiskOps |

|---|---|---|

| Frequency | Periodic | Continuous |

| Ownership | Centralized (GRC/Security Team) | Distributed (Cross-functional) |

| Tools | Siloed Systems | Integrated Workflows |

| Response Time | Slow/Reactive | Fast/Proactive |

| Culture | Compliance-Centric | Risk-Aware/Operations-Centric |

By transforming risk into a collaborative, always-on function, RiskOps helps organizations stay ahead of threats and confidently scale their risk posture.

Why RiskOps Matters Today?

As businesses grow more interconnected, digital, and dependent on third parties, traditional risk management models struggle to keep up. Teams can’t afford to manage risk in silos or rely on outdated assessments. RiskOps matters because it reflects how modern businesses actually operate, in real time, across functions, and with a strong dependency on technology and external vendors.

Key drivers behind RiskOps adoption:

Increased regulatory pressure

Organizations are subject to more complex and overlapping regulations (e.g., GDPR, HIPAA, SOC 2). RiskOps helps manage compliance without stalling operations.

Expanded attack surface

From cloud environments to remote workforces and SaaS vendors, the threat surface has exploded. RiskOps centralizes risk oversight across these areas.

Need for speed and scale

Business teams can’t wait weeks for risk approvals. RiskOps streamlines assessments and automates decision-making to support agile operations.

Board-level visibility

Boards demand real-time risk visibility and accountability. RiskOps tools provide dashboards and reporting tailored to executive stakeholders.

Third-party complexity

With thousands of vendors in play, managing external risk is no longer optional. RiskOps integrates third-party risk into core workflows.

RiskOps is not just a tech trend; it’s a strategic imperative. Companies adopting RiskOps can identify and act on risks faster, reduce manual overhead, improve collaboration across teams, and build trust with customers and regulators.

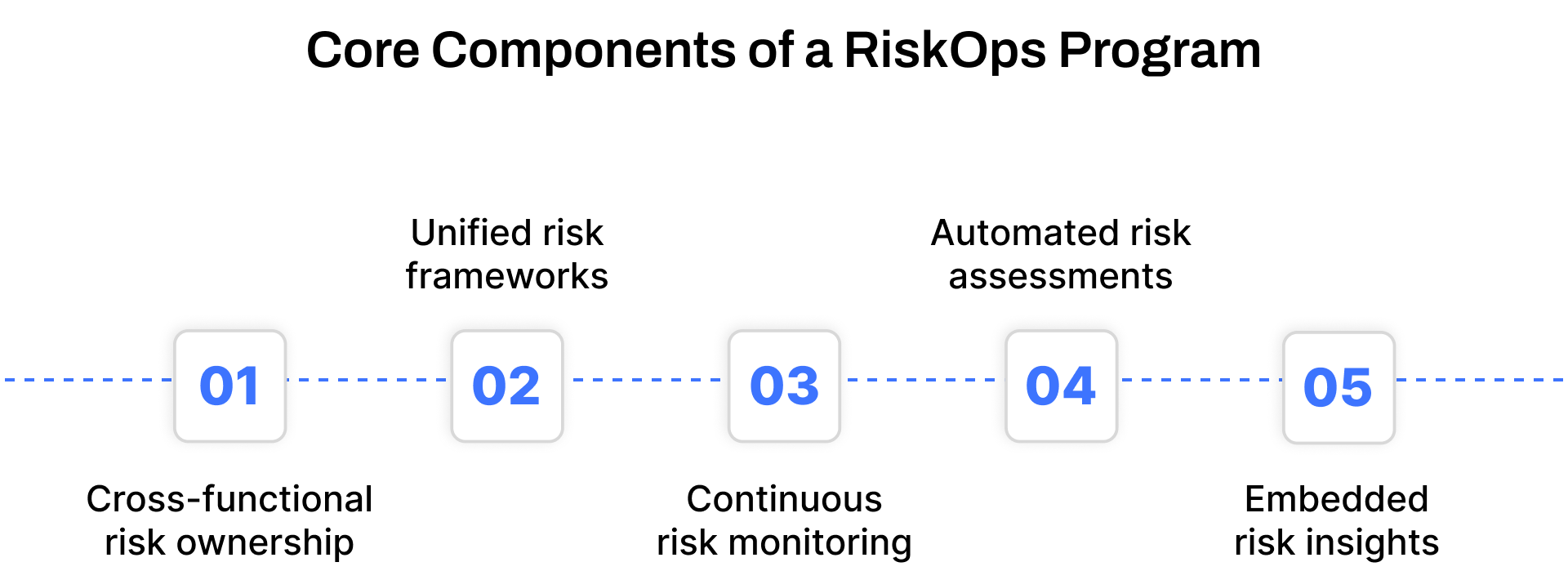

Core Components of a RiskOps Program

A mature RiskOps strategy isn't just about identifying risks; it’s about embedding risk awareness and actionability into every layer of your operations. Below are the essential components that make up a successful RiskOps program:

1. Cross-functional risk ownership

Traditional risk management often operates in departmental silos; security handles cyber risk, legal owns compliance, and procurement deals with vendor contracts. RiskOps removes these boundaries and creates shared ownership of risk across the organization.

Why it matters:

Risk isn't isolated to one team; it spans processes, technologies, and external partners.

A cross-functional approach ensures that risk signals from all areas legal, compliance, engineering, and finance are captured, contextualized, and acted on.

Implementation examples:

Engineering teams flag product risks directly in ticketing tools (e.g., Jira).

Procurement teams use built-in risk checks before vendor onboarding.

GRC teams share real-time dashboards with leadership for visibility.

2. Unified risk frameworks, operationalized

RiskOps doesn’t reinvent the wheel; it leverages industry-standard frameworks (like NIST, ISO 27001, SOC 2, CIS Controls) but integrates them into operational processes. This transforms compliance from a once-a-year audit scramble into an always-on process.

Key benefits:

Enables dynamic mapping of controls to activities (e.g., mapping change management to CI/CD pipeline events).

Reduces audit fatigue by maintaining continuous control assurance.

Aligns business units around consistent definitions of risk severity and thresholds.

Real-world use case:

A healthcare company uses HIPAA requirements mapped to internal engineering workflows, triggering alerts when data privacy configurations are altered.

3. Continuous risk monitoring across the ecosystem

In RiskOps, risk isn’t evaluated quarterly; it’s monitored continuously. This includes internal systems, cloud infrastructure, and most critically, third-party vendors.

How it works:

Real-time telemetry and signals feed into the risk engine (e.g., policy violations, misconfigurations, incident logs).

Third-party vendors are assessed continuously, not just during onboarding.

Risk thresholds automatically trigger actions (e.g., access revocation, alerts to stakeholders).

Example tools:

Security monitoring tools like Wiz, Lacework, or SentinelOne are integrated into dashboards.

Vendor risk platforms like Auditive for live risk scores across all suppliers.

4. Automated risk assessments and workflows

Manual risk questionnaires and approval processes are slow and error-prone. RiskOps introduces automation at key stages, helping organizations evaluate, prioritize, and act on risks efficiently.

Capabilities include:

Pre-built logic that auto-scores risks based on input data (e.g., cloud misconfigurations, SLA breaches).

Triggered workflows that assign owners and deadlines for risk remediation tasks.

Smart routing of risk assessments depending on impact level or business unit.

Impact:

Reduces friction for engineering and business teams.

Scales GRC and security teams without additional headcount.

Improves MTTR (mean time to remediation) on high-priority risks.

5. Embedded risk insights in business workflows

RiskOps doesn’t sit in a separate dashboard; it’s embedded where people work. This ensures decisions are made with context and accountability.

Practical examples:

Procurement systems automatically flag suppliers without valid security attestations.

DevOps pipelines block deployments that violate critical controls.

Contract lifecycle tools prompt legal teams when terms don’t align with the approved risk posture.

Outcome:

Risk becomes part of everyday decision-making, not a post-facto audit concern.

Business users are empowered to act on risks early.

A modern RiskOps strategy isn’t just about faster risk assessments; it’s about giving every team the tools, context, and automation they need to detect, understand, and mitigate risk in real time. When these components work in sync, organizations gain a proactive, scalable, and business-aligned approach to managing risk.

How RiskOps Differs from Traditional GRC

While Governance, Risk, and Compliance (GRC) frameworks have long helped organizations ensure regulatory alignment and internal accountability, they are no longer sufficient in fast-moving, cloud-native environments. RiskOps builds upon GRC principles but adapts them to modern realities, integrating risk into daily workflows, automating insights, and enabling dynamic response.

Let’s break down the key differences:

1. Static vs. Dynamic

| Traditional GRC | RiskOps |

|---|---|

| Periodic audits (quarterly/annually) | Always-on, real-time monitoring |

| Manual checklists | Automated workflows and scoring |

| Risk is documented post-event | Risk is anticipated and addressed pre-incident |

With RiskOps, risk assessments and compliance checks aren’t done after the fact; they happen at the source, whether it's a code deployment, vendor onboarding, or policy update.

2. Siloed vs. Integrated

Traditional GRC often lives in siloed departments security, compliance, and legal all operating with limited cross-functional coordination. RiskOps creates a shared language of risk across the enterprise.

Example:

In GRC, vendor assessments are run independently by procurement.

In RiskOps, vendor risk signals are shared across legal, IT, finance, and security to guide both onboarding and ongoing engagement.

3. Reactive vs. Proactive

GRC often emphasizes documentation and reporting. RiskOps emphasizes prevention and continuous improvement.

GRC mindset:

“We passed the audit.”

RiskOps mindset:

“We caught a misconfiguration in staging before it reached production.”

This shift from checkbox compliance to active risk prevention reduces exposure and accelerates recovery.

4. Generic vs. Context-aware

Traditional risk registers treat all risks equally. RiskOps adds business context to risk evaluation, so you focus on what actually matters.

Illustration:

A vulnerability in a sandbox environment is weighted lower than a vendor handling sensitive PII with expired security certifications.

Risk scoring is tailored to your business model, data sensitivity, and impact thresholds.

Auditive’s role in enabling RiskOps

Auditive is purpose-built to bridge this gap between traditional GRC and agile RiskOps. Its platform allows organizations to:

Automate risk detection across vendors, contracts, and cloud environments.

Break silos between teams by centralizing security, compliance, and procurement data.

Embed real-time risk alerts into systems people already use (like procurement tools or contract management platforms).

Offer live dashboards tailored for CISOs, compliance leaders, and procurement heads, making risk posture visible across levels.

In essence, Auditive operationalizes trust. Instead of relying on one-off assessments or stale spreadsheets, it enables organizations to maintain a dynamic Trust Center, a centralized, always-on view of risk posture across internal systems and third-party relationships.

Benefits of Implementing a RiskOps Model

Adopting a RiskOps framework doesn’t just modernize your risk strategy, it transforms how your entire organization operates. By integrating risk visibility into the DNA of daily workflows, RiskOps empowers faster decisions, greater resilience, and stronger stakeholder trust.

Here’s a breakdown of the most impactful benefits:

1. Proactive risk detection and remediation

RiskOps enables early identification of threats before they escalate. By embedding risk checkpoints into workflows, companies can automatically flag misconfigurations, compliance gaps, or vendor issues without waiting for periodic reviews.

What this means:

Faster response times

Fewer security incidents

Improved regulatory posture

Example: A misaligned vendor control doesn’t go unnoticed for months; it’s flagged and escalated immediately.

2. Increased operational efficiency

By automating risk scoring, assessments, and alerts, RiskOps eliminates the manual busywork traditionally associated with compliance and audit preparation. Teams can focus on strategy, not spreadsheets.

Efficiency gains:

40–70% time saved on assessments and vendor reviews

Streamlined approval processes

Reduced audit fatigue

3. Improved collaboration across teams

RiskOps fosters cross-functional ownership. Instead of pushing risk responsibilities to security or compliance, it distributes them where decisions are made: procurement, legal, and finance.

This results in:

Better risk visibility for decision-makers

Accountability is built into daily operations

Stronger culture of shared trust and governance

4. Stronger vendor risk management

RiskOps shines in environments with complex third-party relationships. It offers a unified platform to assess, monitor, and continuously track third-party risk, instead of relying on static onboarding questionnaires.

Impact:

Faster onboarding of vendors

Real-time visibility into supplier risks

Lower exposure to third-party breaches or compliance failures

5. Real-time risk visibility for leadership

CISOs, CROs, and Boards don’t want outdated metrics; they need actionable, real-time insight. RiskOps enables customizable dashboards that show where the greatest exposures lie and how they’re being addressed.

Why this matters:

Informed executive decision-making

Faster escalations and resource allocation

Confidence during investor or regulatory conversations

6. Resilience and agility at scale

RiskOps isn’t just about reacting; it’s about building resilient systems that adapt. As regulations evolve or new business models emerge, your risk processes flex with them.

That means:

Faster expansion into new markets or verticals

Seamless onboarding of new tools or vendors

Less friction for growth

Platforms like Auditive make it easier to realize these benefits without building everything from scratch. By automating 80% of third-party reviews and offering continuous monitoring, Auditive lets teams focus on meaningful risk signals, not paperwork.

Complete security assessments 4x faster

Get instant visibility into vendor risk

Monitor seller risk continuously in one place

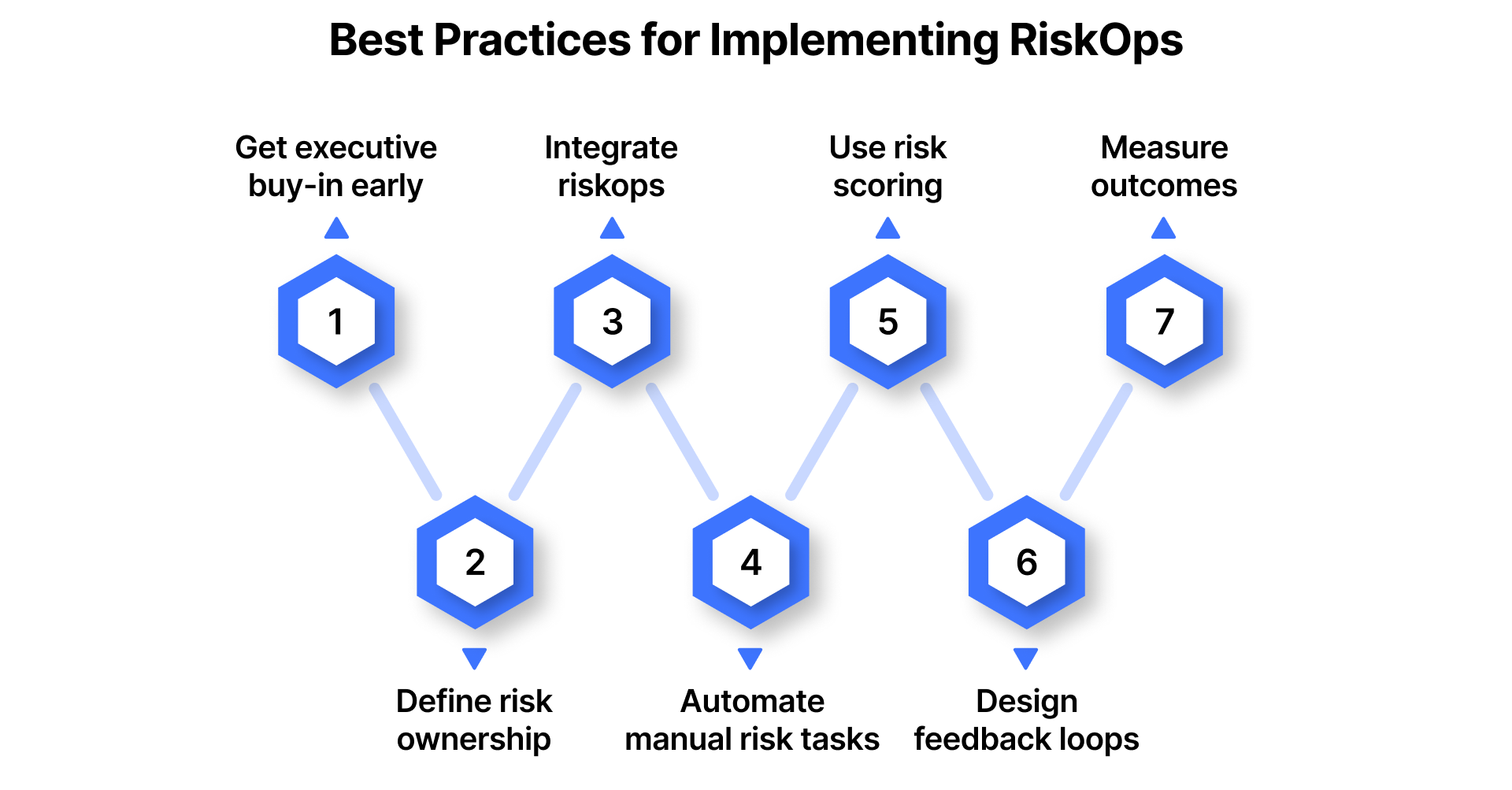

Best Practices for Implementing RiskOps

Implementing RiskOps isn’t just about deploying a framework or tool. It’s about operationalizing risk awareness across people, processes, and platforms, turning static governance into active, real-time resilience. Below are the key best practices that modern businesses can follow to successfully implement and mature a RiskOps model.

1. Get executive buy-in and cross-functional alignment early

Risk touches nearly every business function, from procurement and engineering to finance, legal, and compliance. Without executive sponsorship and interdepartmental alignment, RiskOps can quickly stall as “just another initiative.”

What to do:

Identify key executive sponsors across risk, security, and procurement.

Show how RiskOps supports strategic outcomes like faster go-to-market, audit-readiness, or lower compliance costs.

Align priorities and timelines across all stakeholders: InfoSec, Legal, Procurement, Finance, DevOps, etc.

Define governance and communication channels to prevent silos.

Auditive’s network-driven model makes alignment easier by giving both buyers and sellers a shared view of risk status and compliance progress, cutting down on back-and-forth and aligning stakeholders faster.

2. Define risk ownership and responsibilities clearly

RiskOps thrives on clarity. When ownership is vague, issues fall through the cracks or get delayed in remediation. RiskOps makes risk everyone’s business, but responsibilities must be clear and documented.

What to do:

Create a risk responsibility matrix (e.g., RACI chart) across business units.

Define who triages issues, who remediates, who escalates, and who signs off.

Assign “risk champions” in each department who liaise with central teams.

Establish playbooks for common scenarios like third-party risk, data breaches, or SLA violations.

3. Integrate riskops into day-to-day business workflows

The more RiskOps feels like a parallel process, the harder it will be to adopt. RiskOps should fit within your existing tools and workflows, surfacing real-time risk signals wherever people are already working.

What to do:

Integrate risk monitoring into existing platforms: Jira for dev teams, Slack for alerts, ServiceNow for ITSM.

Automate risk evaluations in procurement flows (e.g., during vendor onboarding).

Bring compliance alerts into productivity tools to reduce context-switching.

Use SSO and workflow connectors to unify systems across departments.

Auditive excels here by embedding itself into procurement and productivity workflows, turning risk reviews into seamless, continuous processes without the noise or delays of traditional reviews.

4. Automate manual risk tasks, prioritize scale and speed

Manual risk assessments and static reports don't scale. RiskOps is about turning episodic assessments into ongoing monitoring. Automation is key to faster decisions and accurate threat detection.

What to do:

Automate evidence gathering for third-party risk reviews using prebuilt questionnaires and frameworks.

Set up auto-flagging for noncompliant behaviors or expired certifications.

Use real-time monitoring tools for changes in vendor posture, region-specific threats, or SLA breaches.

Connect your data feeds (threat intel, cloud logs, audit tools) to trigger proactive workflows.

Auditive’s network-based risk model eliminates 80% of the back-and-forth by continuously pulling in evidence, updating statuses, and scoring vendors based on frameworks suited to your industry.

5. Use risk scoring that reflects your business priorities

A generic risk score won’t help your team prioritize or understand the real business impact. RiskOps relies on contextual scoring that reflects how much each issue matters to you.

What to do:

Create risk scoring logic based on operational context, not just technical severity.

Customize scoring by region, business unit, type of data handled, or cloud footprint.

Incorporate compliance requirements (SOC 2, GDPR, HIPAA) into your scoring models.

Continuously update scoring as vendors or systems evolve.

Auditive allows you to evaluate vendors against frameworks tailored to your industry, helping you see true business impact, not just a static number.

6. Design feedback loops for continuous improvement

RiskOps is not “set it and forget it.” As your risk surface evolves with new vendors, new products, and regulatory shifts, you’ll need mechanisms to adapt quickly.

What to do:

Conduct quarterly retrospectives with key stakeholders.

Analyze false positives, alert fatigue, and bottlenecks in risk remediation.

Benchmark your metrics across quarters and peer companies.

Adjust your playbooks, alerts, and workflows based on real-world usage.

7. Measure outcomes, not just activity

To validate the value of RiskOps, you need to go beyond tracking how much work is being done and focus on outcomes like faster incident response or reduced risk exposure.

What to do:

Track KPIs such as:

Mean time to detect (MTTD) and resolve (MTTR) risk issues

Reduction in manual reviews or redundant assessments

Number of third-party risks mitigated proactively

Compliance audit success rate or time saved

Vendor onboarding speed with compliance confidence

Auditive helps you visualize these metrics clearly, cutting onboarding time by 4x, improving vendor collaboration, and making every risk activity measurable.

By following these best practices, organizations can shift from reactive risk mitigation to proactive risk management, embedded deeply across systems, decisions, and workflows.

How Auditive Supports RiskOps Transformation

RiskOps isn’t just a methodology; it’s a mindset shift that requires tight coordination between security, risk, compliance, and operational teams. This is where Auditive comes in.

Auditive empowers organizations to operationalize risk in real-time across complex third-party relationships, helping them move beyond manual processes and fragmented insights. By consolidating third-party risk activities into a single network-driven platform, Auditive transforms how teams manage, assess, and act on risk.

Here’s how Auditive strengthens RiskOps:

Continuous Risk Monitoring

Auditive provides always-on surveillance of vendor and third-party risks, surfacing real-time signals instead of relying on point-in-time assessments. This is crucial for organizations implementing a RiskOps model that depends on live, dynamic inputs.

Network-Centric Risk Intelligence

Instead of duplicating effort for each assessment, Auditive’s shared network model lets vendors securely share validated data with multiple customers, reducing fatigue and streamlining onboarding.

Alignment with Industry Frameworks

RiskOps requires relevance. Auditive aligns assessments with the standards that matter most in your sector, helping your team measure risk where it truly counts, not just generic scores.

Integrated Workflow Automation

RiskOps thrives when risk processes are embedded into business workflows. Auditive integrates smoothly into procurement, compliance, and security tools, helping your team take action faster, without context switching.

Trust Center for Transparency

With a built-in Trust Center, vendors can proactively share their security posture, compliance documentation, and certifications, accelerating trust and reducing the time it takes to make confident decisions.

Conclusion

RiskOps is not just a term; it’s a proactive, integrated, and scalable approach to managing risk across the enterprise. By unifying risk, compliance, and security processes into a single, dynamic operational strategy, organizations can break silos, reduce decision lag, and build real-time resilience.

As businesses increasingly rely on complex third-party ecosystems and face faster-evolving threats, adopting RiskOps becomes critical. It’s not about adding more tools; it’s about operationalizing intelligence, automating the mundane, and putting risk at the core of business decisions.

Platforms like Auditive are leading the way in enabling this transformation. With continuous third-party risk monitoring, shared assessments, and a powerful Trust Center, Auditive helps organizations scale vendor risk management and bring RiskOps to life.

Ready to operationalize your risk strategy? Schedule a demo with Auditive and modernize how your business manages vendor risk.

FAQs

Q1. What is RiskOps in simple terms?

A1. RiskOps (Risk Operations) is an integrated approach to managing risk that brings together teams, tools, and workflows across security, compliance, and procurement functions to respond faster and more effectively.

Q2. How is RiskOps different from traditional risk management?

A2. Traditional risk management is often reactive and siloed. RiskOps is continuous, cross-functional, and built to deliver real-time insights and action.

Q3. Who should be involved in RiskOps within an organization?

A3. RiskOps typically involves risk managers, cybersecurity professionals, compliance teams, procurement, and leadership, collaborating under shared workflows and dashboards.

Q4. Is RiskOps only useful for large enterprises?

A4. Not at all. While larger companies benefit from scale, small and mid-sized organizations can also improve efficiency and reduce exposure by adopting a RiskOps model early.

Q5. How can a platform like Auditive support RiskOps implementation?

A5. Auditive supports RiskOps by offering continuous third-party risk monitoring, industry-aligned frameworks, automated workflows, and a shared Trust Center, streamlining how organizations assess and act on vendor risk.