What Is Operational Risk Management? Definition, Framework & Tools

Every organization faces risks, but not all risks are strategic or financial. Some are embedded in the day-to-day running of a business. These are operational risks, failures in processes, systems, people, or external events that interrupt normal workflows. And in a time when business continuity and resilience are at the forefront, managing these risks isn’t just a precaution; it’s a necessity.

Operational risk management is a structured approach to identifying, assessing, and controlling potential threats that arise from routine operations. Whether it's a supply chain failure, system downtime, or employee error, operational risk management (ORM) helps businesses safeguard performance, maintain compliance, and protect their reputation.

This blog unpacks the operational risk management meaning, explores why it matters across industries, and outlines how to apply it effectively using modern strategies and tools, especially in complex environments where visibility and control are crucial.

Overview

Operational risk stems from failures in people, processes, systems, or external events, and it’s embedded in everyday business activities.

Effective Operational Risk Management (ORM) helps organizations reduce disruptions, meet compliance standards, and maintain customer trust.

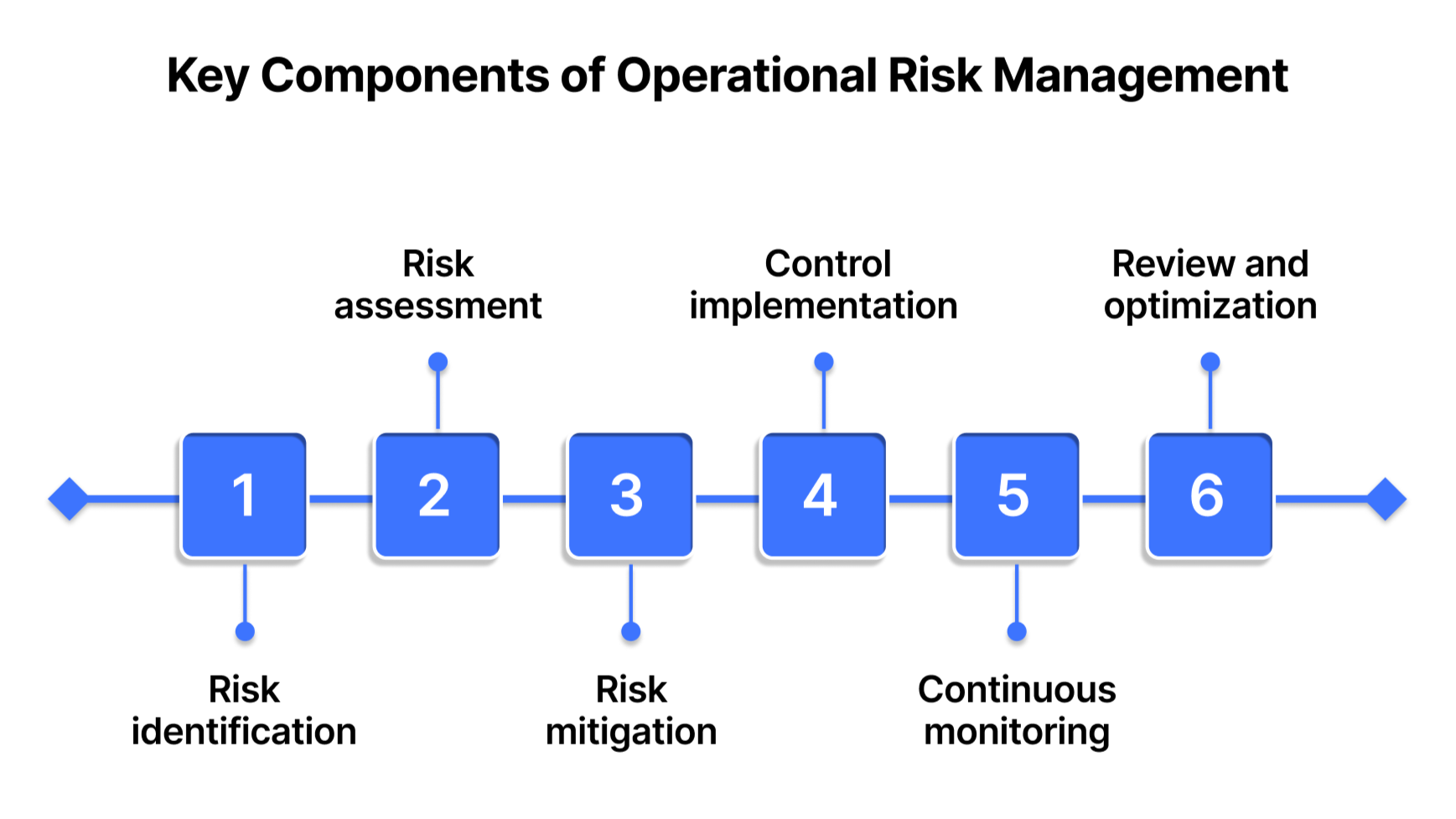

A strong ORM framework includes identification, assessment, mitigation, control implementation, monitoring, and continuous improvement.

Auditive enhances ORM with real-time vendor monitoring, AI-powered verification, automated workflows, and a collaborative Trust Center network.

Investing in ORM isn’t optional, it’s essential for resilience, efficiency, and long-term competitive advantage in today’s complex risk landscape.

What Is Operational Risk Management?

Operational risk management refers to the processes and tools organizations use to manage risks arising from internal operations. Unlike strategic risks (which relate to long-term goals) or financial risks (like market fluctuations), operational risks are tied to the systems and procedures businesses rely on daily.

Common sources of operational risk include:

People: Human error, insufficient training, insider fraud

Processes: Poorly designed workflows, lack of standardization, manual dependencies

Systems: Technology outages, cyberattacks, outdated platforms

External events: Natural disasters, regulatory changes, geopolitical issues

What makes operational risk unique is that it is everywhere, embedded in your HR policies, vendor onboarding process, or even how employees handle data. Left unmanaged, these risks can lead to loss of productivity, fines, reputational damage, or even shutdowns.

Why Operational Risk Management Is Crucial Today?

Operational risk management isn’t just about preventing things from going wrong; it’s about making your business stronger, faster, and more adaptable in the face of change.

Here’s why it matters:

Keeps the business running

ORM ensures that essential operations continue, even when disruptions occur. It reduces downtime and helps businesses recover quickly from incidents.

Protects financial performance

Operational disruptions can be expensive. By controlling these risks, organizations prevent revenue loss and reduce unexpected costs.

Supports regulatory compliance

Regulatory bodies across finance, healthcare, and technology demand proof of risk control. ORM helps organizations meet audit and legal requirements.

Enhances trust and brand integrity

Customers and partners are more confident in companies that demonstrate strong risk controls and transparency.

Drives better decision-making

ORM feeds real-time risk insights to leadership, enabling smarter, more proactive planning.

Platforms like Auditive provide continuous monitoring and AI-powered insights into operational vulnerabilities, helping companies reduce uncertainty and stay compliant without added overhead.

6 Key Components of an Effective Operational Risk Management Framework

A strong ORM program follows a cycle of identification, assessment, mitigation, monitoring, and continuous improvement. Let’s break down each stage in detail:

1. Risk identification

The first step is recognizing where operational risks exist within your organization.

Areas to evaluate:

Vendor relationships and supply chain dependencies

Internal processes across departments (e.g., finance, IT, compliance)

Employee actions and access controls

Legacy systems, manual tasks, and automation gaps

Environmental and geopolitical events

Auditive’s TPRM platform can highlight third-party risks automatically, helping you map out where vendors may introduce vulnerabilities into your operations.

2. Risk assessment and prioritization

Not all risks carry the same weight. Once identified, they must be evaluated based on:

Likelihood: How probable is the risk?

Impact: What’s the potential damage, financial, reputational, or operational?

Velocity: How quickly could the risk materialize and cause disruption?

Procurement and security teams can use tools like risk heatmaps, key risk indicators (KRIs), and scenario analysis to quantify risks and determine which ones require immediate action.

3. Risk mitigation strategies

Once risks are prioritized, you need to decide how to handle them.

Common risk treatment strategies:

Avoid: Discontinue or redesign the risky activity

Reduce: Implement controls to minimize impact

Transfer: Outsource or insure against the risk

Accept: Acknowledge the risk, but monitor closely

Mitigation plans must be realistic, cost-effective, and tailored to the business environment. Auditive supports this phase with intelligent dashboards that track mitigation efforts across your vendor ecosystem.

4. Control implementation

After planning, it’s time to act. Controls are safeguards that reduce the chance or impact of a risk.

Examples of operational controls:

Segregation of duties

Approval workflows and dual sign-offs

Automated compliance alerts

Regular access and permissions audits

Incident response playbooks

The right controls should integrate into daily operations without slowing teams down, especially in fast-moving industries like FinTech or HealthTech.

5. Continuous monitoring and reporting

Risks evolve. That’s why monitoring is essential.

ORM monitoring includes:

Real-time alerts on vendor status changes

Regular KRI tracking and threshold breaches

Audit trails for all mitigation and control activities

Reports for internal stakeholders and regulators

With Auditive, procurement and security leaders get a unified view of risk across all third-party relationships, updated continuously, allowing faster response times and stronger compliance posture.

6. Review and optimization

An ORM framework must evolve. After every incident, audit, or major change, review what worked and what didn’t.

Conduct post-event analyses

Update controls and documentation

Train staff based on lessons learned

Improve collaboration across departments

Operational risk isn’t a one-time project. It’s an ongoing cycle of learning, adapting, and strengthening your business.

Real-World Examples of Operational Risks

Operational risk shows up in unexpected ways. Some examples across industries include:

Banking: IT system outages preventing transaction processing

Healthcare: Mishandling of sensitive patient data leading to compliance fines

Manufacturing: Single-source vendor failure delaying production

EdTech: Platform downtime during high-traffic exam periods

Retail: Supply chain disruptions due to external strikes or weather events

These incidents don’t just cause immediate losses, they often expose gaps in planning and controls that could have been prevented with stronger operational risk management.

How Auditive Helps You Manage Operational Risk

Operational risks often stem from external relationships, particularly suppliers and vendors. Whether it’s a security lapse, compliance failure, or unreliable documentation, third-party vulnerabilities can have a direct impact on your internal workflows. That’s where Auditive steps in, not just as a tool, but as a partner in building operational resilience.

Here’s how Auditive strengthens your operational risk management efforts across the board:

1. Real-time risk monitoring

Auditive continuously tracks your vendors’ risk posture, scanning for changes in security status, compliance issues, or newly surfaced threats.

Instant alerts help teams act before disruptions occur

Ongoing monitoring replaces outdated, point-in-time assessments

Supports business continuity by keeping procurement and risk aligned in real time

2. AI-Powered information verification

Manually reviewing vendor documents is slow and prone to oversight. Auditive uses AI to verify security audits, certifications, and policy documents provided by vendors.

Cuts down review time and human error

Ensures you're working with current, validated data

Builds trust in supplier-provided risk data without relying on self-reporting alone

3. Centralized risk profiles for every vendor

Auditive creates a single source of truth for each supplier, pulling in all relevant risk, compliance, and performance data.

Helps security, procurement, and compliance teams collaborate more effectively

Reduces confusion caused by fragmented systems or duplicate records

Enables faster, better-informed decisions

4. Auditive Trust Center network

With its Trust Center, Auditive facilitates transparent, secure data exchange between buyers and suppliers.

Encourages mutual accountability and compliance readiness

Makes risk communication clearer and more structured

Strengthens long-term vendor relationships by promoting openness

5. Automated workflows and reporting

From onboarding to audits, Auditive automates risk assessments, document collection, and compliance reporting.

Saves time while standardizing data gathering

Keeps audit trails consistent and accessible

Reduces the burden of manual paperwork and follow-ups

6. Scalable risk oversight

Whether you're managing ten suppliers or ten thousand, Auditive scales with you.

Supports growing procurement ecosystems without increasing workload

Maintains oversight even as vendor complexity grows

Ideal for multi-regional, high-regulation industries like FinTech, EdTech, or HealthTech

7. Seamless integration with workflows

Auditive fits directly into your existing procurement and productivity workflows.

Enables teams to onboard vendors 4x faster

Allows easy invitation and onboarding of sellers to the Auditive network

Ensures continuous risk visibility without requiring a change in daily operations

By bringing these capabilities together, Auditive transforms operational risk management from a reactive checklist into a proactive, intelligence-driven discipline. Whether you’re securing your supply chain, improving audit readiness, or aligning risk insights with strategic planning, Auditive gives your team the tools to lead with confidence.

Conclusion

Understanding the operational risk management meaning is more than a definition, it’s about embedding a mindset of vigilance, clarity, and control into your operations. When risks are managed effectively, businesses gain more than stability, they gain the confidence to grow, adapt, and lead.

With Auditive’s cutting-edge Vendor Risk Management and Trust Center tools, your procurement and risk teams gain the visibility, automation, and intelligence needed to thrive in today’s fast-moving, risk-heavy environment.

Ready to strengthen your operational risk strategy?

Book a free demo today and take control of your operational resilience with Auditive.

FAQs

Q1. What is the main goal of operational risk management?

A1. The primary goal of operational risk management is to identify, assess, and mitigate risks that arise from internal processes, systems, people, or external events, ensuring the organization can operate smoothly, maintain compliance, and reduce losses.

Q2. How is operational risk different from other types of risk?

A2. Operational risk focuses on failures in day-to-day business functions, like process breakdowns, cyber incidents, or human error. In contrast, financial risk deals with market fluctuations, and strategic risk relates to long-term business goals or competitive positioning.

Q3. What are examples of operational risks in a business?

A3. Common examples include:

IT system outages

Data breaches due to weak security controls

Supplier non-compliance or failure

Fraud or unauthorized transactions

Inaccurate reporting due to manual errors

Q4. How can technology improve operational risk management?

A4. Technology platforms like Auditive automate risk detection, centralize vendor data, provide real-time monitoring, and use AI for intelligent verification. This enhances accuracy, speeds up assessments, and ensures better oversight across operations.

Q5. Why should organizations invest in operational risk management now?

A5. Marked by regulatory pressure, cybersecurity threats, and global supply chain disruptions, ignoring operational risk can lead to costly failures. ORM not only protects the business but also builds resilience, trust, and long-term value.