Operational Due Diligence Software Solutions

Operational due diligence has become a cornerstone of informed business decision-making. Whether it’s assessing a potential investment, acquiring a company, or evaluating vendor partnerships, understanding the operational health of an organization is critical. It helps uncover hidden inefficiencies, compliance risks, and governance gaps that could affect long-term success.

However, with growing regulatory scrutiny and complex global operations, manual due diligence processes often fall short. This is where due diligence software steps in, streamlining workflows, improving data accuracy, and ensuring every assessment is backed by comprehensive, real-time insights.

In this blog, we’ll explore the core areas and objectives of operational due diligence, walk through the framework and checklist, and highlight top software solutions that help organizations strengthen their review and risk management processes.

Key takeaways:

Operational due diligence (ODD) evaluates vendor and third-party risks to safeguard your organization.

Due diligence software centralizes documentation, automates workflows, and enhances compliance.

Key ODD areas include financials, legal, operational, IT/security, and regulatory compliance.

Top tools like Ideals, DealRoom, DD360, ShareVault, Midaxo, Nexis Diligence, and Box provide secure, feature-rich platforms.

Auditive offers continuous monitoring, vendor Trust Centers, and automated risk management to optimize ODD programs.

What is Operational Due Diligence (ODD)?

Operational Due Diligence (ODD) is a structured and investigative analysis of a company’s operational processes, conducted primarily by investors, acquirers, or stakeholders before making a major financial decision such as a merger or acquisition. It goes beyond the financial metrics to evaluate how a business truly functions, examining its workflows, management practices, systems, and ability to sustain performance over time.

In essence, ODD focuses on how effectively an organization transforms its inputs, like people, technology, and resources, into outputs such as products, services, and customer satisfaction. The goal is to determine whether the business model is operationally sound, scalable, and resilient in the face of future challenges.

By uncovering inefficiencies, compliance issues, or dependencies that could pose post-acquisition risks, operational due diligence helps buyers make informed decisions and ensures that an investment aligns with both strategic goals and operational stability.

Types of Operational Due Diligence

Operational due diligence (ODD) can be approached from two primary perspectives, buy-side and sell-side, each serving a unique purpose in assessing and improving business operations.

Buy-Side Operational Due Diligence

Buy-side ODD is the more commonly discussed form, typically conducted by investors, private equity firms, or acquirers during mergers and acquisitions (M&A). The focus here is forward-looking, evaluating whether the target company’s operations can sustain and support future growth under new ownership.

Instead of merely reviewing historical performance, buy-side ODD asks strategic questions such as:

Are the company’s operations scalable and efficient enough to meet projected demand?

How well are current systems, processes, and supply chains positioned for long-term performance?

What operational risks could impact profitability or integration post-acquisition?

By thoroughly analyzing these aspects, buyers can identify operational weaknesses early, estimate the investment required for optimization, and ensure the acquisition aligns with their strategic objectives.

Know more about: Understanding Supply Chain Attacks: Key Insights and Examples

Sell-Side Operational Due Diligence

Sell-side ODD, on the other hand, is a proactive assessment conducted by the company preparing for a sale or merger. It acts as an internal health check, allowing the seller to identify inefficiencies, strengthen operations, and present the business as a well-managed, low-risk opportunity to potential buyers.

A sell-side ODD might explore questions such as

Do our machines or infrastructure require upgrades or maintenance?

Are we operating at optimal capacity, or could productivity be improved?

Can we streamline workflows to enhance efficiency and reduce costs?

By addressing these issues early, sellers not only boost valuation but also build confidence with investors. In essence, sell-side ODD transforms operational diligence into a value creation strategy, ensuring that the company’s strengths are clearly demonstrated and potential concerns are resolved before negotiations begin.

Whether on the buy-side or sell-side, conducting operational due diligence is ultimately about foresight, anticipating future performance, identifying gaps, and making data-driven decisions that protect and enhance business value.

Objectives of Operational Due Diligence

The objectives of operational due diligence (ODD) vary depending on the industry, target company, and the acquirer’s goals. However, the overarching purpose remains the same, to uncover potential risks, validate operational capabilities, and ensure that the business is equipped for sustainable growth post-acquisition. Below are the key objectives that typically guide the ODD process:

1. Business Plan Evaluation

At the heart of operational due diligence lies a detailed analysis of the company’s business plan, how it operates, generates revenue, and plans for growth. Assessors critically examine assumptions, forecasts, and dependencies to ensure that the business model is realistic, scalable, and aligned with market conditions. This step forms the foundation of all subsequent ODD activities.

2. Risk Identification and Mitigation

One of the primary goals of ODD is to detect operational and strategic risks before they affect deal value. Private equity firms and investors, known for their cautious approach, focus on identifying potential disruptions, ranging from supply chain vulnerabilities to cybersecurity gaps, and outlining mitigation strategies. Risks that cannot be effectively managed often become deal breakers.

3. Customer and Supplier Dependency Review

A company’s strength often lies in the stability of its ecosystem of customers and suppliers. ODD assesses the concentration of key contracts, dependency risks, and termination clauses to understand how disruptions in these relationships could impact business continuity. This helps acquirers anticipate challenges in revenue flow and supply reliability.

4. Management Capability Assessment

Evaluating leadership is an essential part of due diligence. Investors look at the management team’s ability to execute strategic plans, handle transitions, and drive innovation. Questions like “Can this team deliver on new objectives?” or “Do they align with our post-acquisition goals?” are central to the evaluation. Leadership gaps identified here often guide post-deal restructuring decisions.

5. Compliance and Regulatory Alignment

Every industry operates within specific regulatory frameworks. ODD ensures that the target company adheres to relevant compliance standards, licensing requirements, and reporting obligations. Early identification of compliance issues not only prevents costly legal consequences but also strengthens the acquirer’s long-term governance structure.

When executed effectively, these objectives enable acquirers to make confident, data-driven decisions, balancing opportunity with risk.

With platforms like Auditive, organizations can bring automation, intelligence, and transparency into their due diligence workflows. By integrating compliance monitoring, vendor risk assessments, and performance tracking within one secure Trust Center, Auditive empowers businesses to evaluate operational risks with precision and efficiency, before, during, and after a transaction.

Operational Due Diligence Process and Framework

A strong operational due diligence (ODD) framework acts as the backbone of every effective investment or acquisition review. It ensures that no operational aspect, be it financial, legal, or technological, is overlooked. By following a structured framework, organizations can gain a 360-degree understanding of a target company’s strengths, weaknesses, and potential red flags before committing to any deal.

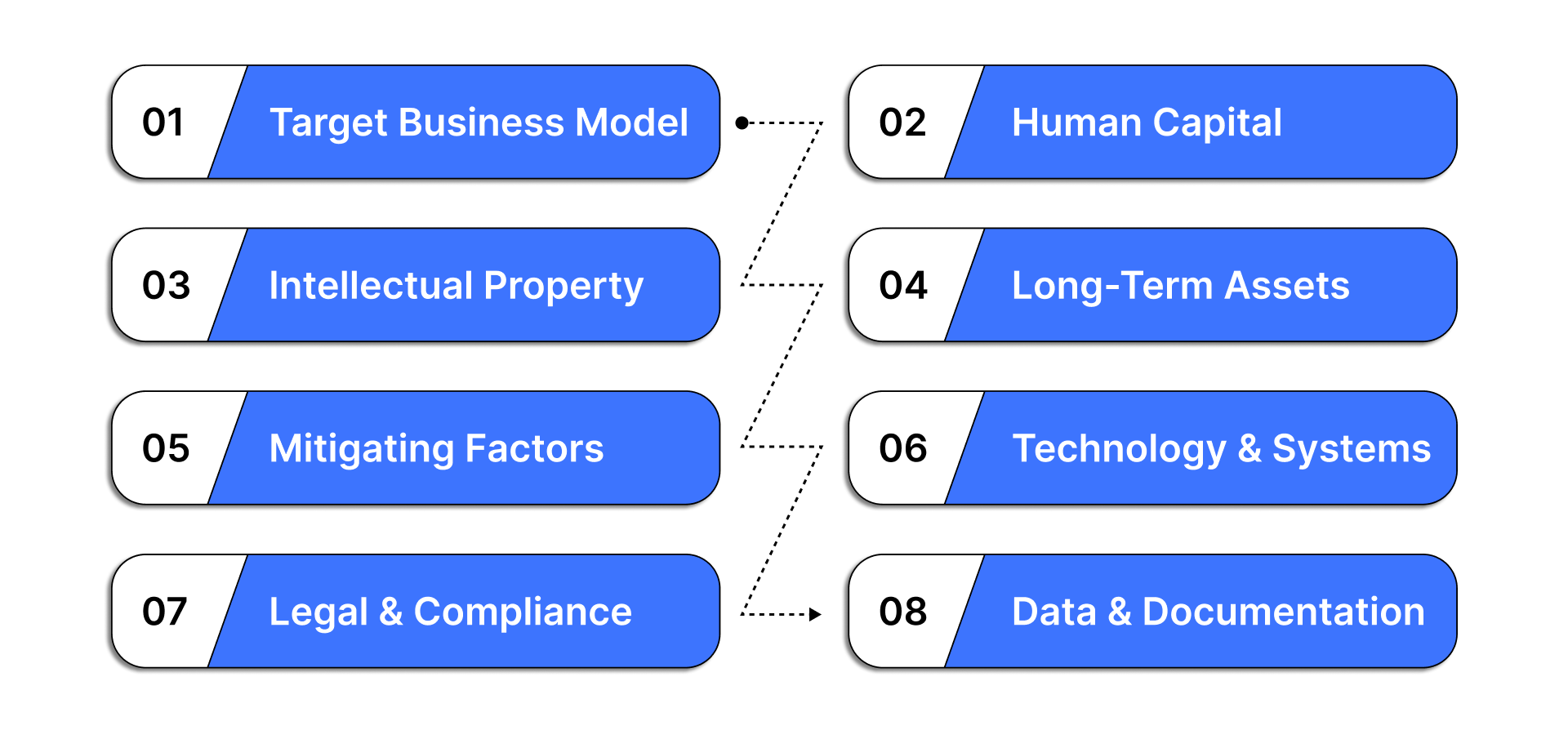

Below are the key components of a comprehensive ODD process and what each entails:

1. Target Business Model

The first step in operational due diligence is understanding the business model, how the company generates and sustains cash flow. This involves analyzing revenue sources, cost structures, and financial cycles. For instance, companies with long inventory cycles might tie up substantial cash, reducing liquidity.

On the other hand, subscription-based models like SaaS provide recurring, predictable revenue, which investors often find more appealing. Evaluating how efficiently a company converts resources into cash flow helps determine its long-term viability and growth potential.

2. Human Capital

People drive performance, and assessing the human capital of a target company is vital. This involves evaluating leadership quality, employee engagement, organizational structure, and talent retention. Key considerations include:

How well do employees understand and support the company’s goals?

Are there key individuals whose departure could disrupt operations?

How aligned is the workforce culture with that of the acquiring company?

Strong, engaged teams contribute to smooth transitions and consistent operational performance.

3. Intellectual Property (IP)

For many companies, intellectual property represents their most valuable asset. The ODD process must assess ownership, protection, and potential risks tied to IP assets such as patents, copyrights, and trademarks. Evaluators should ask:

Are all IP assets legally documented and up to date?

Are there disputes or challenges over IP ownership?

How critical are these assets to maintaining the company’s competitive advantage?

A robust IP portfolio not only enhances market value but also supports innovation and future scalability.

4. Long-Term Assets

A detailed review of long-term assets, both tangible and intangible, is essential. These include property, plants, equipment, and even proprietary data or brand value. Teams should verify asset conditions, maintenance practices, and compliance with accounting standards. Critical considerations include:

Are assets accurately valued on the balance sheet?

What is the efficiency level of these assets compared to industry benchmarks?

Are leases, warranties, and ownership documents in proper order?

This analysis helps determine the organisation’s operational resilience and capital efficiency.

5. Risks and Mitigating Factors

Operational due diligence ultimately revolves around identifying and addressing risks. Potential concerns could range from supply chain vulnerabilities to regulatory non-compliance. The process should focus on:

Operational dependencies that could hinder post-acquisition performance.

Integration challenges with existing business models.

Immediate improvements that could enhance value post-deal.

By recognizing these risks early, companies can develop mitigation strategies and avoid costly surprises later.

Also Read: Guide to Effective Reputation Risk Management and Mitigation

6. Technology and Systems

In the digital era, technology underpins nearly every aspect of business operations. The ODD process evaluates the effectiveness, scalability, and security of IT infrastructure. Key questions include:

Are current systems capable of supporting future growth?

How robust are cybersecurity measures?

Are there integration challenges with existing platforms?

Identifying outdated or incompatible systems early prevents disruptions during integration and supports operational continuity.

7. Legal and Compliance

Compliance failures can derail even the most promising transactions. This step examines the target company’s adherence to laws, regulations, and industry standards. Evaluators review contracts, licenses, permits, and ongoing litigations. The focus areas include:

Are internal compliance policies up to standard?

Are there unresolved legal disputes or liabilities?

How transparent and consistent are regulatory practices?

Legal due diligence ensures operational stability and minimizes exposure to future liabilities.

8. Data and Documentation

Finally, reliable data management underpins every operational assessment. This involves verifying financial records, operational reports, and sensitive data storage practices. Key questions include:

Are data management systems consistent and compliant with regulations?

Is sensitive customer and employee information properly secured?

Is documentation easily auditable and well-organized?

A transparent, well-maintained data infrastructure signals maturity, accountability, and readiness for growth.

To streamline and elevate each phase of operational due diligence, Auditive provides end-to-end solutions that simplify vendor evaluation, automate documentation workflows, and ensure compliance accuracy. Whether analyzing human capital or assessing data integrity, Auditive helps organizations conduct ODD with greater precision and efficiency, turning a complex process into a confident, data-driven decision.

Top Due Diligence Software to Use

Selecting the right due diligence software can make all the difference in streamlining your operational reviews, managing risk efficiently, and ensuring compliance. Here’s a closer look at seven leading solutions, their key features, and benefits:

1. Ideals

Ideals is a premium virtual data room solution known for its reliability and robust security measures. With a 99.95% uptime guarantee and multilingual support, Ideals ensures smooth collaboration among stakeholders. Its intuitive interface, advanced Q&A module, and heat map reports allow for detailed bidder activity insights.

Top features:

Multi-layered data encryption

8-level document access rights and granular permissions

Secure spreadsheet viewer

GDPR compliance and security certifications

Activity dashboards and e-signature feature

Automatic index numbering for organized documentation

2. DealRoom

DealRoom caters to both sell-side and buy-side operations, integrating seamlessly with platforms like Google Apps, Microsoft Office, and Slack. It facilitates multi-party collaboration, deal tracking, and risk flagging to speed up the due diligence process.

Top features:

256-bit AES encryption and multi-factor authentication

Drag-and-drop upload and built-in Excel viewer

Template automation for standardizing workflows

Deal request tracker and activity dashboards

3. DD360

DD360 is ideal for asset managers, investment officers, and consultants, offering centralized workflow management and automated report generation. Users can manage questions, pre-populate responses, and benchmark data effectively.

Top features:

Document and workflow management

Real-time data and analytics

Customizable reports and benchmarking capabilities

4. ShareVault

ShareVault combines ease of use with secure file sharing and reporting. Its interactive user activity reporting, granular access controls, and auto-numbering ensure that sensitive information is protected while maintaining transparency.

Top features:

Full-text search and infinite document scrolling

Q&A module for clarifications

IP address tracking and secure batch downloads

5. Midaxo

Midaxo provides dedicated workspaces for teams, centralized reporting, and one-click dashboards. Its integrated technologies reduce risks and ensure clarity throughout the deal process.

Top features:

Access controls and project/document management

Preconfigured dashboards and workflow automation

Due diligence playbooks for structured reviews

6. Nexis Diligence

Nexis Diligence focuses on third-party risk evaluation, offering insights into over 200 million companies. The platform supports risk mitigation with dashboards, alerts, and expert guidance.

Top features:

Collection of regulatory, ESG, legal, and news data

Risk report builder and proactive alerts

Business background screening

7. Box

Box is a cost-effective solution for small businesses, providing a secure, collaborative environment for due diligence processes. Its wide integration options and departmental templates enhance productivity.

Top features:

FINRA and SOX compliance

Dynamic watermarking and 7-level access permissions

1,400+ partner integrations and 120-format file preview

Each of these platforms offers unique strengths depending on your organization’s operational needs, scale, and industry focus. Comparing features, pricing, and trial options can help you choose the most suitable solution.

For teams looking to elevate operational due diligence while maintaining continuous vendor oversight, Auditive provides seamless integration and automated monitoring to complement these software solutions, helping organizations manage third-party risk with real-time insights and proactive reporting.

Learn more about: What Is Operational Risk Management? Definition, Framework & Tools

Enhance Operational Due Diligence with Auditive

While traditional due diligence software helps centralize documents and streamline workflows, managing ongoing vendor and third-party risk requires continuous oversight. Auditive bridges this gap by offering real-time monitoring, compliance tracking, and automated risk insights, ensuring your operational due diligence efforts remain robust and proactive.

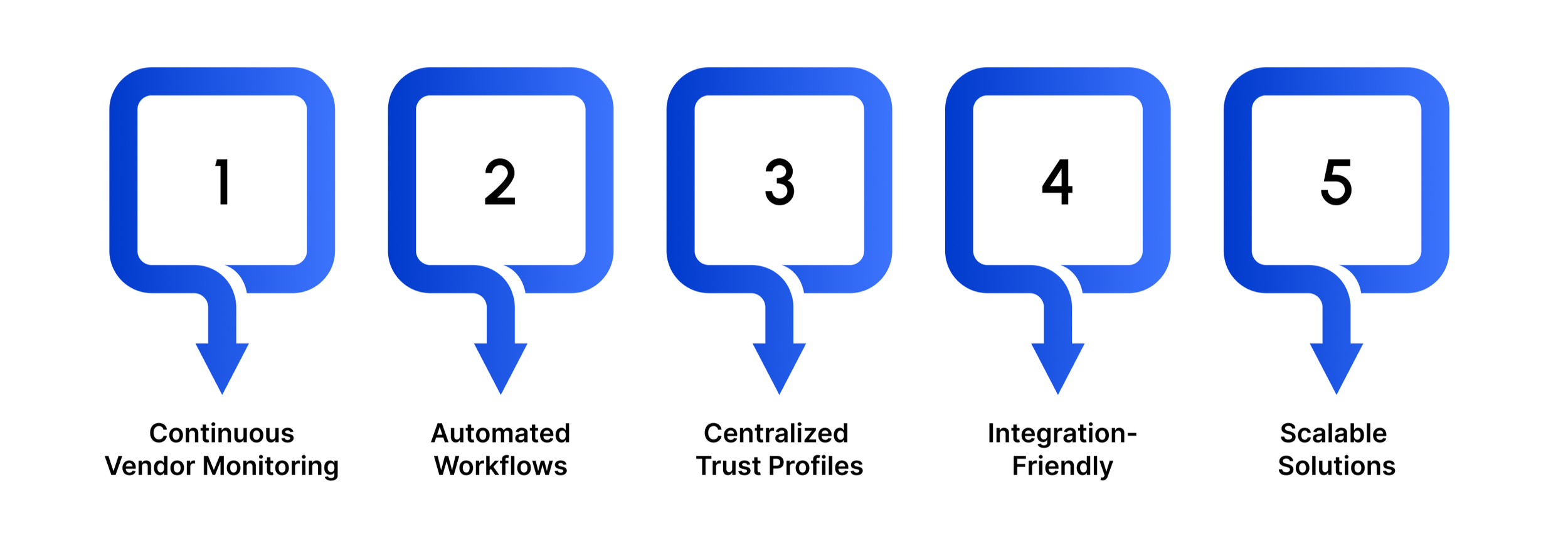

Key Benefits of Auditive for Due Diligence Programs:

Continuous Vendor Monitoring: Stay updated with real-time insights on your vendors’ security posture, compliance changes, and potential risk events.

Automated Workflows: Reduce manual effort with automated risk assessments, notifications, and reporting throughout the vendor lifecycle.

Centralized Trust Profiles: Access dynamic Trust Profiles for all vendors in one platform, ensuring transparency and easier decision-making.

Integration-Friendly: Seamlessly integrate with your existing procurement, workflow, and compliance tools without disrupting current operations.

Scalable Solutions: From small teams to enterprise-level programs, Auditive adapts to your organization’s due diligence needs with flexible modules and customizable dashboards.

With Auditive, organizations can move beyond one-time due diligence reviews and implement a continuous, risk-aware approach to vendor management. This not only strengthens compliance but also supports strategic decisions with actionable insights.

Conclusion

Effective operational due diligence is no longer optional, it is a cornerstone of sound vendor risk management. By implementing a structured due diligence process and leveraging advanced due diligence software, organizations can gain complete visibility into their third-party ecosystem, assess potential risks, and ensure compliance with regulatory standards.

Modern platforms, such as Auditive, take this a step further by offering a centralized Trust Center, continuous vendor monitoring, and automated workflows. These features not only reduce manual effort but also allow teams to respond proactively to emerging risks, safeguard sensitive data, and maintain trust with stakeholders. Integrating these tools into your operational strategy ensures that your organization stays resilient, transparent, and fully compliant while optimizing relationships with vendors and partners.

Take control of your vendor risk today. Book a demo with Auditive to see how its comprehensive vendor risk management and Trust Center solutions can transform your due diligence process, streamline monitoring, and strengthen your organization’s risk posture.

FAQs

1. What is operational due diligence (ODD)?

Operational due diligence is the process of evaluating a company’s operational, financial, and compliance practices, often used in private equity, mergers, acquisitions, and vendor assessments, to identify potential risks and ensure regulatory compliance.

2. Why is vendor risk management important in ODD?

Vendors and third parties can introduce operational, security, and compliance risks. Effective vendor risk management ensures continuous monitoring, mitigates threats, and protects sensitive data throughout the vendor lifecycle.

3. What features should I look for in due diligence software?

Look for secure document management, workflow automation, real-time reporting, customizable dashboards, integration with existing tools, and continuous monitoring capabilities.

4. How does a Trust Center support due diligence efforts?

A Trust Center centralizes information on vendor compliance, certifications, and performance, promoting transparency, easy audits, and stronger trust between organizations and their stakeholders.

5. Can small businesses benefit from operational due diligence software?

Absolutely. Many solutions, such as Auditive and Box, offer scalable and affordable options that help small and mid-sized businesses monitor vendors, ensure compliance, and reduce operational risk without significant overhead.