Guide to the Top Vendor Questionnaires for Third-Party Risk Decisions

Vendor risk assessment is a fundamental process for organizations that rely on third-party vendors to manage sensitive data or operate key services. For industries like financial services, healthcare, and education, a comprehensive vendor risk assessment questionnaire is necessary to ensure third-party vendors meet your organization's security, compliance, and operational standards.

These assessments help identify risks and prevent data breaches, non-compliance, and other issues that could compromise your organization.

In this article, we’ll explore how to build top vendor questionnaires, the best methodologies for assessing vendors, and how to implement an effective vendor risk management strategy.

Key Takeaways

Vendor risk assessments help identify potential threats and protect your business from third-party vulnerabilities.

Use specific questionnaires to assess data security, compliance, and operational reliability of vendors.

Regular updates to vendor assessments ensure long-term risk mitigation and strong vendor partnerships.

Automated monitoring tools and audits are essential to evaluate vendor security continuously.

Maintaining transparent communication and compliance with vendors enhances your organization’s overall security posture.

What Is a Vendor Risk Assessment Questionnaire?

A Vendor Risk Assessment Questionnaire (VRAQ) helps organizations evaluate the risks posed by third-party vendors, covering areas such as information security, compliance, operational risks, and legal considerations.

For CISOs in industries like financial services, healthcare, and education, using a VRAQ is essential to assess how well a vendor protects data and complies with regulations. It helps ensure the vendor’s security posture, operational processes, and legal obligations align with your organization’s standards.

When evaluating third-party risks, completing RFPs and risk questionnaires can be time-consuming. With Auditive’s Supplier Questionnaire Copilot, you can complete over 80% of vendor questionnaires in minutes, automating the process and ensuring high accuracy. This AI-powered solution simplifies the data collection and analysis, streamlining your vendor risk evaluation.

Now that you know what they are, let’s see why these questionnaires matter so much.

Why Use a Vendor Risk Assessment Questionnaire for Third-Party Risk Management?

Vendor risk assessments are crucial for identifying vulnerabilities in third-party relationships. By using top vendor questionnaires, you can:

Identify Risks: Identify vulnerabilities in vendor practices, ensuring you’re aware of potential security, operational, and legal risks before they affect your organization.

Ensure Compliance: Ensure that vendors comply with industry-specific regulations like HIPAA, GDPR, or SOX, reducing the risk of legal issues or penalties.

Enhance Data Protection: Assess how vendors protect sensitive data and if their cybersecurity practices meet industry standards.

Improve Relationships: Vendor assessments create clear expectations, building mutual trust and helping strengthen partnerships.

Minimize Operational Risks: Evaluate vendors’ ability to meet your service requirements, ensuring smooth delivery of goods or services without disruptions.

Also Read: How to Create a Vendor Management Program

Once you know why they’re valuable, the next step is building one that actually works.

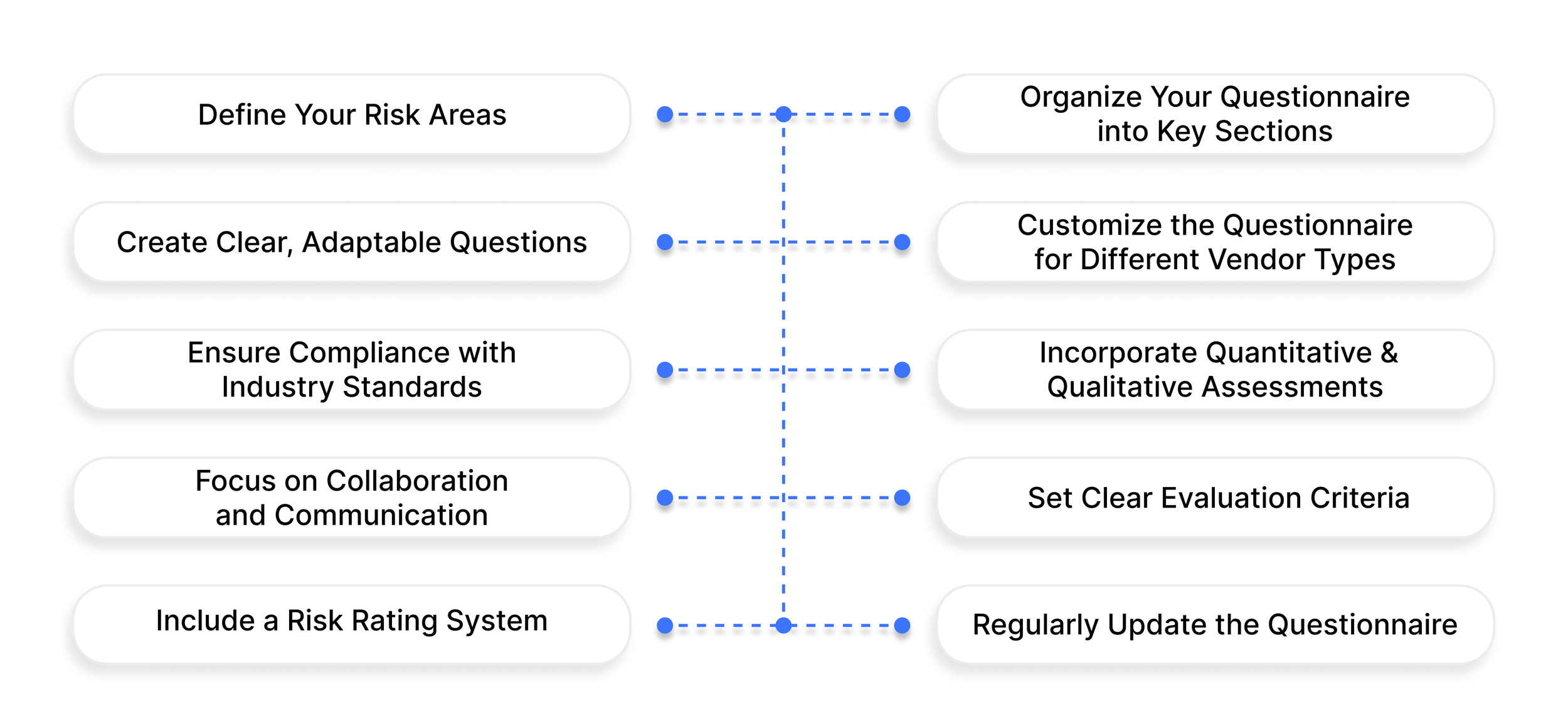

How to Build Effective Vendor Questionnaires for Stronger Risk Assessment

Building a vendor risk assessment questionnaire helps evaluate key areas like security, compliance, and operational risks. A well-designed questionnaire ensures you are aware of potential vulnerabilities associated with your vendors.

1. Define Your Risk Areas

Identify major risk categories such as data protection, compliance, financial health, and operational risks. These areas ensure that your assessment covers all potential vulnerabilities. Focusing on key areas allows for a more comprehensive evaluation.

2. Organize Your Questionnaire into Key Sections

Structure the questionnaire by segmenting it into relevant sections like security, compliance, and financial stability. This will streamline the process, allowing for a thorough risk assessment. A structured approach ensures no risk area is overlooked.

3. Create Clear, Adaptable Questions

Design clear, concise, and customizable questions for each risk area. Tailor these questions to different vendors based on their specific services. Customization ensures that you effectively assess vendor-specific risks across industries.

4. Customize the Questionnaire for Different Vendor Types

Adjust the questionnaire to account for the unique risks posed by different vendors. Vendors in healthcare or finance, for example, require industry-specific questions on compliance and security. Customization ensures you address relevant concerns for each vendor.

5. Ensure Compliance with Industry Standards

Align your questionnaire with industry standards like GDPR, HIPAA, and SOC 2. This ensures vendors meet required regulatory and data security standards. Staying updated with regulations minimizes the risk of non-compliance.

6. Incorporate Quantitative and Qualitative Assessments

Include both quantitative data (like financial health) and qualitative assessments (like business practices). This holistic approach provides a full picture of the vendor's risk profile. It ensures you evaluate both measurable and behavioral risks effectively.

7. Focus on Collaboration and Communication

Evaluate the vendor’s communication methods and responsiveness. Effective communication is key to addressing potential issues quickly. Ensure that vendors have clear communication channels and are proactive in their updates.

8. Set Clear Evaluation Criteria

Establish clear criteria for acceptable responses in each section of the questionnaire. Define minimum requirements for each risk area, such as security standards and compliance certifications. This ensures consistency in your assessments.

9. Include a Risk Rating System

Use a risk rating system (e.g., low, medium, high) to quantify vendor risk. This will help prioritize higher-risk vendors and streamline decision-making. A scoring system helps objectively assess each vendor.

10. Regularly Update the Questionnaire

Update your questionnaire regularly to reflect new risks and compliance requirements. This keeps the tool relevant and ensures that threats are addressed. Regular updates help you stay ahead of potential vendor-related risks.

Also Read: Operational Due Diligence Software Solutions

After building your framework, it’s time to know what criteria define a high-quality questionnaire.

Criteria for Selecting the Best Vendor Assessment Questionnaires

Selecting the right vendor risk assessment questionnaire involves evaluating both the content and the tools used to collect data. Here are some factors to consider:

1. Comprehensive Coverage

The questionnaire should cover all key risk areas like security, compliance, financial stability, and operational risk without leaving any important categories out.

2. Customization Options

Look for questionnaires that are customizable to your company’s specific needs. For example, healthcare and financial services may have different security and compliance requirements than general industries.

3. Clarity and Usability

The questions should be clear and easy to answer, minimizing ambiguity. Complex questions may discourage vendors from fully participating, so opt for straightforward inquiries.

4. Scalability

Your vendor risk assessment questionnaire should be scalable for companies of different sizes and complexities. For larger vendors, more detailed information may be necessary, while smaller companies may require a streamlined version.

5. Legal and Regulatory Alignment

Ensure the questionnaire aligns with your industry’s legal and regulatory standards. For example, healthcare companies should include questions about HIPAA compliance, while financial institutions may need a focus on SOX or GDPR compliance.

Also Read: Integrating ESG with Enterprise Risk Management Strategies

With the selection criteria clear, let’s look into the questions that matter most.

90+ Vendor Risk Assessment Questions to Add to Your Questionnaire

A Vendor Risk Assessment questionnaire helps you evaluate the security, compliance, and operational risks your vendors may pose. It’s especially essential for industries like finance, healthcare, and education to ensure every vendor meets required standards. Let’s break down the key areas to assess with the most relevant questions.

1. Cybersecurity Risk Assessment Questions

Cybersecurity is one of the most vital aspects to evaluate in a vendor relationship. You need to ensure that the vendor’s systems are capable of protecting your sensitive data and preventing unauthorized access. These questions help identify vulnerabilities that could lead to security breaches.

Do you prevent unauthorized physical access to facilities?

Are emergency safety measures in place for employees and visitors?

Are physical security controls tested and updated regularly?

Do you monitor access to sensitive areas like servers?

Do you use an intrusion prevention system (IPS)?

Do you use intrusion detection systems (IDS) and retain logs?

Are network access and data monitoring policies documented?

Do you conduct external penetration tests annually?

Do you have a Network Security Policy?

Do deny-by-default firewalls protect production hosts?

Is multi-factor authentication (MFA) used for remote access?

2. Data Privacy and Protection Questions

Data privacy and protection are paramount in safeguarding sensitive customer information. These questions evaluate how well a vendor protects personal and sensitive data in line with regulatory standards like GDPR, HIPAA, or others.

Do you have a Confidentiality Policy for employees?

Are measures in place to address risks when sharing personal data with vendors?

Is there a Data Protection Policy for handling personal data?

Do you conduct regular Data Protection Impact Assessments?

3. Business Continuity and Disaster Recovery Questions

A vendor’s ability to recover from a disaster and ensure business continuity is vital for maintaining operations. These questions assess the vendor's preparedness and response to unexpected disruptions.

Have you experienced a disaster recovery event recently?

Do you test your disaster recovery plan regularly?

Is your disaster recovery plan reviewed annually?

Do you have a documented Disaster Recovery Policy?

Are failures in critical controls addressed promptly?

Are production databases backed up for disaster recovery?

Is there a documented Data Backup Policy?

4. Employee Risk Assessment Questions

Your vendor’s employees can be a significant source of risk. Ensuring that vendors properly train their staff, perform background checks, and enforce proper data handling procedures is important.

Do employees receive training to handle sensitive data?

Are background checks conducted for staff with sensitive access?

Are company policies reviewed during onboarding?

5. Support and Customer Service Questions

Customer support is an integral part of vendor relationships. These questions assess if vendors provide adequate support and resolve issues promptly, helping to maintain smooth operations.

Do you provide customers with a way to report incidents or complaints?

Do you track and resolve customer support tickets promptly?

Is there a process to escalate unresolved support issues?

Do you provide customers with a Service Level Agreement (SLA)?

Are customer support teams trained to handle sensitive information securely?

Do you have multilingual support capabilities for global customers?

Are customer satisfaction metrics monitored and reported?

Do you have a process for handling support-related incidents or breaches?

Auditive’s Partner Trust Exchange allows you to connect with a dynamic network of vendors, offering real-time updates on their risk profiles. By using this tool, you can make informed decisions based on continuously updated vendor data, simplifying the vendor evaluation process and ensuring stronger, more reliable partnerships

6. Vendor Management Risk Questions

Managing vendors effectively involves ensuring that they comply with security policies and contractual obligations. These questions help you evaluate the vendor’s adherence to compliance and risk management protocols.

Do you have a Vendor Management Policy?

Do you perform regular vendor risk assessments?

Are subservice organizations periodically reviewed?

Are vendor contracts reviewed for compliance with your security policies?

Do you maintain an updated inventory of vendors and their access rights?

Are vendors required to sign non-disclosure agreements (NDAs)?

Is vendor performance evaluated against agreed service levels?

Do you monitor vendors for cybersecurity or data privacy incidents?

Are vendors required to comply with certifications like SOC 2, ISO 27001, etc.?

Is there a process for terminating vendor relationships securely?

7. Change Management Risk Questions

Change management is essential for ensuring that any modifications to systems or processes are securely implemented. These questions evaluate how well vendors manage changes in their systems, especially when dealing with security and compliance.

Is there an approved change management policy?

Do you track and log application code changes?

Do you monitor regulatory changes across all regions of operation?

Is there a designated team or individual responsible for regulatory updates?

Do you assess the impact of regulatory changes on your business?

Are regulatory changes communicated to relevant teams promptly?

Do you update policies and procedures to align with new regulations?

Is training provided to employees on recent regulatory changes?

Do you maintain documentation of actions taken in response to regulatory updates?

8. End-User Device Security Questions

Ensuring that vendor devices are secure is important in protecting sensitive data. These questions assess the vendor’s measures for securing the devices their employees use, which could pose a significant risk.

Are device security standards reviewed annually?

Do devices auto-lock after inactivity?

Are remote access and file-sharing encrypted and authenticated?

Are device logs detailed enough for incident investigations?

Is there a mobile device management program?

Are workstations equipped with screen-locking mechanisms?

9. Data Encryption Risk Questions

Data encryption is one of the most effective ways to secure sensitive information. These questions assess if a vendor properly implements encryption practices to protect data in transit and at rest.

Do you encrypt data in transit?

Do you encrypt data at rest?

Do you use key management systems (KMS) to secure encryption keys?

Are encryption protocols reviewed and updated annually?

Do you use end-to-end encryption for sensitive communications?

Is encryption implemented for data on portable devices and media?

Do third-party vendors comply with your encryption standards?

Do you change your secret digital keys frequently to prevent potential security breaches?

Is decryption access strictly limited and logged?

10. Regulatory Compliance Questionnaires

Regulatory compliance is important for mitigating risks and maintaining industry standards. Here are key questions to evaluate a vendor’s adherence to necessary regulations and certifications.

Do you hold certifications like HIPAA, ISO 27001, or SOC 2?

Are your compliance policies aligned with relevant industry regulations?

Do you perform regular internal audits to verify compliance?

Do you track compliance requirements across all operational regions?

Is there a dedicated team or officer overseeing compliance?

Do you maintain documentation for audits and inspections?

Are compliance performance metrics regularly reported to stakeholders?

Do you have a whistleblower policy in place for reporting violations?

ISO 27001 Compliance Questions:

Do you have an established Information Security Management System (ISMS)?

Are regular risk assessments performed to identify and mitigate threats?

Are roles and responsibilities for information security clearly outlined?

Are your incident management and response policies documented?

Do you track and review corrective actions during internal audits?

SOC 2 Compliance Questions:

Which Trust Service Criteria (TSCs) are included in your SOC 2 report?

Are access controls in place to prevent unauthorized data access?

How is data availability ensured during system outages or disruptions?

Do you follow encryption standards for data both in transit and at rest?

Is there an annual review process to maintain SOC 2 certification?

GDPR Compliance Questions:

Is personal data processing documented in accordance with GDPR principles?

Are Data Protection Impact Assessments (DPIAs) conducted as needed?

Has a Data Protection Officer (DPO) been appointed, where required?

How do you ensure compliance with data subject rights (e.g., access, erasure)?

Are data breaches reported to the relevant authorities within 72 hours?

HIPAA Compliance Questions:

Is there a designated Privacy Officer and Security Officer for HIPAA oversight?

Are physical, technical, and administrative safeguards in place for PHI (Protected Health Information)?

How are Business Associate Agreements (BAAs) managed and enforced?

Are regular training sessions conducted for employees on HIPAA compliance?

Is there a documented process to handle potential PHI breaches?

NIST Compliance Questions:

Which NIST framework is followed (e.g., CSF, 800-53)?

Are security controls mapped to specific organizational risks?

Do you have a process for continuous monitoring of systems?

How is the effectiveness of implemented security controls evaluated?

Are incident response plans regularly tested for effectiveness and readiness?

Also Read: Comprehensive Guide to Integrated Risk Management

Knowing the best questions is helpful, but using them effectively is what truly reduces risk.

5 Best Practices for Making Your Vendor Risk Assessments More Effective

Effective vendor risk assessments are not just about asking the right questions; they are about ensuring the process is thorough, efficient, and actionable. Here are some best practices to follow:

1. Regularly Update Your Assessments

Vendor risks change over time, especially as regulations, technologies, and business environments advance. Regularly updating your vendor risk assessments ensures that you stay ahead of potential risks.

2. Engage Vendors in the Process

Building a collaborative relationship with vendors during the risk assessment process ensures transparency. Encourage open communication and provide vendors with a clear understanding of your security and compliance requirements.

3. Use Third-Party Tools for Verification

Use third-party risk management tools to verify the information provided in vendor questionnaires. These tools can automate the process, helping identify discrepancies and ensuring greater accuracy.

4. Consider Using a Tiered Approach

Not all vendors are the same, so adopt a tiered approach to risk assessments. High-risk vendors should undergo more detailed evaluations, while low-risk vendors may only require basic assessments.

5. Track Performance Over Time

Track the performance of your vendors and monitor any changes in their operations, security measures, or compliance status. This ongoing monitoring allows you to act quickly if issues arise.

Also Read: Strategies for Managing Risks in International Procurement

And if you want to make all of this easier, there’s a smarter way to manage vendor risk.

Simplify Your Third-Party Risk Assessments with Auditive

Auditive makes it easier to stay compliant and manage risks by providing real-time monitoring, security profiles, and streamlined vendor evaluations. Here's how Auditive enhances your third-party risk management:

Contract Monitor: Auditive’s Contract Monitor ensures vendors adhere to contract terms by extracting key information from documents and flagging any discrepancies. It also sends automated reminders for contract renewals, ensuring you stay ahead of potential issues.

Partner Trust Exchange: With Partner Trust Exchange, Auditive connects you to a network of vendors, gathering real-time risk-relevant data across your portfolio.

Accelerated Intake Form: Accelerated Intake Form automates your vendor onboarding, providing instant insights into the inherent risks of new vendors. With AI, it categorizes vendors, customizes risk measurements, and updates stakeholder statuses in real-time, ensuring seamless integration into your risk management process.

Questionnaire Copilot: Auditive’s Questionnaire Copilot uses AI to complete over 80% of RFPs and risk questionnaires with high accuracy. By automating responses and integrating with your Trust Profile and other sources, this tool simplifies vendor evaluations and speeds up the process.

Supplier Risk Assessment Agent: The Supplier Risk Assessment Agent speeds up risk evaluations, using AI to analyze third-party data against your custom controls and frameworks.

Supply Chain Continuous Monitoring: Supply Chain Continuous Monitoring provides real-time notifications on changes or incidents within your supply chain, such as security breaches or financial risks.

Find out how Auditive helped Checkr cut down hours of repetitive tasks, enabling them to focus on what matters most – read the full story here.

These Auditive solutions enable efficient, ongoing vendor risk management and ensure that you stay compliant with industry regulations.

Final Thoughts

Asking the right vendor risk assessment question is key to protecting your business from potential third-party threats. By evaluating things like cybersecurity, data protection, and compliance, you can ensure that your partnerships don’t bring unnecessary risks. Regularly updating these assessments helps manage risks over time and builds stronger vendor relationships.

Auditive enables you to streamline the vendor onboarding process, automatically assess inherent risks, and monitor your vendors’ ongoing security compliance. With continuous updates and real-time insights, you can reduce manual effort and make confident, well-informed decisions that protect your organization.

Reach out to Auditive and improve your vendor risk management and enhance your compliance efforts.

FAQs

1. How do you assess third-party vendor data privacy practices?

Evaluate a vendor’s data privacy framework, including GDPR and other relevant regulations, to assess their compliance and safeguarding methods for sensitive information.

2. How do you monitor vendor security posture post-assessment?

Continuous monitoring using automated tools and periodic audits ensures that a vendor’s security posture remains compliant with the agreed-upon risk management standards.

3. What steps do you take to mitigate risks posed by vendors with poor compliance histories?

If vendors have compliance gaps, implement risk mitigation strategies such as more frequent audits, enhanced contract clauses, and security improvements during contract negotiation.

4. How do you evaluate a vendor’s disaster recovery capabilities?

Assess disaster recovery plans by reviewing their backup systems, recovery time objectives (RTO), and recovery point objectives (RPO) to ensure minimal service disruption.

5. What processes do you follow to ensure vendors adhere to cybersecurity standards?

Ensure vendors adhere to cybersecurity standards by requiring certifications (e.g., SOC 2), continuous monitoring, and contractual obligations to comply with your organization’s cybersecurity requirements.