The Ultimate Guide to Tax Vendor Due Diligence for High-Risk M&A Deals

Tax vendor due diligence in M&A transactions is now a core priority for security and risk leaders who support deal teams during high-stakes acquisitions. As a CISO or security leader, you already balance regulatory pressure, data security concerns, and the need to protect enterprise integrity during rapid assessments. But when the target company's tax posture is unclear, or worse, inaccurate, you face risks that can slow negotiations or weaken valuation.

If a target company has unresolved tax filings, compliance gaps, or historical discrepancies, those issues become your responsibility upon closing the transaction. These exposures can trigger financial penalties, disrupt integration plans, and introduce security risks. With multiple departments relying on this information during due diligence, any lack of visibility creates even greater friction and uncertainty.

This makes a structured approach to tax vendor due diligence in M&A transactions essential. It helps you uncover hidden risks early, validate the target company's compliance posture, and ensure the deal moves forward with clarity and confidence.

At a Glance

Tax due diligence shapes deal outcomes by revealing hidden liabilities, multistate exposure, and filing inconsistencies that directly affect valuation, deal protections, and post-closure obligations.

Buy-side and sell-side reviews serve different goals. Buyers quantify risk before closing, while companies preparing for sale resolve issues early to avoid delays and strengthen their negotiating position.

A structured process reduces uncertainty. Targeted request lists, management interviews, and quantitative analysis confirm whether the target's reported tax position matches reality.

Third-party dependencies create overlooked risk when payroll, tax, or financial data systems sit on weak controls or fragmented platforms that compromise data integrity.

Tools like Auditive help security leaders evaluate the vendors supporting targets' tax workflows. It helps you detect security posture changes before they surface in tax due diligence during M&A Transactions.

What is Tax Due Diligence?

Tax due diligence is a focused review of a target company's tax position in M&A transactions. From a buyer's perspective, its purpose is simple. It includes identifying tax risks before the deal, validating the target's compliance posture, and assessing whether any liabilities could affect the purchase price. This early insight helps your deal team make confident decisions while reducing the chance of costly surprises after closing.

The checks help you identify issues such as unfiled returns, underreported income, or unpaid sales tax. When these risks surface, they often influence deal structure. Buyers may:

Request price adjustments

Require escrow holdbacks (set aside funds for issues)

Strengthen indemnification clauses (shift liability back to the target)

Ask for pre-closing remediation

Slow or pause the transaction if the exposure is significant

Buyer-side example: While supporting your organization's acquisition of a fast-scaling EdTech company, you review how the target manages tax and financial data. Through tax due diligence, you discover the company expanded into several states without updating its sales tax collection processes. You also learn that its tax data is stored on outdated systems with weak access controls.

This presents two immediate concerns for you:

Financial exposure: Multiple states show potential underpaid sales tax, which could lead to penalties your organization could inherit.

Security exposure: Sensitive tax and financial data may be at risk due to outdated protection measures.

Because the buyer's (your) tax due diligence identified these issues early, you can advise the deal team to implement one or more of the safeguards mentioned above.

What is Sell-Side Tax Due Diligence?

Sell-side tax due diligence is a proactive review that helps the entity being acquired evaluate its tax position before the buyer begins its review. This process provides them with a clearer view of tax risks, documentation gaps, and compliance issues that could delay the deal or reduce the price.

Targets can identify issues early, create a process remediation plan, and complete fixes before buyers raise concerns.

Here are the key benefits of sell-side tax due diligence:

Identifying tax risks early

Correcting errors in past filings, deductions, or tax credits

Completing missing documentation for expenses and deductions

Reducing risk exposure

Strengthening negotiation standpoint

Supporting a higher valuation

Target-side example: While supporting your company's decision to sell a healthcare platform, you learn the tax team is preparing for sell-side tax due diligence. During the review, they find that several years of sales tax data are stored in outdated systems with inconsistent access controls. The review also identifies a few missing documents tied to past tax credits.

These findings create two clear priorities for you:

Security remediation: You need to secure legacy tax systems and tighten access controls before buyers begin evaluating your environment.

Operational support: You must ensure the tax team can safely organize and share documentation without exposing sensitive data.

Whether you approach the process as a buyer or as the entity preparing for sale, these reviews depend on a structured framework. You need to understand the core elements that shape every review clearly.

Core Elements Driving Tax Due Diligence: A Phased Approach

During tax vendor due diligence, the buyer's review typically moves through three core phases: an information request list, management interviews, and a quantitative analysis. Each phase adds clarity on the target company's tax posture and helps confirm that reported figures match actual activity. Here's a clear, step-by-step approach.

1. Information request list

The diligence team begins with a structured request list aligned with the target's entity type and the deal terms. This list highlights the documents needed to assess the accuracy of tax filings and the completeness of supporting records.

Key items commonly included:

| Item | Purpose |

|---|---|

| Tax returns (last 3 years) | Validate filings and identify unusual positions |

| Financial statements | Understand tax-related disclosures and notes |

| Sales and use tax filings | Confirm multistate compliance |

| Payroll tax data | Review employee classifications and withholdings |

| Documentation for credits, deductions, and exemptions | Ensure eligibility and support |

| Notices, disputes, or past audit results | Identify unresolved exposure |

Why it matters: This phase gives you the first signal of potential gaps, such as inconsistent filings, missing backup files, or signs that the company may have misunderstood tax obligations in certain states.

2. Interviews with management

Once the document review is underway, the diligence team holds focused interviews with leadership, such as the tax director or CFO. These conversations help fill in details that documents alone may not show.

Interviews help you:

Clarify unusual entries or one-time tax positions

Understand the decision-making behind key tax strategies

Confirm how multistate or international operations are handled

Validate the processes used to prepare and store tax data

3. Quantitative analysis

In this phase, the team evaluates all collected information to determine the potential tax exposure the buyer may inherit. This step converts findings into dollar amounts and estimates how they may influence deal terms.

Common focus areas include:

Incorrectly categorized expenses

Credits or deductions without proper documentation

Underreported sales tax in nexus states

Timing differences that could trigger adjustments

Gaps between reported income and supported amounts

Once you understand the review's structure, you must know which experts are best equipped to manage it and interpret the findings.

Who's Responsible for Tax Due Diligence in M&A?

Vendor tax due diligence is usually handled by specialized professionals trained in M&A transactions. Most companies rely on external CPA firms with dedicated M&A tax teams. These firms often employ attorneys who support the legal side of the review.

Who are typically involved?

| Professional | Role in the Review |

|---|---|

| CPA or CPA firm | Leads the tax analysis, reviews filings, identifies exposure, and prepares findings. |

| Tax attorney | Focuses on legal issues, IRS disputes, litigation, and compliance with legal agreements. |

| Internal teams | Support only as needed; not usually responsible for leading due diligence. |

Why do companies use external firms?

Most organizations avoid handling tax due diligence in-house. Common reasons include:

Confidentiality protection (reduces risk of internal leaks)

Dedicated expertise (outside firms specialize in M&A complexity)

Internal workload (teams are usually focused on integration tasks)

Independent assessment (buyers want unbiased, documented findings)

Also Read: Understanding Data Leak Prevention: Key Benefits and Practices

Understanding the Timeline for Tax Due Diligence

The length of tax due diligence in M&A transactions depends on deal complexity, entity structure, and the type of acquisition. While some reviews conclude in a few weeks, others can extend to several months.

Here, you'll find the typical timelines:

| Deal Type | Approximate Duration | Notes |

|---|---|---|

| Asset purchase | 3–4 weeks | Less risk for the buyer, faster review. |

| Stock or ownership purchase | 2–3 months | More exposure due to successor liability. |

| Large or complex transactions | Up to 6 months | May involve multistate, international, or layered entity structures. |

Why timing varies

Several factors influence how long the tax review takes. These include:

Entity type (LLC, partnership, S Corp, C Corp)

Number of jurisdictions the company operates in

Quality of documentation and data availability

Complexity of past tax positions

Presence of unresolved audits or disputes

Why it matters for risk and security leaders

Longer diligence timelines often require extended access to systems containing tax and financial data. This increases:

Security risk if controls are inconsistent

Operational pressure to maintain confidentiality

Compliance risk when legacy systems hold sensitive tax files

With a clear understanding of how long a thorough review can take, the next step is knowing how to approach the work effectively.

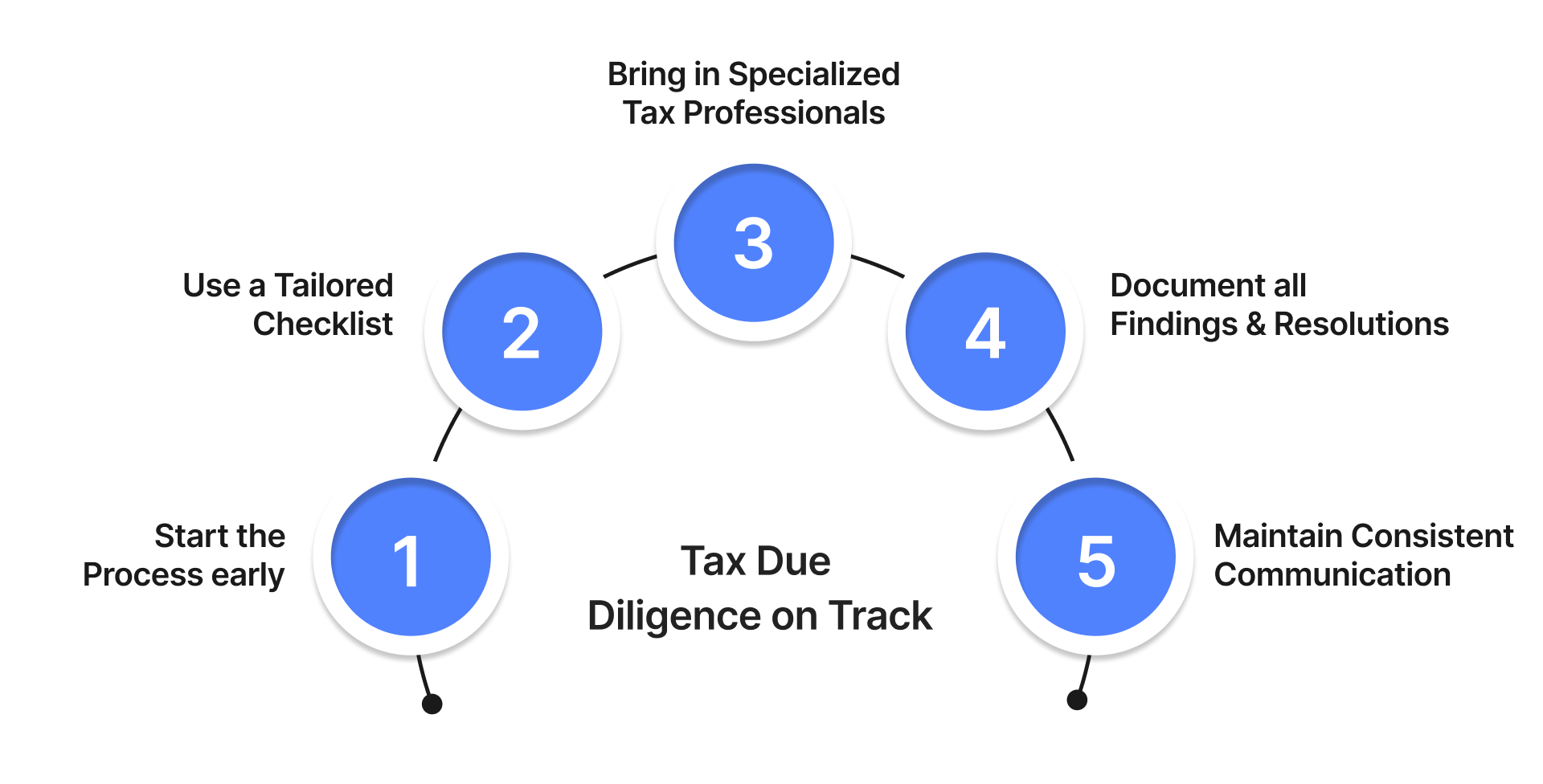

5 Best Practices That Keep Your Tax Due Diligence on Track

Strong tax due diligence before M&A transactions depends on preparation, collaboration, and early visibility into the target's tax posture. These best practices help you reduce risk and keep the transaction on schedule.

Start the process early: Begin the review a few months before the deal reaches advanced stages. This gives your team enough time to evaluate findings and request fixes without slowing negotiations. Early preparation also helps you manage system access, confidentiality controls, and secure document sharing.

Use a tailored checklist: A one-size-fits-all checklist rarely works in M&A. Build a list aligned with the target's entity type, jurisdictions, and business model. This ensures your team reviews the proper documents and avoids unnecessary gaps that could lead to missed liabilities.

Bring in specialized tax professionals: Experienced M&A tax teams understand complex tax positions, state-level rules, and the nuances tied to ownership transfers. Their insight helps you assess exposure quickly and ensures the review stays aligned with financial and legal expectations.

Document all findings and resolutions: Every tax question, discrepancy, or concern should be recorded, validated, and addressed before moving into final negotiations. This documentation helps safeguard the purchase price and unwanted exposure.

Maintain consistent communication: Clear communication between both sides reduces delays. When document gaps, inconsistencies, or missing records appear, aligned messaging helps resolve issues faster and prevents repeated back-and-forth during the review.

Also Read: Vendor Due Diligence Best Practices Guide

With the proper foundation in place, ensure you have real-time visibility into the risks across the target's broader ecosystem. That's where Auditive can help.

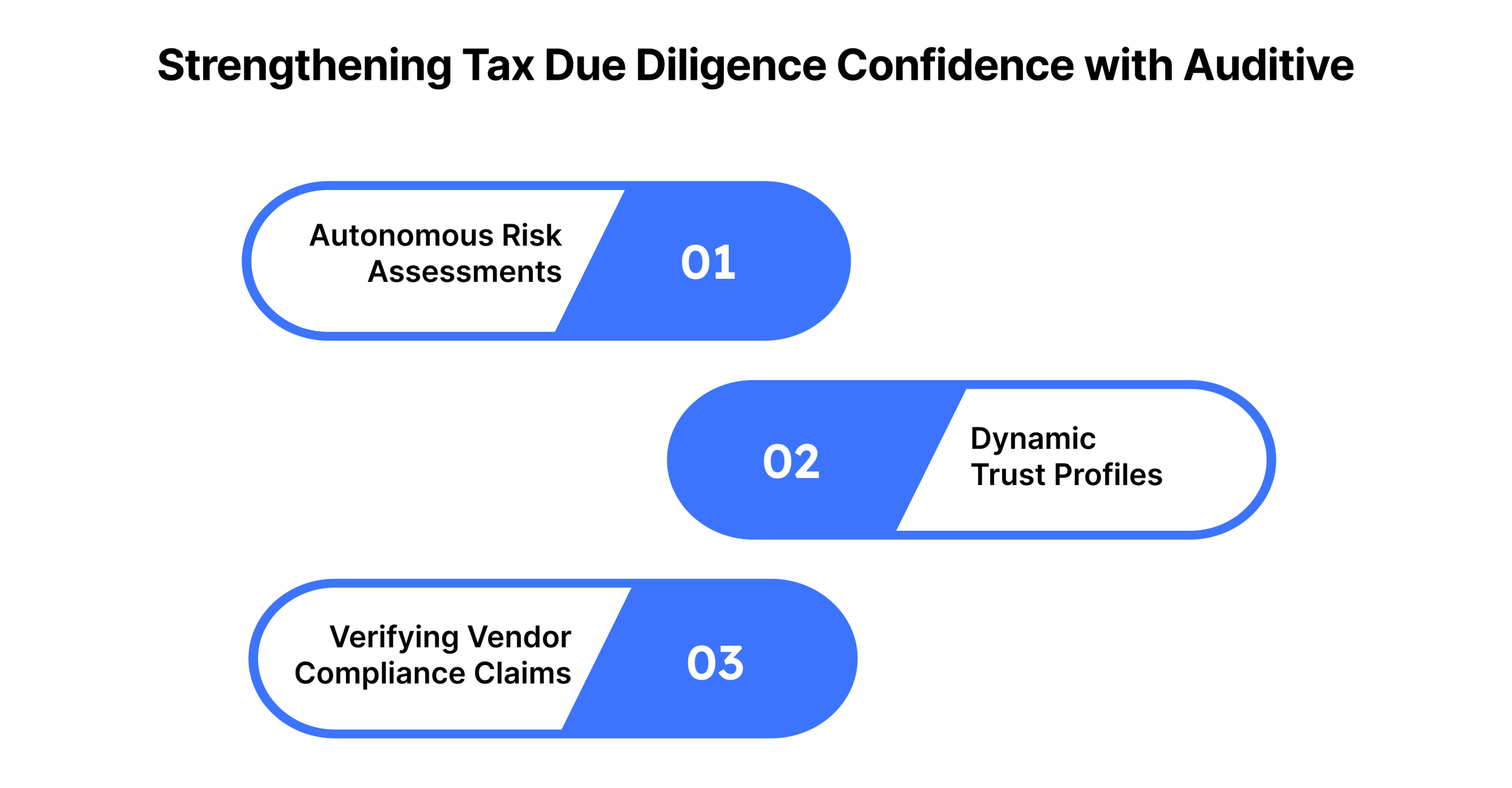

Strengthening Tax Due Diligence Confidence with Auditive

Effective tax due diligence goes beyond reviewing records or financial statements. As a security leader, you need a clear understanding of how the target company and its critical third parties protect tax and economic data. Auditive, a third-party risk management (TPRM) platform, helps you bring sharper visibility and real-time assurance into this part of the review.

With Auditive, you gain:

Autonomous risk assessment agent: AI-powered evaluations that measure third-party controls against your internal requirements. This is especially valuable when the target relies on external systems to store or process tax and financial data.

Accelerated Intake: It simplifies the collection of security evidence from vendors that support the target’s tax, payroll, and financial systems. Instead of chasing documents, you receive structured, auto-validated submissions that speed up your review of tax-relevant environments.

Support for verifying vendor compliance claims: Often, the target company relies on third-party vendors that assert compliance with tax-related data-handling standards. Auditive's verification and monitoring help you confirm whether those claims are accurate before the target becomes part of your environment.

By giving you a live, always-updating view of third-party risk, Auditive supports a more accurate and confident approach to tax due diligence.

Wrapping Up

Tax due diligence has become a critical safeguard in modern M&A. It helps buyers avoid hidden liabilities, compliance gaps, and security risks tied to financial and tax data. As target companies depend on various third parties to manage these workflows, buyers need clear, reliable visibility into every connected environment.

Auditive helps you bring this hidden layer into focus. The Supplier Questionnaire Copilot enables vendors to complete risk questionnaires quickly with AI support, hence continuously updating their risk profiles. That allows you to verify control evidence and identify changes that could affect deal protections or valuation discussions.

To bring greater clarity and assurance to your M&A tax evaluations, book a demo with Auditive. See how continuous monitoring strengthens tax vendor due diligence in mergers and acquisitions.

FAQs

1. What tax risks are easiest to miss during M&A reviews?

Hidden risks often sit in areas not captured in formal filings. These include outdated tax configuration settings in software, undocumented state nexus triggers, or legacy accounting methods that were never updated as the business expanded. These issues rarely appear in surface-level reviews.

2. How do technological changes inside the target affect tax exposure?

If the target migrated ERP, payroll, or accounting systems without reconciling historical tax data, discrepancies may exist between periods. These gaps can complicate audits and create record mismatches, affecting exposure calculations and post-close reporting accuracy.

3. How do frequent acquisitions made by the target influence tax risk?

If the target acquired entities but didn't fully integrate their tax procedures, multiple filing methods and inconsistent nexus footprints may exist. This creates reconciliation issues and increases the risk of inherited liabilities from past, unreviewed acquisitions.

4. How do international operations complicate tax due diligence?

Foreign subsidiaries introduce transfer pricing rules, treaty considerations, VAT exposure, and jurisdiction-specific documentation standards. You must confirm whether local filings align with corporate-level reporting and whether past cross-border transactions were adequately supported.