Comprehensive Guide to Vendor Due Diligence Reports

Choosing the right vendor can make or break your operations. That’s why vendor due diligence reports play such a crucial role; they provide a structured way to evaluate a vendor’s financial health, compliance standards, and overall reliability before you sign any deal.

A well-prepared report goes beyond surface-level checks. It uncovers potential risks, validates trust, and ensures that your partnerships align with long-term business goals. Whether you’re onboarding a new supplier or reviewing an existing one, a vendor due diligence report template helps bring consistency, accuracy, and transparency to the entire process.

In this guide, we’ll walk you through what a vendor due diligence report includes, how to prepare one effectively, and how tools like Auditive can simplify vendor risk management for better decision-making.

Key Takeaways

A vendor due diligence report is vital for identifying and mitigating third-party risks.

It provides insights into a vendor’s financial, legal, and operational performance for informed decision-making.

Continuous monitoring is key to maintaining compliance and resilience.

Auditive simplifies vendor due diligence with automation, AI insights, and centralized risk tracking.

Build trust and transparency through Auditive’s Trust Center for long-term vendor risk management success.

Understanding Vendor Due Diligence Reports

Before partnering with any third-party vendor, it’s essential to know exactly who you’re dealing with. That’s where a vendor due diligence (VDD) report comes in. It’s a detailed assessment of a vendor’s financial stability, compliance record, operational performance, and overall credibility, helping organizations make informed and low-risk business decisions.

Typically prepared by independent third-party experts, these reports offer an unbiased look into a company’s strengths, weaknesses, and potential risks. Whether used for investor evaluation, procurement decisions, or compliance checks, a VDD report provides a clear snapshot of a vendor’s reliability and long-term viability.

Each report may focus on different aspects, legal, financial, or operational, depending on the business needs. In larger transactions, multiple reports are often compiled to give a complete picture of the vendor’s standing.

Simply put, a vendor due diligence report acts as a safety net, ensuring you partner with vendors who are stable, compliant, and aligned with your organization’s goals.

Why Vendor Due Diligence Reports Matter More Than Ever

In today’s fast-moving and risk-heavy business environment, vendor due diligence reports have become more than just a box-ticking exercise; they’re a strategic necessity. While these reports are typically created for a specific transaction or event, their value extends far beyond that. Retaining them helps businesses build a solid foundation for future risk assessments, investor evaluations, and internal audits.

Here’s why vendor due diligence reports hold lasting importance for businesses:

They save time and costs for investors.

A professionally prepared due diligence report allows potential investors to access verified insights upfront, eliminating the need for repetitive investigations. This reduces both the cost and time associated with conducting full due diligence from scratch.

They open doors to more investor opportunities.

Since investors can rely on an existing, credible report, more participants are encouraged to evaluate the business opportunity. This increased interest enhances competitive tension and improves the likelihood of achieving favorable terms during negotiations.

They streamline management efforts.

Management teams no longer have to repeatedly answer the same questions for every potential investor. The report provides a central source of verified data, freeing up valuable time and reducing operational disruptions.

They educate investors unfamiliar with the business.

A well-structured vendor due diligence report helps potential investors understand the company’s unique aspects, from industry regulations to market positioning. This is especially helpful for financial investors or private equity firms exploring new industries.

They inspire trust and confidence.

Knowing that an independent third-party expert has thoroughly assessed the business builds credibility. It reassures potential investors that material issues have been addressed, reducing uncertainty and strengthening confidence in the partnership.

In essence, vendor due diligence reports don’t just protect your business; they elevate it. They turn complex evaluations into opportunities for trust, transparency, and smarter decision-making, both today and in the future.

Learn more about: Understanding What is Vendor Due Diligence Strategy and Compliance

Key Components of a Vendor Due Diligence Report

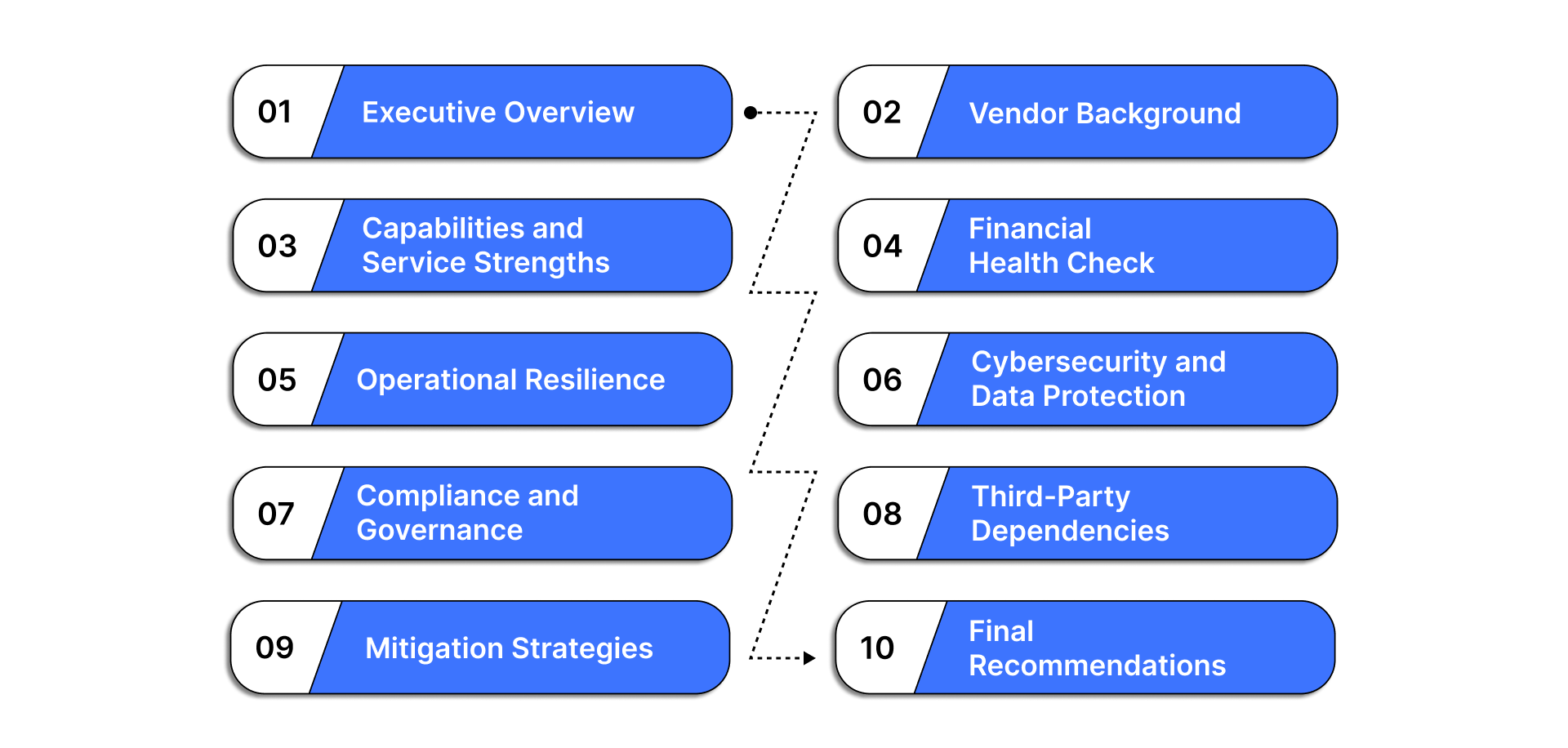

A well-prepared vendor due diligence report gives businesses a complete, 360-degree view of their potential or existing partners. It helps decision-makers uncover financial, operational, and compliance risks before they escalate.

Let’s break down the essential elements that make up an effective VDD report:

1. Executive Overview

This section serves as a snapshot of the entire report, summarizing major findings, potential risks, and actionable recommendations. It’s designed for leadership teams and stakeholders who need a clear, at-a-glance understanding of whether a vendor is a safe and reliable choice.

2. Vendor Background and Reputation

Here, the report outlines the vendor’s origin, ownership details, geographical presence, and market reputation. This helps organizations evaluate the vendor’s credibility and business history, a vital first step before forming any long-term partnerships.

3. Capabilities and Service Strengths

An in-depth look at what the vendor brings to the table, from technical expertise and infrastructure to delivery efficiency and scalability. This section identifies whether the vendor has the resources and know-how to meet your organization’s specific goals and performance expectations.

4. Financial Health Check

Evaluating the vendor’s financial stability ensures they have the resources to stay operational and fulfil commitments. The report typically includes credit analyses, financial ratios, and a review of recent statements, highlighting any signs of financial distress or dependency risks.

5. Operational Resilience and Continuity Planning

This section assesses the vendor’s ability to keep operations running during crises or disruptions. It examines process maturity, disaster recovery plans, and incident response mechanisms, all key to avoiding downtime or service interruptions.

6. Cybersecurity and Data Protection

With cyber threats growing rapidly, assessing a vendor’s security posture is now non-negotiable. The report reviews how data is stored, shared, and protected, and checks compliance with standards like GDPR, ISO 27001, or SOC 2. A strong data protection framework signals reliability and trustworthiness.

7. Compliance and Governance

Every industry has its own set of rules, and vendors must comply. This section evaluates how well the vendor adheres to legal, regulatory, and internal compliance standards. It also examines their approach to governance and ethical business practices.

8. Third-Party Dependencies

Vendors often depend on subcontractors or external service providers. This part of the report digs into those relationships to uncover potential chain risks. A vendor is only as strong as its weakest link, so understanding these dependencies is critical.

9. Risk Management and Mitigation Strategies

Once risks are identified, this section recommends how to manage them. From tighter contractual terms to enhanced monitoring and security controls, it lays out practical ways to reduce exposure and strengthen resilience against vendor-related disruptions.

10. Final Recommendations

The report concludes with a verdict on whether to proceed, renegotiate, or reconsider. It summarizes findings and suggests next steps, ensuring stakeholders can make confident, data-backed decisions about vendor partnerships.

A vendor due diligence report isn’t a one-time task; it’s a living document. As vendors evolve and regulations shift, revisiting and updating these reports ensures you stay ahead of emerging risks and maintain a trusted vendor network.

Managing this entire due diligence process manually can be exhausting; that’s where Auditive steps in. With its Trust Center and automated vendor monitoring tools, Auditive makes it easy to track compliance, assess risks, and maintain transparency with vendors, all in one place. You can monitor your vendors continuously, access real-time Trust Profiles, and strengthen your vendor risk management program without added complexity.

Also read: Third-Party Contract Management: Steps and Best Practices

Why Addressing Vendor Due Diligence Reports Matters

Taking vendor due diligence seriously can make a huge difference in how smoothly your business deals progress, especially when investors and buyers are involved. When done right, it builds confidence, attracts more opportunities, and saves time in the long run. But neglecting it can slow things down, limit participation, and add unnecessary stress to your management team.

Pros of Conducting Vendor Due Diligence Reports

Here’s why organizations that prioritize vendor due diligence stand out:

Attracts a Wider Pool of Investors: A well-prepared due diligence report gives potential investors clarity and confidence, helping you reach a broader and more competitive market.

Encourages Investor Participation: By providing verified information upfront, businesses give investors more incentive to stay engaged and move forward quickly.

Extends Competitive Tension: The transparency that comes from a VDD report can keep multiple bidders in play for longer, strengthening your negotiation position.

Saves Management Time: When reports are prepared early, management avoids repeated questioning and can focus on strategy instead of endless due diligence rounds.

Cons of Ignoring Vendor Due Diligence

On the flip side, skipping or delaying due diligence can slow momentum and shrink opportunities:

Fewer Interested Bidders: Without a clear, verified report, many bidders may drop out due to higher research costs or lack of transparency.

Requests for Exclusivity: Buyers may demand exclusivity before committing time and resources to their own due diligence, limiting your flexibility.

Reduced Investor Participation: Financial investors may hesitate to join the process due to the added cost of assessing vendors independently.

Increased Strain on Management: Without centralized information, leadership faces repetitive questioning, slowing down deal execution and decision-making.

With Auditive, organizations can simplify vendor risk reviews and manage due diligence seamlessly. From centralizing vendor assessments to continuous monitoring, Auditive ensures your team spends less time chasing data and more time making strategic decisions.

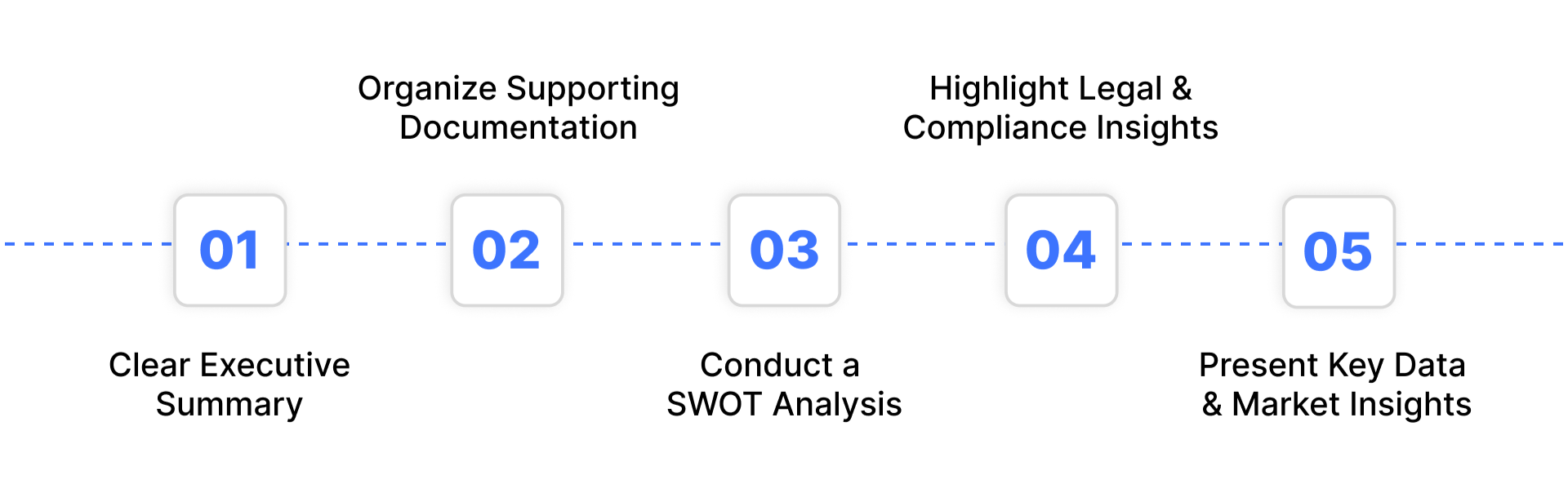

How to Prepare a Vendor Due Diligence Report in 5 Simple Steps

A vendor due diligence report isn’t just a checklist; it’s a strategic document that helps leadership understand whether a vendor is the right fit for long-term collaboration. While every business may have its own format, most reports follow a structured approach that turns raw data into actionable insights.

Here’s how you can prepare one effectively:

1. Start with a Clear Executive Summary

Begin by outlining the purpose of your report. Mention the vendor being evaluated, the scope of your assessment, and a brief overview of your findings. The goal here is to help executives quickly grasp the key takeaways, who the vendor is, what you reviewed, and what your top insights are.

2. Gather and Organize Supporting Documentation

Back up your findings with credible evidence. This might include financial statements, compliance certificates, corporate filings, or performance reports. Having these documents in one place adds transparency and makes it easier for decision-makers to verify critical details.

3. Conduct a SWOT Analysis

Break down your analysis into four parts: Strengths, Weaknesses, Opportunities, and Threats. This helps illustrate the vendor’s business standing in a balanced way. By showing both the positives and potential concerns, stakeholders can assess whether the partnership aligns with the company’s goals and risk appetite.

4. Highlight Legal and Compliance Insights

Legal stability is a cornerstone of any partnership. Include findings about pending litigations, financial liabilities, or regulatory compliance issues that could impact the business relationship. Clarity on these aspects helps avoid surprises down the road and ensures full transparency from the start.

5. Present Key Data and Market Insights

Numbers make your report stronger. Use data from market research, surveys, or financial analysis to provide a clear picture of the vendor’s performance and market reputation. Visual summaries like charts or scorecards can make complex insights easier to digest for C-suite readers.

Preparing a due diligence report manually can be tedious, from gathering vendor data to monitoring compliance updates. That’s where Auditive steps in. With its automated vendor risk management tools, you can centralize vendor insights, continuously track compliance, and build reliable reports without the manual hassle.

Auditive turns vendor due diligence from a lengthy task into a streamlined, data-driven process, helping you make confident business decisions faster.

Streamline Your Vendor Due Diligence with Auditive

Creating a vendor due diligence report doesn’t have to be a time-consuming, manual process. With Auditive, you can automate and centralize your third-party risk management (TPRM) workflows, saving valuable time while ensuring no detail goes unnoticed.

Auditive’s Trust Center empowers teams to:

Access real-time vendor data for instant insights into compliance, certifications, and risk profiles.

Automate due diligence checks with AI-powered workflows that flag high-risk vendors before they impact your business.

Collaborate seamlessly with vendors through live updates, document sharing, and transparent communication.

Monitor continuously with ongoing risk assessments and automated alerts for changes in vendor performance or compliance.

If you’re building your first vendor due diligence report or managing a global network of suppliers, Auditive simplifies every step.

It transforms traditional due diligence into a proactive, data-driven process, ensuring your business stays compliant, resilient, and ready for growth.

Wrapping Up

A vendor due diligence report is more than a compliance document; it’s a strategic tool that strengthens your organisation’s vendor ecosystem. By understanding your third parties inside out, you can identify potential risks, maintain compliance, and build resilient partnerships rooted in transparency and trust.

That’s where Auditive steps in. As a unified Trust Center and vendor risk management platform, Auditive helps you automate due diligence, monitor vendor compliance continuously, and stay ahead of emerging risks. With real-time insights, AI-powered workflows, and seamless collaboration tools, you can transform complex assessments into confident decisions.

If you’re refining your vendor selection or scaling your TPRM strategy, Auditive empowers you to do it faster, smarter, and more securely.

Start your journey with Auditive today, streamline vendor due diligence, and strengthen trust across every partnership.

FAQs

1. What is a vendor due diligence report?

A vendor due diligence report is a comprehensive analysis of a vendor’s financial, legal, operational, and compliance standing. It helps organizations assess potential risks before entering or continuing business relationships.

2. Who prepares a vendor due diligence report?

Typically, these reports are prepared by internal risk teams or independent third-party experts who evaluate vendors based on defined risk criteria and compliance requirements.

3. How often should vendor due diligence be conducted?

Due diligence should be performed before onboarding a new vendor and updated regularly—often annually or whenever a significant change occurs in the vendor’s business or compliance status.

4. What are the key sections in a vendor due diligence report?

The report usually includes an executive summary, risk assessment, compliance evaluation, financial health overview, security posture, and recommendations for ongoing monitoring.

5. How does Auditive enhance the vendor due diligence process?

Auditive automates due diligence workflows, integrates real-time vendor monitoring, and offers a centralized Trust Center, making it easier to assess, track, and manage vendor risks efficiently.