Effective Strategies for Managing Operational Risks

Every business plan looks great on paper, until unforeseen risks start disrupting operations. From system failures and compliance breaches to supply chain delays and human errors, operational risks can quickly derail even the most well-structured strategies. That’s why managing operational risks is not just a regulatory requirement but a critical component of building resilience and trust.

Operational risk management (ORM) equips businesses with a framework to identify potential threats, evaluate their impact, and establish controls that safeguard long-term objectives. When integrated into a business plan, ORM ensures that growth ambitions are supported by stability, agility, and preparedness. Simply put, it transforms risk into an opportunity for smarter, more sustainable decision-making.

Quick Glance

Operational risks can disrupt business plans, impacting finances, reputation, and compliance.

ORM provides structured processes to identify, assess, mitigate, and monitor risks effectively.

Key tools include business process analysis, risk registers, heat maps, KRIs, and loss data analysis.

Continuous monitoring and vendor risk management are essential to maintain operational resilience.

Platforms like Auditive, with a Trust Center and automation, turn risk management into a proactive, strategic capability.

What Is Operational Risk Management?

Operational risk refers to the potential for loss resulting from failed or ineffective internal processes, human error, system breakdowns, or external events that disrupt the normal flow of business activities. Unlike credit or market risks, which tend to be more measurable and predictable, operational risks are embedded in day-to-day operations, making them harder to foresee but equally critical to address.

These risks can manifest in both direct and indirect ways:

Direct impacts: A poorly trained employee mishandling a transaction might cause immediate financial loss.

Indirect impacts: Repeated service delays or poor customer experiences can damage reputation, eroding customer trust and long-term profitability.

Operational risk should be viewed as a chain reaction. Small control lapses or overlooked issues can escalate into larger problems, leading to financial setbacks, reputational harm, or even structural breakdowns within the organization.

This is where Operational Risk Management (ORM), often referred to as oprisk, plays a key role. ORM is a structured approach within broader enterprise risk management that focuses specifically on unsystematic risks tied to daily operations. It involves identifying vulnerabilities, assessing their potential impact, applying controls, training staff, and enforcing policies to reduce exposure.

In essence, ORM provides businesses with the framework to anticipate disruptions, strengthen resilience, and maintain stability, ensuring that operational risks are managed before they evolve into business-wide challenges.

Also read more about: Operational Risk Management

The Importance of ORM and How It Works

Operational Risk Management (ORM) is not a one-time checklist, it’s an ongoing discipline woven into the fabric of an organization’s daily activities. Risks arise constantly from people, processes, systems, and external factors. Instead of aiming for complete elimination, ORM focuses on keeping these risks within acceptable boundaries so that operations remain stable and strategic goals stay on track.

At its core, ORM works through a structured cycle:

Risk Identification – recognizing vulnerabilities across operations, whether they stem from internal inefficiencies, technology failures, or outside disruptions.

Risk Assessment and Measurement – analyzing the probability and impact of each risk to determine priorities.

Mitigation – putting safeguards in place, such as updated policies, control mechanisms, or new technologies, to reduce exposure.

Monitoring and Reporting – continually tracking risk levels and ensuring transparency through regular updates to stakeholders.

This cycle is guided by several key principles:

Accept risk when the potential benefits justify it.

Avoid unnecessary risks that add no value.

Plan ahead to minimize surprises and strengthen preparedness.

Make risk-related decisions at the right level of authority for accountability.

Why does ORM matter so much for a business plan? Because it shifts an organization from reacting to crises toward anticipating them. Strong ORM drives:

Proactive readiness – identifying threats before they become disruptions.

Smarter decisions – giving leaders reliable, risk-informed insights.

Operational efficiency – reducing waste, downtime, and financial losses.

Stronger stakeholder trust – assuring customers, employees, and investors of business resilience.

Regulatory confidence – meeting requirements from frameworks like Basel III, PCI DSS, and GDPR, and protecting against penalties or reputational harm.

Ultimately, ORM doesn’t just control uncertainty, it converts it into a structured advantage. For businesses looking to integrate risk strategies into their plans, ORM becomes the bridge between ambition and stability.

Main Types of Operational Risk

Operational risks often stem from different sources, but they typically fall into four main categories. Understanding these categories helps in designing a business plan that not only accounts for growth but also prepares for disruptions.

1. Internal Process Risks

These risks originate from flaws or inefficiencies within the organization itself. They can include:

Inaccurate financial planning or budgeting errors.

Gaps in internal controls or poorly executed processes.

Delays in meeting commitments to clients or suppliers.

Impact: Such issues usually result in wasted resources, unexpected expenses, and reduced competitiveness. If not managed proactively, internal risks can undermine the overall efficiency of a business plan.

2. External Risks

These are factors beyond the direct control of a company but capable of significantly affecting operations. Examples include:

Natural disasters such as floods, earthquakes, or fires.

Utility or infrastructure failures like power cuts or network outages.

Sudden regulatory changes requiring rapid compliance shifts.

Global or regional health crises, including pandemics.

Impact: External risks often disrupt supply chains, slow down production, or force businesses to rethink strategies quickly. A resilient operational risk management approach ensures that the business plan is flexible enough to absorb these shocks.

Also look into: Managing Supply chain

3. People-Related Risks

Employees are both a company’s greatest strength and a potential source of risk. These risks may arise from:

Mishandling or theft of sensitive information.

Labour strikes, disputes, or absenteeism.

Insufficient training for critical roles.

Cases of fraud or misconduct.

Impact: Personnel risks can lead to compliance violations, reputational harm, and operational breakdowns. Managing operational risks in a business plan should therefore prioritize workforce development, training, and a culture of accountability.

4. Technology Risks

As businesses become increasingly dependent on digital systems, technology-related risks are growing in scale and complexity. Common examples are:

Cyberattacks, hacking attempts, and data breaches.

Outdated or vulnerable IT infrastructure.

Failures during the adoption of new platforms or automation tools.

Impact: Technology failures can halt operations, cause data loss, and result in costly recovery measures. A business plan that integrates operational risk management should include ongoing IT audits, strong cybersecurity protocols, and disaster recovery planning.

How to Manage Operational Risk?

Effectively managing operational risks requires more than isolated controls, it demands a structured, continuous approach that aligns with business objectives. A well-designed operational risks business plan should cover four critical stages: identification, analysis, mitigation, and monitoring.

1. Risk Identification

The process begins with recognizing potential threats that could disrupt operations. This includes evaluating internal processes, human behaviour, technology systems, and external market conditions. Creating a comprehensive risk catalog ensures that vulnerabilities across every area of the business are mapped out early.

2. Risk Analysis and Evaluation

Once risks are identified, businesses must assess their likelihood and potential impact. This can be done through different methodologies:

Qualitative analysis – Classifies risks as high, medium, or low, providing an initial overview.

Quantitative analysis – Uses data and models to measure probability and impact with greater precision.

Monte Carlo simulation – Projects multiple scenarios to estimate probabilities and outcomes.

FMEA (Failure Mode and Effect Analysis) – Evaluates how process or technical failures could affect operations.

These methods allow companies to prioritize threats and design responses backed by both insight and evidence.

3. Designing Controls and Mitigation Strategies

After assessing risks, organizations must implement strategies to reduce exposure. This may involve strengthening internal controls, adding new layers of protection, or transferring risk through insurance or third-party arrangements. The goal is to balance cost and control while ensuring resilience.

4. Continuous Monitoring and Testing

Risk management doesn’t end once controls are in place, it must be ongoing. Companies should track risks through indicators, carry out regular audits, and test continuity plans through crisis simulations. This ensures strategies remain effective as business environments evolve.

This is also where intelligent platforms like Auditive can make a significant impact, providing real-time monitoring, vendor risk insights, and automated testing capabilities that strengthen overall operational risk resilience.

Operational Risk Management Tools and Techniques

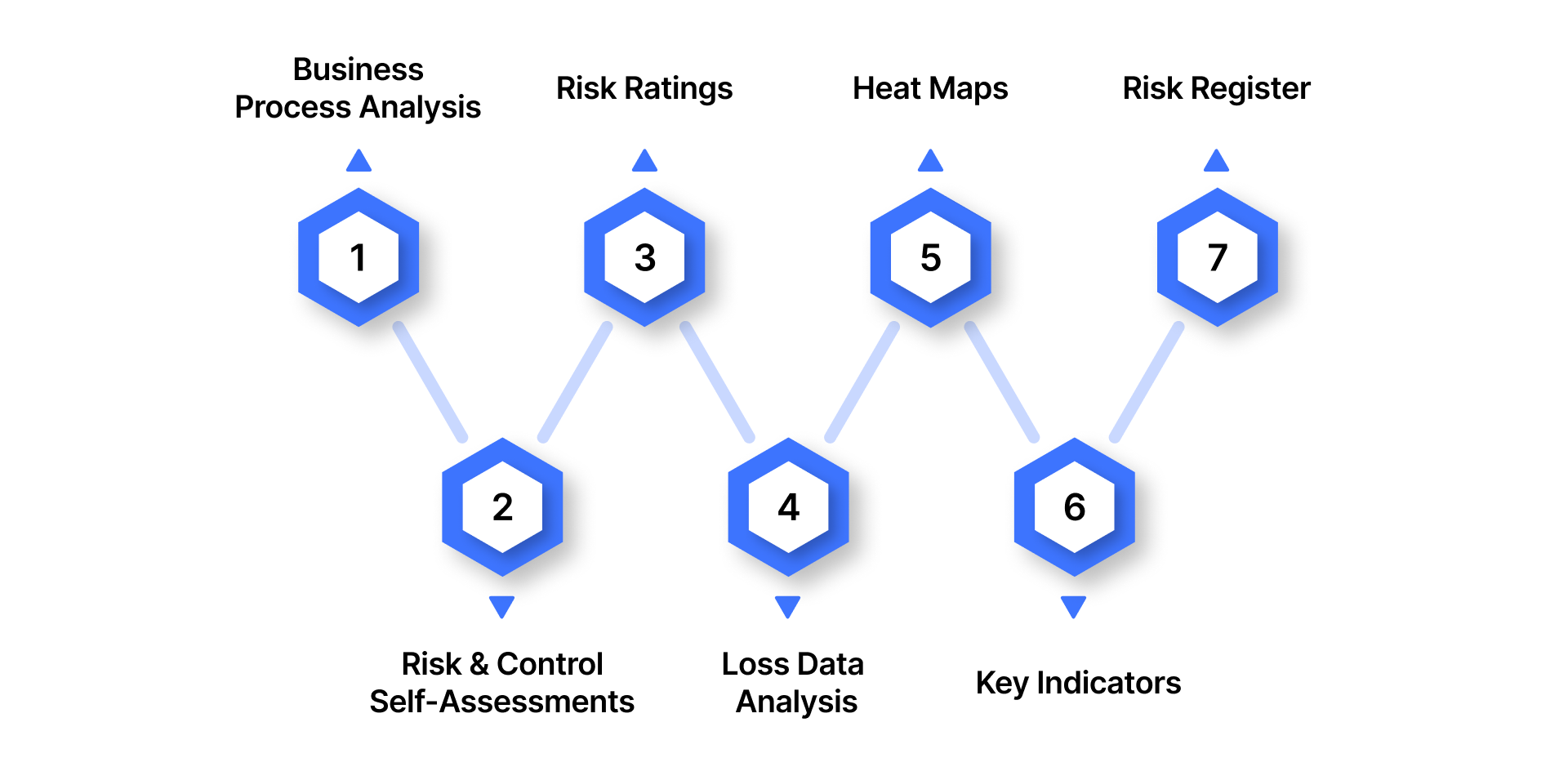

Turning operational risk management (ORM) into measurable results requires more than theory, it demands practical tools and techniques. These methods help organizations not only identify and assess risks but also track, prioritize, and mitigate them in a structured, repeatable way. Below are some of the most effective tools widely used today:

Business Process Analysis (BPA): Maps out processes end-to-end to identify inefficiencies, bottlenecks, and vulnerabilities before they escalate into disruptions.

Risk and Control Self-Assessments (RCSAs): Brings frontline teams into the risk process, capturing insights and highlighting blind spots often missed by top-down reviews.

Risk Ratings: Categorizes risks (low, medium, high) based on impact and likelihood, offering a clear prioritization framework for immediate or long-term attention.

Loss Data Analysis: Reviews past incidents to extract lessons, understand root causes, and build stronger preventive measures.

Heat Maps: Visualizes risks by plotting likelihood against impact, enabling leadership to see at a glance where the greatest vulnerabilities lie.

Key Indicators: Tracks KRIs, KPIs, and KCIs as early warning signals, flagging when thresholds are breached and risks require intervention.

Risk Register: Serves as a central repository for risks, detailing probabilities, impacts, mitigation plans, and responsible owners, ensuring transparency and accountability.

Together, these tools provide businesses with the structure and foresight to move from reactive responses to proactive, predictive risk management.

Know more: Risk management strategies

To elevate these techniques even further, organizations need intelligent platforms that integrate data, automate monitoring, and strengthen decision-making. This is where solutions like Auditive step in, helping businesses transform fragmented processes into a connected, resilient risk management ecosystem.

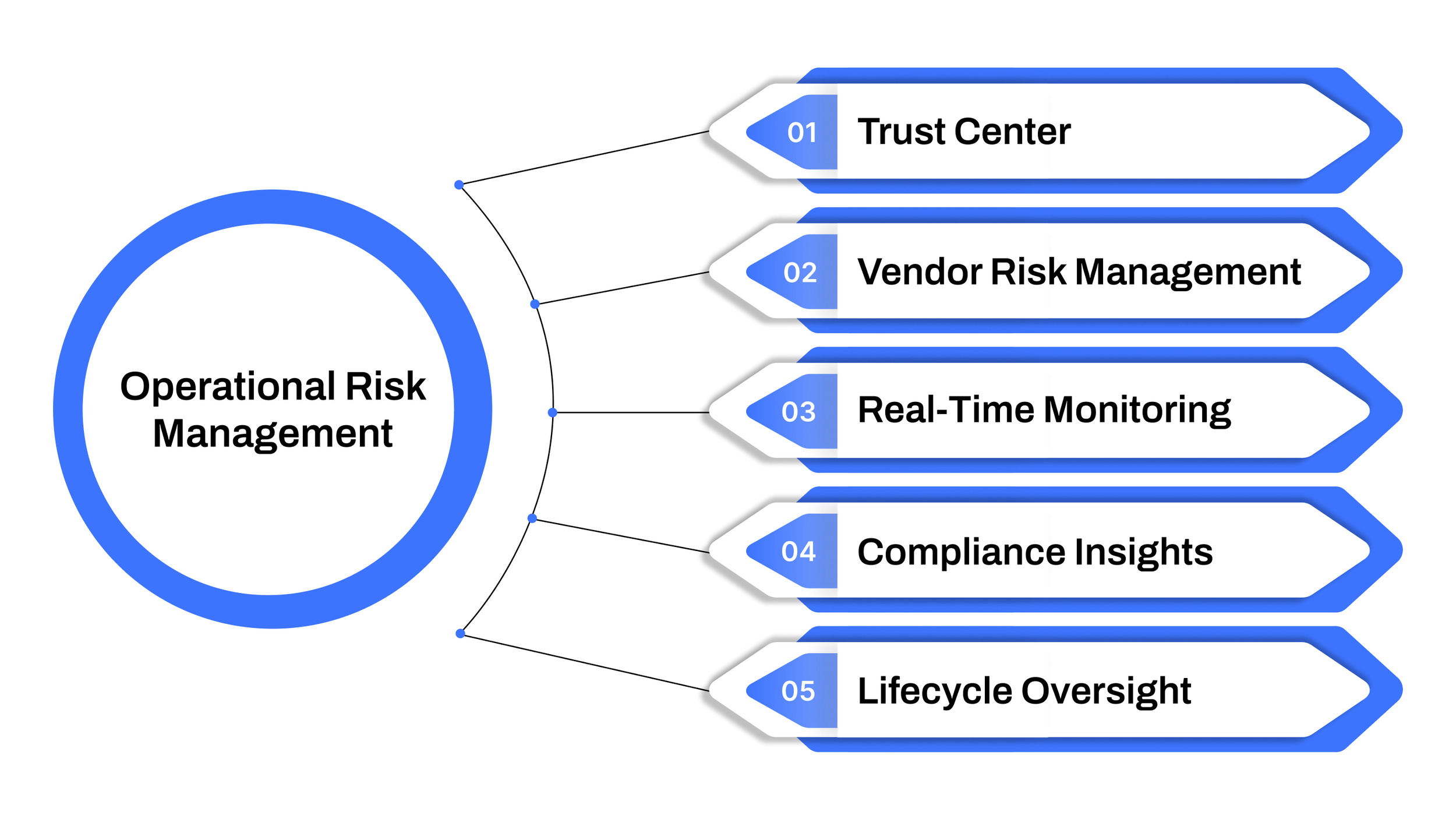

Enhancing Operational Risk Management

Operational risks are no longer confined within the four walls of an organization—they extend across vendors, partners, and third-party systems. Auditive provides businesses with the tools to gain real-time visibility, monitor continuously, and take proactive actions to manage these risks effectively.

Key capabilities include:

Trust Center: A centralized hub that allows organizations to document, share, and verify operational risk practices with internal stakeholders, vendors, and regulators.

Vendor Risk Management: Enables businesses to assess, monitor, and mitigate risks from third-party relationships, ensuring alignment with organizational standards.

Real-Time Monitoring: Continuous oversight of operational and vendor risks allows for early detection of anomalies, preventing small issues from escalating into significant incidents.

Compliance Insights: Automated tracking of regulatory and internal compliance requirements ensures that risks are managed in line with both industry standards and organizational policies.

Lifecycle Oversight: From onboarding vendors to ongoing monitoring, Auditive supports the entire risk lifecycle, integrating ORM into daily business operations.

By combining automation, transparency, and continuous monitoring, Auditive empowers organizations to move from reactive risk responses to proactive, data-driven operational risk management, strengthening resilience and strategic decision-making.

Conclusion

Effectively managing operational risks business plan is crucial for long-term resilience, stability, and strategic growth. Organizations that integrate operational risk management into their business processes can anticipate disruptions, safeguard assets, and maintain stakeholder trust.

Tools and frameworks alone are not enough continuous visibility, proactive monitoring, and strong vendor oversight are essential. Platforms like Auditive provide a centralized Trust Center, real-time monitoring, and comprehensive vendor risk management, enabling businesses to identify, assess, and mitigate risks seamlessly across the enterprise and third-party ecosystem.

Schedule a demo with Auditive to see how your organization can transform operational risk into a strategic advantage.

FAQs

1. What is operational risk management (ORM)?

ORM is a structured approach to identifying, assessing, mitigating, and monitoring risks arising from day-to-day operations, including processes, people, technology, and external factors.

2. Why is ORM important for a business plan?

Incorporating ORM ensures that potential disruptions are anticipated, enabling businesses to protect assets, maintain continuity, and achieve strategic goals.

3. What are common operational risks in businesses?

Operational risks typically include process failures, human errors, cyber incidents, technology breakdowns, supply chain disruptions, and third-party/vendor risks.

4. How can technology improve operational risk management?

Automation, real-time monitoring, and centralized dashboards streamline risk assessments, provide early warnings, and enhance compliance reporting, making ORM more effective and proactive.

5. How does Auditive support operational risk management?

Auditive provides continuous monitoring, vendor risk management, and a Trust Center to document, track, and mitigate risks across internal operations and third-party relationships, ensuring comprehensive risk oversight.