Risk Management Lifecycle Steps for Small Businesses

For small businesses, every decision carries weight.

A single disruption whether financial, operational, or reputational, can have lasting effects. That’s why risk management isn’t just for large corporations with vast resources; it’s equally vital for small enterprises managing competitive markets with limited margins for error.

The risk management lifecycle offers a structured way for business owners to identify potential threats, evaluate their impact, and implement strategies that protect both daily operations and long-term goals. By following a clear process, small businesses can not only minimize losses but also uncover opportunities for resilience and growth.

In this guide, we’ll break down the risk management lifecycle for small businesses, exploring its importance, common types of risks, and actionable steps you can apply to safeguard your company.

Before we dive in:

Risk management is vital for small businesses to safeguard operations, finances, and reputation.

A structured risk management lifecycle includes identifying, assessing, and mitigating potential threats.

Strategies include utilizing frameworks, MVP development, contingency planning, root cause analysis, and third-party risk assessments.

Auditive provides centralized vendor risk management, continuous monitoring, and a Trust Center for transparency and compliance.

Integrating these strategies transforms risk management from reactive to proactive, giving small businesses a competitive edge.

What Is Risk Management?

Risk management is the practice of identifying, assessing, and addressing potential threats that could disrupt a business. It allows organizations to anticipate challenges and take proactive steps to reduce their impact, ensuring long-term stability and growth.

For small businesses, this often happens informally, while larger enterprises rely on dedicated teams or departments. Either way, the goal is the same: spotting risks early, understanding their severity, and deciding the best way to mitigate them.

Think of risks as potholes on a racetrack. A small pothole, like a minor supply delay, may just slow you down, while a bigger one, such as a cyberattack or financial crisis, can cause serious damage. Risk management helps businesses prepare for both, allocating resources where they matter most, whether that’s financial planning, process improvements, or safety measures.

In short, effective risk management gives businesses a competitive edge by strengthening resilience and enabling smarter decision-making.

Why Is Risk Management Important?

Every business, no matter its size, operates in an environment full of uncertainty. For small businesses, these risks are often magnified because they have fewer resources to absorb setbacks compared to larger organizations. That’s why risk management isn’t just a safeguard it’s a growth enabler.

By identifying and addressing potential threats early, small businesses can build resilience and make decisions with greater confidence. Instead of reacting to crises when they arise, risk management equips you to anticipate challenges and take proactive steps to minimize their impact.

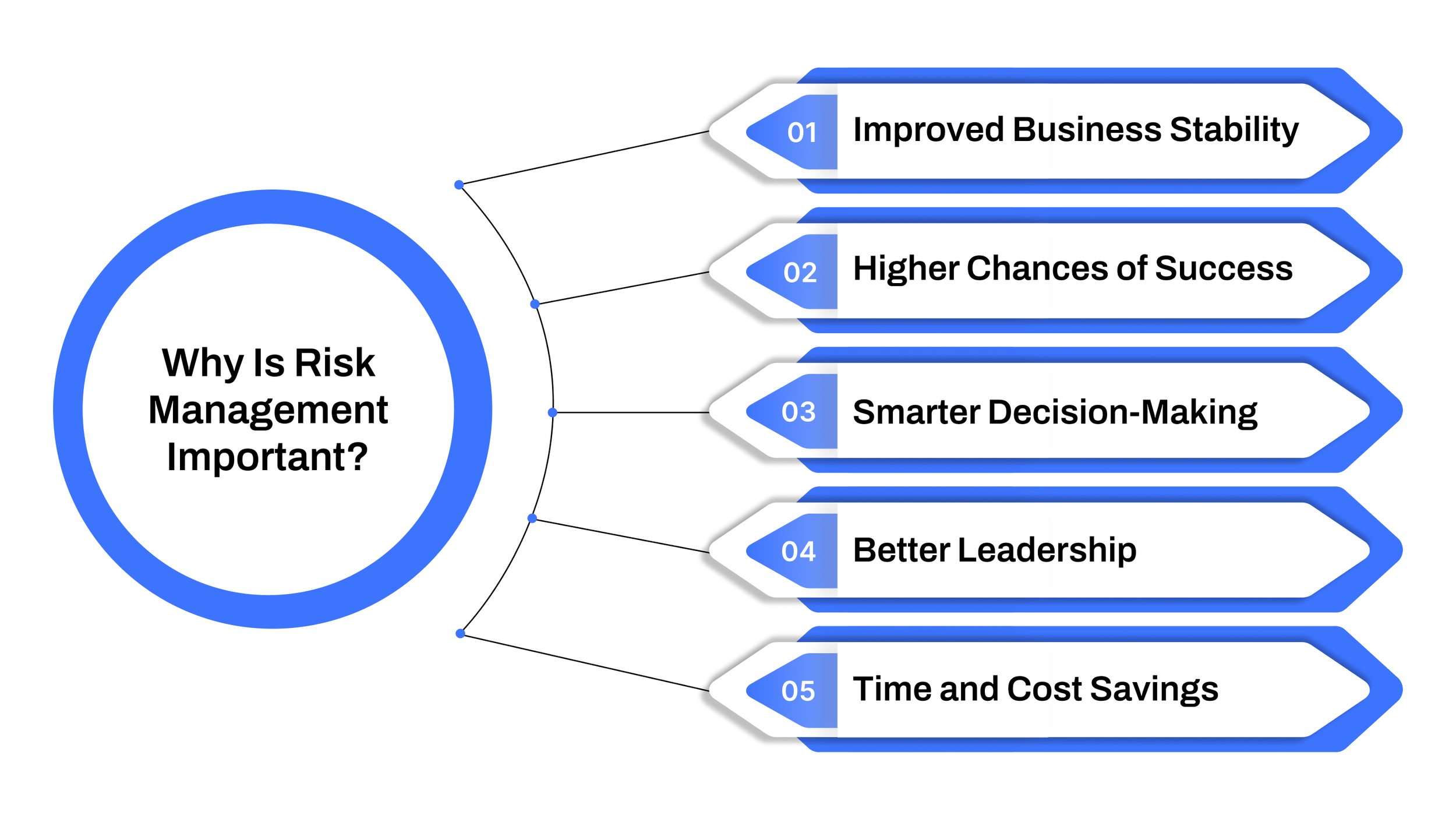

Some of the key benefits include:

Improved business stability: Preparing for disruptions, from supply chain delays to sudden market changes, keeps operations running smoothly.

Higher chances of success: Businesses that manage risks well are more likely to achieve sustainable growth because they’re ready for the unexpected.

Smarter decision-making: A clear framework helps evaluate which opportunities are worth pursuing and which may expose the business to unnecessary risks.

Better leadership: Developing a risk-aware mindset makes you a stronger business owner who can adapt quickly and guide the team with clarity.

Time and cost savings: With structures in place to handle risks, you reduce downtime, avoid costly mistakes, and maintain customer trust.

In many cases, the survival and long-term viability of a small business depend directly on its ability to tackle risks effectively and put effective strategies in place.

Types of Business Risks

Small businesses face a variety of threats that can affect their ability to achieve financial and operational goals. These risks generally fall into six key categories:

1. Financial Risk

Financial risk specifically relates to cash flow and liquidity. Over-reliance on a single client, excessive debt, or delayed payments can threaten business solvency. Key financial risks include:

Liquidity risk: Inability to convert assets into cash quickly for short-term needs.

Credit and default risk: Challenges in collecting receivables or repaying loans.

Mitigation strategies: Risk avoidance, transferring risk through insurance, or spreading risk across assets and operations.

2. Strategic Risk

Strategic risks arise when pursuing business opportunities that carry potential downsides. Every growth initiative involves risk, but proper planning can minimize exposure.

Key actions:

Identify potential risks tied to strategic objectives.

Evaluate which risks are acceptable versus those that may threaten survival.

Develop contingency plans for initiatives that may fail.

3. Reputational Risk

Reputational risk is tied to public perception of your business. Negative reviews, employee misconduct, or issues in associated partners can damage trust and reduce customer loyalty.

Learn more about: Reputational risk management

Prevention strategies:

Monitor online reputation across review platforms.

Address problems quickly and transparently.

Maintain high standards of customer service and employee training.

4. Hazard Risk

Hazard risks include property damage, legal liabilities, and employee safety incidents, such as fires, storms, or workplace injuries.

Management strategies:

Conduct regular safety audits.

Provide mental health and safety training for employees.

Implement policies to reduce exposure to hazardous conditions.

5. Operational Risk

Operational risks involve internal processes, technology, and employee actions that can disrupt daily operations. Examples include server outages, data entry errors, or cash mismanagement.

Mitigation strategies:

Develop frameworks to assess and prioritize operational risks.

Train staff to reduce human errors.

Create contingency plans for technology failures or natural events.

6. Cybersecurity Risk

With increasing digital reliance, cyber threats, such as hacking, phishing, or fraud, pose serious risks to small businesses.

Protection strategies:

Use advanced security software and fraud detection tools.

Educate employees on identifying cyber threats.

Consider cyber insurance to transfer risk.

Managing these diverse risks effectively requires continuous monitoring, transparency, and centralized oversight. Platforms like Auditive enable small businesses to assess, track, and mitigate vendor and operational risks efficiently, providing a unified view across financial, strategic, operational, and cyber exposures.

Steps of a Risk Management Process

Managing risk effectively requires a structured approach that moves beyond intuition. Small businesses can benefit from a systematic risk management process, which typically involves assessment, treatment, monitoring, and evaluation. Each step ensures risks are identified, understood, and mitigated in alignment with organizational objectives.

1. Risk Assessment

Qualitative Risk Assessment

Not all risks can be expressed in numbers. Many operational or environmental risks, such as climate change impacts or reputational threats, are inherently qualitative. Qualitative risk assessments allow businesses to evaluate the likelihood and severity of these risks using structured methods, ensuring consistency and objectivity across the organization. Standardized frameworks help prevent bias while enabling informed decision-making.

Quantitative Risk Assessment

Financial and data-driven risks are better assessed quantitatively. These assessments are common in finance, where metrics like revenue, interest rates, or loss probabilities provide clear insight. Quantitative methods are more objective and can be automated, allowing real-time analysis and integration into broader enterprise risk management frameworks. Advanced tools can combine both qualitative and quantitative insights, giving businesses a comprehensive view of potential threats.

2. Risk Prioritization

Once risks are identified, they must be ranked based on their potential impact and likelihood. This prioritization allows small businesses to focus on the most critical threats first, allocating resources efficiently while avoiding unnecessary efforts on minor issues.

3. Risk Treatment

Every identified risk requires mitigation, containment, or elimination. In traditional systems, this involves multiple stakeholders, scattered communications, and extensive follow-ups. Modern risk management solutions simplify this by centralizing discussions, assigning responsibilities, and tracking progress in real-time. Stakeholders can collaborate directly within the platform, ensuring alignment and transparency.

Platforms like Auditive enhance risk treatment by integrating vendor risk management and automated workflows. Teams can quickly address third-party exposures, assign mitigation tasks, and monitor progress without the fragmentation of manual processes.

4. Risk Monitoring and Review

Risks are dynamic; some, such as market fluctuations or environmental factors, are continuous. Monitoring risk ensures businesses remain proactive rather than reactive. Manual monitoring relies on diligent observation, whereas digital tools provide constant oversight, automatically flagging changes in risk levels and enabling faster responses. Continuous monitoring also strengthens business continuity planning.

Know more about: Risk monitoring techniques

5. Risk Evaluation

Evaluating the effectiveness of the risk management framework is essential. Regular evaluations uncover strengths, weaknesses, and areas for improvement, helping businesses refine their processes. Technology simplifies these evaluations, providing actionable insights that support smarter decision-making and more resilient operations.

By following these steps, small businesses can not only safeguard themselves against potential threats but also integrate risk management into strategic planning, ensuring long-term growth and stability.

Examples of Risk Management Strategies

Effective risk management requires a tailored approach that aligns with your industry, business objectives, and the types of risks your organization may face. Small businesses can use a combination of frameworks, operational practices, and proactive strategies to manage uncertainty and build resilience.

1. Using Existing Frameworks and Best Practices

Businesses don’t have to reinvent the wheel. Established risk management frameworks provide structured guidance to identify, assess, and mitigate risks:

ISO 31000 Family: International standards for comprehensive risk management.

NIST Risk Management Framework (RMF): Guidance aligned with the Cybersecurity Framework (CSF) for managing cyber and operational risks.

COSO Enterprise Risk Management (ERM): Enterprise-level risk management guidance, offering a holistic approach.

2. Minimum Viable Product (MVP) Development

Developing a simplified version of a product first allows companies to test market response while reducing financial and operational risk. By focusing on core features, businesses can limit overspending, shorten development cycles, and adjust plans based on real-world feedback.

3. Contingency Planning

Preparing for worst-case scenarios ensures continuity during unexpected events. Contingency plans may cover system outages, natural disasters, or operational disruptions, outlining response protocols and recovery measures to safeguard employees, customers, and assets.

4. Root Cause Analysis and Lessons Learned

After an incident or risk materializes, analyzing the underlying causes provides actionable insights. Integrating lessons learned into risk processes helps prevent recurrence and strengthens overall operational resilience.

5. Built-In Buffers

Allocating extra time, resources, or budget creates flexibility to manage unforeseen challenges. Projects with built-in buffers are better positioned to stay on track, even if risks materialize.

6. Risk-Reward Analysis

Evaluating potential benefits against possible risks allows businesses to make informed investment and operational decisions. Historical data, research, and prior lessons inform whether the expected reward justifies taking on a particular risk.

7. Third-Party Risk Assessments

Periodic evaluations of vendors or external partners can reveal hidden risks. Third-party assessments provide independent perspectives, identify gaps in security or compliance, and often include actionable recommendations for mitigating exposure.

Integrating a platform like Auditive enhances these strategies by centralizing risk visibility, continuously monitoring third-party relationships, and providing actionable insights through a Trust Center. With automation and real-time monitoring, businesses can proactively manage risk, reduce manual oversight, and maintain compliance with confidence.

By combining traditional strategies with modern technology, small businesses can transform risk management from a reactive exercise into a strategic advantage.

Streamlining Risk Management for Small Businesses

Small businesses often lack the resources to constantly monitor risk across operations and third-party relationships. Auditive simplifies this process by providing a centralized, automated platform designed to make risk management both efficient and actionable.

Key Features for Small Businesses:

Trust Center: A single hub to track vendor compliance, share security practices, and maintain transparency with stakeholders.

Real-Time Monitoring: Continuous oversight of third-party relationships, identifying risks before they escalate into costly incidents.

Automated Risk Assessments: Evaluate vendors and internal processes efficiently, reducing manual effort and human error.

Compliance Insights: Keep pace with regulations and industry standards, including financial, operational, and cybersecurity requirements.

Vendor Risk Management Tools: Streamline onboarding, auditing, and monitoring of third-party partners with a scalable approach.

By integrating Auditive into the risk management lifecycle, small businesses can proactively identify vulnerabilities, monitor evolving threats, and take decisive action. This ensures not only regulatory compliance but also stronger operational resilience, turning risk management into a strategic advantage rather than a reactive necessity.

Know more: Third-party contract management

Final Thoughts

Managing risk is not optional; it’s essential for small businesses seeking stability, growth, and resilience. By implementing a structured risk management lifecycle, businesses can identify threats early, assess their potential impact, and take proactive steps to mitigate them.

Platforms like Auditive make this process seamless. With centralized vendor risk management, a transparent Trust Center, and continuous monitoring, small businesses can stay ahead of operational, financial, and third-party risks. By integrating these tools, risk management transforms from a reactive task into a strategic advantage.

Schedule a demo with Auditive to explore how your business can gain real-time insights, streamline third-party oversight, and protect operations with confidence.

FAQs

1. What is a risk management lifecycle for small businesses?

It’s a structured process to identify, assess, and manage potential risks, ensuring businesses minimize losses and maintain operational resilience.

2. Why is vendor risk management important for small businesses?

Third-party vendors can introduce financial, operational, or compliance risks. Managing these relationships proactively reduces vulnerabilities and protects business continuity.

3. How can technology improve small business risk management?

Platforms like Auditive automate monitoring, compliance tracking, and third-party assessments, saving time while providing real-time visibility into risks.

4. What are common strategies for mitigating business risks?

Strategies include contingency planning, risk-reward analysis, root cause evaluation, using frameworks like ISO 31000, and performing third-party risk assessments.

5. How does Auditive’s Trust Center help small businesses?

The Trust Center centralizes vendor and internal risk information, enhances transparency, ensures compliance, and provides actionable insights for proactive decision-making.