What is Compliance Monitoring: Essential Guide for Definition & Importance

Compliance is more than a box-ticking exercise; it is the backbone of trust, accountability, and long-term sustainability. Organizations across industries face mounting regulatory requirements, evolving security threats, and rising stakeholder expectations.

Failing to meet these standards not only exposes businesses to legal penalties but can also erode reputation and customer confidence. This is where compliance monitoring systems come into play.

By implementing effective compliance monitoring, businesses gain the visibility and control needed to ensure internal policies, external regulations, and contractual obligations are consistently met.

Before we dive in:

Compliance monitoring systems track organizational adherence to policies, regulations, and industry standards.

Integrating vendor risk management ensures third-party compliance is continuously monitored.

Key challenges include evolving regulations, limited resources, manual processes, accountability gaps, and system integration.

Auditive Trust Center automates compliance monitoring, provides AI-driven Trust Profiles, and enables real-time vendor oversight.

Combine good compliance monitoring systems with Auditive to streamline workflows, reduce risks, and strengthen stakeholder trust.

What is Compliance Monitoring?

Compliance monitoring is the structured and ongoing process of ensuring that an organization consistently follows internal policies, external regulations, and industry-specific standards. It acts as a safeguard, enabling businesses to detect gaps, address weaknesses, and prevent violations before they become costly risks.

At its core, compliance monitoring goes beyond occasional audits. It involves continuous observation, evaluation, and testing of business operations to ensure adherence to legal, ethical, and contractual obligations.

By establishing a proactive approach, organizations can build stronger resilience against regulatory penalties, reputational damage, and operational disruptions while reinforcing stakeholder confidence and trust.

Why Is Compliance Monitoring Important?

Compliance monitoring is not just about meeting legal requirements, it is about creating a culture of accountability and resilience. By using compliance monitoring systems, organizations can proactively detect gaps, strengthen internal controls, and stay aligned with evolving regulatory standards.

This proactive approach helps avoid violations that could lead to severe penalties, financial losses, or reputational damage.

1. Strengthens Risk Management

Effective compliance monitoring is at the heart of modern risk management. It enables organizations to identify and mitigate potential legal, financial, and operational risks before they escalate. With regulations constantly changing, businesses that monitor compliance consistently are better equipped to adapt and prevent costly noncompliance issues.

2. Protects Reputation and Builds Trust

Non-compliance can quickly erode trust among customers, investors, and employees. Businesses that frequently face penalties or legal scrutiny risk being perceived as unreliable. Continuous compliance monitoring showcases a company’s dedication to ethical practices and regulatory integrity, safeguarding its reputation and strengthening stakeholder trust.

3. Drives Operational Efficiency

Well-structured compliance monitoring streamlines business processes, enforces accountability, and reduces manual oversight. Automated compliance monitoring systems minimize repetitive tasks, improve data security, and free up resources for strategic initiatives. This not only improves decision-making but also enhances overall organizational productivity while reducing compliance-related costs.

4. Ensures Financial Stability

Compliance monitoring also plays a direct role in financial health. By ensuring accurate reporting and maintaining financial transparency, organizations strengthen investor confidence and improve access to capital. A reliable compliance program demonstrates fiscal responsibility, which is critical for long-term growth and sustainability.

Who Is Responsible for Monitoring Compliance?

Monitoring compliance is not the responsibility of a single individual; it requires collaboration across different roles and departments to be effective.

The key players include:

Compliance Officer or Department

A designated compliance officer or team ensures that the organization follows internal policies, ethical standards, and all legal and regulatory requirements. They are responsible for creating and implementing compliance monitoring plans, conducting training, and running audits.

Management

Senior and middle management are equally accountable for embedding compliance into daily operations. By setting the right tone and leading by example, managers help cultivate a strong culture of compliance within the organization.

Internal Auditors

Internal auditors assess whether internal controls are functioning properly, particularly around regulatory adherence. They play a critical role in confirming that risk management, governance, and compliance processes operate effectively.

External Auditors, Regulators, and Agencies

In many industries, external auditors and regulatory bodies oversee compliance directly. Government agencies may also intervene to ensure adherence to sector-specific regulations.

Third-Party Consulting Firms

Organizations without in-house expertise often turn to third-party consultants who specialize in compliance, risk management, and corporate governance. These firms can build or even fully manage compliance monitoring programs on behalf of the business.

To make compliance monitoring seamless and future-ready, businesses need platforms that unify vendor oversight, governance, and trust. This is where Auditive’s Trust Center empowers organizations to stay one step ahead.

Learn more about: Third Party Contract Management: Steps and Best Practices

What Is Government Compliance Monitoring?

Government compliance monitoring refers to the process of ensuring organizations adhere to laws, regulations, and industry standards. It combines audits, inspections, and reporting to verify that operations remain lawful and ethical.

The ultimate objective is to:

Maintain transparency in how organizations operate

Strengthen accountability across departments and officials

Prevent fraud, data breaches, safety violations, and unethical practices

To achieve this, government agencies use monitoring tools, on-site inspections, investigations, and, when necessary, penalties.

Real-World Examples

GDPR Enforcement in the EU: Organizations mishandling user data can face fines of up to €20 million (about $21 million) or 4% of global turnover. In September 2023, Ireland’s Data Protection Authority fined TikTok €345 million (around $363 million) for violating GDPR data principles.

EPA Inspections in the U.S.: The Environmental Protection Agency (EPA) conducts audits on pollution control devices, operating conditions, and materials. These involve record reviews, interviews, site photography, and operational checks to ensure compliance with environmental laws.

Why It’s Crucial for Governments

Government agencies are particularly vulnerable because:

Much of their infrastructure still runs on legacy systems with decades of stored data

They face frequent targeting by state-sponsored threat actors

Manual processes combined with outdated systems make it easier for data to be mishandled or exposed

To combat these risks, compliance monitoring often blends manual oversight with automated tools to:

Detect vulnerabilities in system architecture

Identify insider threats or improper handling of sensitive data

Ensure readiness for periodic inspections and audits

A strong monitoring program not only protects sensitive public-sector data but also ensures agencies avoid hefty fines and reputational damage.

Just as governments need systematic monitoring to maintain accountability, businesses must ensure compliance across their entire vendor ecosystem. Auditive’s vendor risk management solutions extend this same rigor to organizations, providing real-time oversight and actionable insights to keep risks in check.

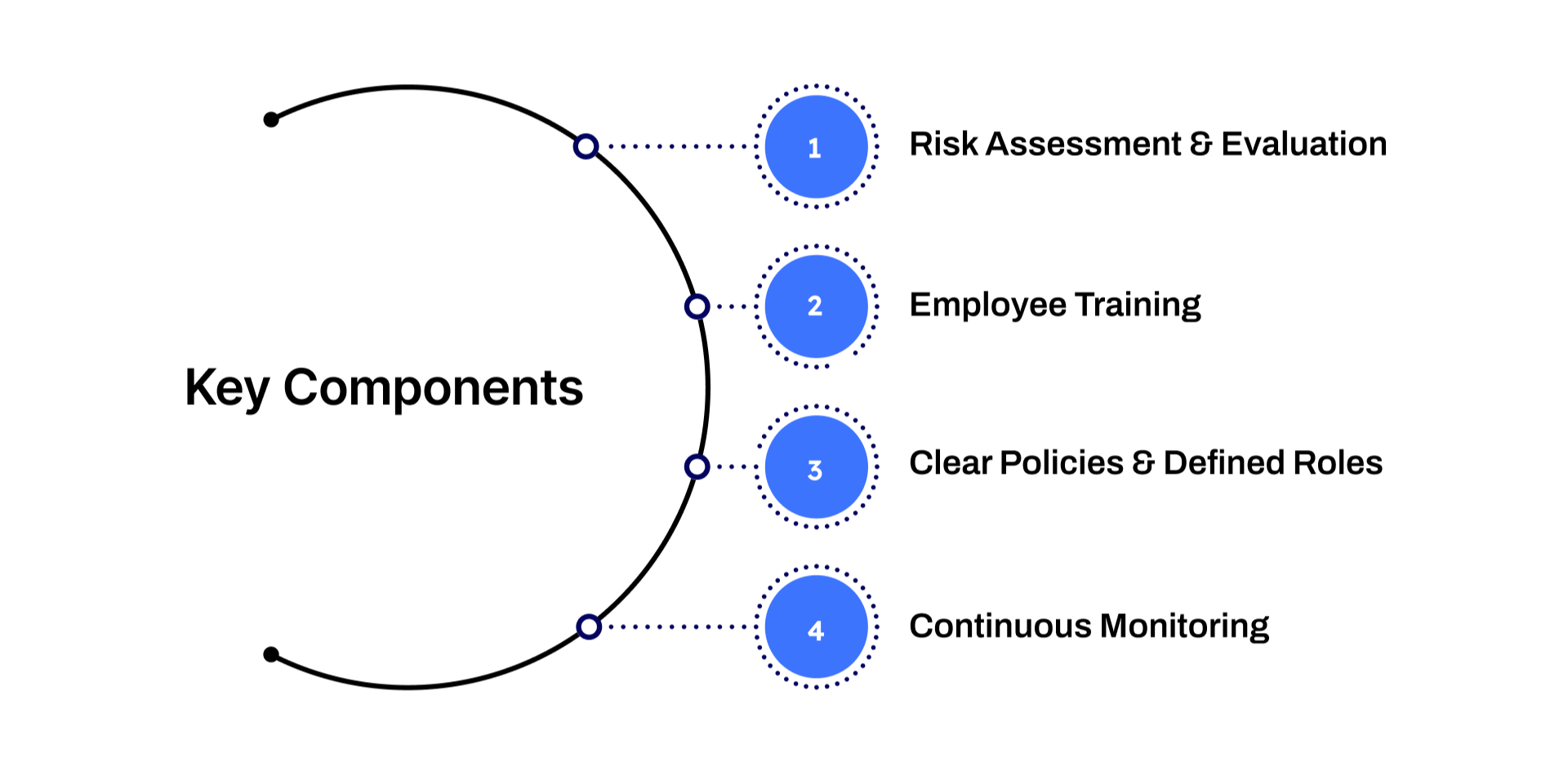

Key Components of an Effective Compliance Monitoring Program

An effective compliance monitoring program is not a one-off initiative, it is a structured framework made up of interconnected elements that collectively safeguard an organization from legal, operational, and reputational risks. By using compliance monitoring systems, businesses can ensure industry standards, regulatory requirements, and internal policies are consistently upheld.

Look into: Guide to Effective Reputation Risk Management and Mitigation

1. Risk Assessment and Evaluation

The foundation of compliance monitoring lies in strong risk assessment and evaluation. Organizations must identify potential compliance risks, prioritize them based on impact, and implement preventive controls. This includes:

Conducting regular compliance policy reviews to align with evolving regulations and industry standards.

Engaging third-party auditors for unbiased evaluations that uncover weaknesses.

Running internal audits to test adherence to compliance protocols.

Using third-party risk management software to automate tracking of regulatory changes, streamline reporting, and maintain accurate records.

This proactive approach ensures that risks are identified early and addressed before they escalate into costly violations.

2. Employee Training

Employees are on the frontlines of compliance, making training a critical pillar of any monitoring program. Structured training programs should clarify individual responsibilities and provide practical knowledge of industry-specific regulations.

Key benefits of ongoing training include:

Reducing the likelihood of compliance violations.

Minimizing legal exposure and organizational liability.

Improving productivity by embedding compliance into daily workflows.

Reinforcing accountability across teams.

Organizations should integrate workshops, refresher sessions, and e-learning modules to keep employees updated on evolving policies and compliance protocols.

3. Clear Policies and Defined Roles

Strong compliance monitoring systems require well-documented policies and clearly assigned responsibilities. Establishing a dedicated compliance unit or officer ensures accountability and structured oversight.

Core practices include:

Drafting clear compliance policies that act as a reference guide for handling compliance issues.

Appointing compliance officers to monitor regulations, conduct audits, and guide corrective action.

Creating response protocols to manage compliance breaches swiftly and effectively.

This clarity not only improves efficiency but also builds trust across stakeholders.

4. Continuous Monitoring and Technology Integration

Compliance is dynamic, regulations evolve, risks emerge, and controls need constant validation. Continuous monitoring supported by technology integration allows organizations to stay ahead.

Automated compliance software can streamline reporting and real-time tracking.

Regular testing and monitoring detect potential gaps early.

Tracking regulatory updates ensures strategies remain current and effective.

By embedding technology into compliance monitoring, organizations create scalable systems that adapt as regulations and risks change.

Together, these components, risk assessment, training, clear policies, and continuous monitoring, form the backbone of an effective compliance monitoring framework. When executed cohesively, they help organizations achieve regulatory adherence, mitigate risks, and foster a culture of integrity and accountability.

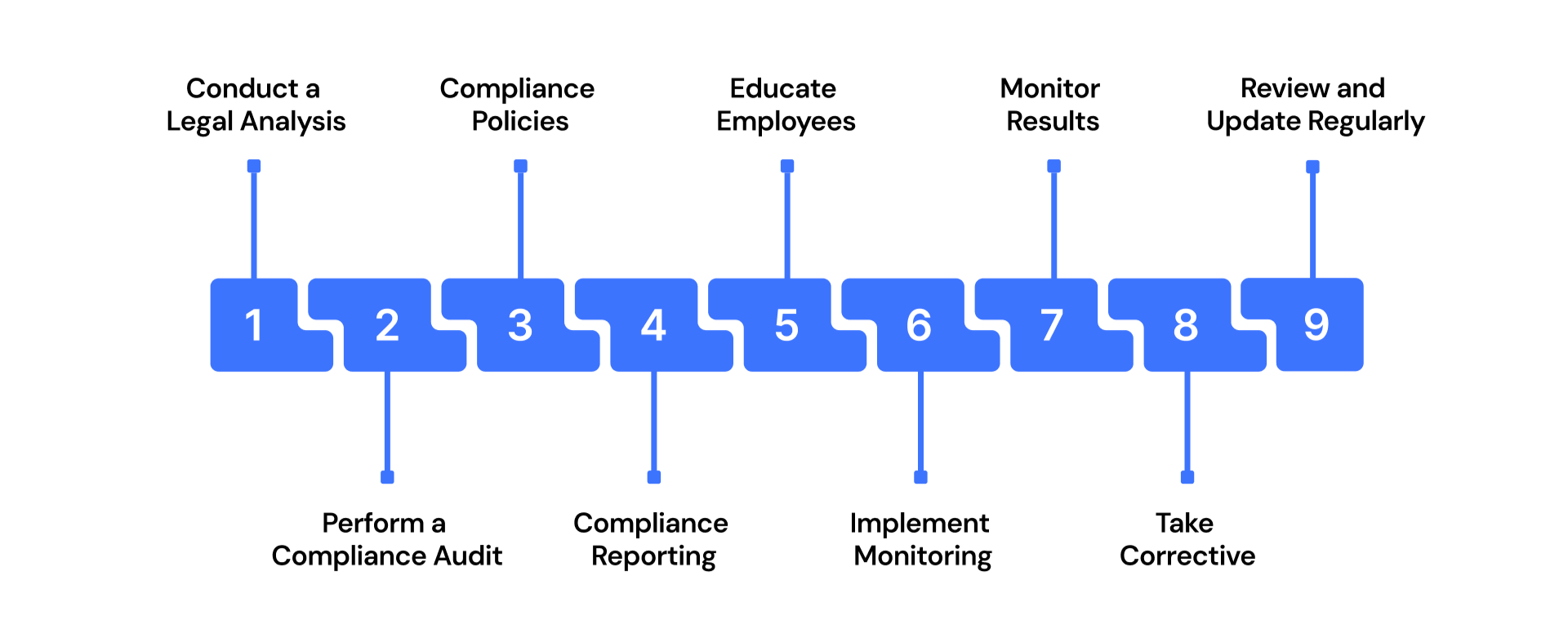

9 Steps to Create a Compliance Monitoring Plan

A strong compliance monitoring plan acts as a safeguard against violations while nurturing a culture of accountability and continuous improvement. Below are the essential steps organizations should take to design and implement an effective program.

1. Conduct a Legal Analysis and Internal Review

Start by identifying all relevant laws, regulations, and industry standards that apply to your business. This includes reviewing internal policies, past compliance issues, and potential gaps. Engaging compliance experts or legal counsel ensures your analysis is accurate and comprehensive. This foundation helps prioritize high-risk areas that need closer monitoring.

2. Perform a Compliance Audit and Risk Assessment

Evaluate current adherence levels through a compliance audit, followed by a risk assessment to uncover potential threats. Prioritize risks based on severity and impact, and document findings to create a clear roadmap for your compliance plan.

3. Establish Compliance Policies and Procedures

Develop clear, practical policies that address identified risks. These should be supported by step-by-step procedures for reporting and resolving compliance issues. Ensure policies are accessible to employees and endorsed by senior management to reinforce organizational commitment.

4. Align Compliance Reporting

Design a reporting framework that ensures transparency and accountability. Use automation tools to streamline reporting, set KPIs to measure performance, and provide stakeholders with regular, accurate updates. This strengthens credibility and decision-making.

5. Train and Educate Employees

Employees play a critical role in compliance success. Implement role-specific training programs, use real-world scenarios, and conduct regular refresher courses. Providing resources like handbooks or e-learning modules helps employees understand and apply compliance responsibilities.

6. Implement Monitoring and Testing Strategies

Set up a structured schedule for regular audits and continuous surveillance. Using automated tools to detect anomalies in real time and refine your strategies based on findings. This proactive approach ensures policies remain effective.

7. Monitor Results Continuously

Track KPIs, analyze trends, and gather stakeholder feedback to evaluate program effectiveness. Continuous monitoring provides valuable insights into recurring issues and areas for improvement.

8. Take Corrective and Preventive Actions

When issues arise, perform root cause analysis, apply corrective measures, and establish preventive strategies to avoid recurrence. Document all actions to demonstrate accountability and commitment to ongoing improvement.

9. Review and Update Regularly

Regulatory landscapes evolve, so review and update your compliance plan frequently. Stay informed on new requirements, revise procedures, and incorporate stakeholder feedback to keep the program relevant and resilient.

Building a compliance monitoring plan is one thing, ensuring it adapts to dynamic risks is another. This is where Auditive provides value by helping organizations align compliance, vendor risk management, and trust center capabilities into one seamless framework.

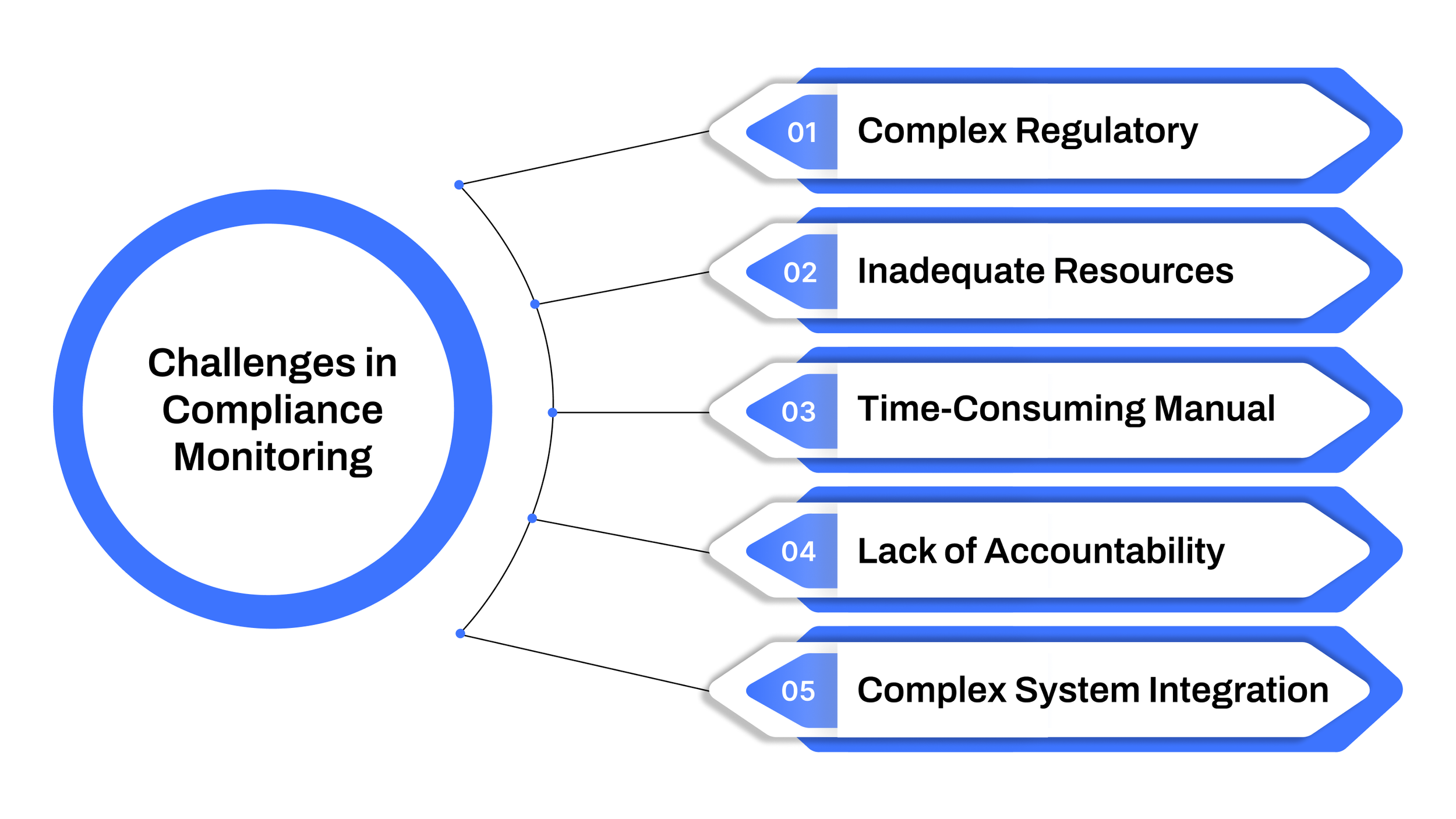

Challenges in Compliance Monitoring

Implementing an effective compliance monitoring program is not without hurdles. Organizations often face multiple challenges that can impede their ability to maintain regulatory adherence and operational integrity.

Complex Regulatory Landscape

Regulations are constantly evolving across industries and geographies. For sectors like healthcare and finance, managing frameworks such as HIPAA, GDPR, and SOX can be overwhelming. Failing to keep up with these standards can lead to substantial fines, legal penalties, and reputational damage.

Inadequate Resources

Many businesses struggle with limited budgets, insufficient staff, and a lack of specialized expertise in compliance monitoring. Smaller organizations or those with competing priorities often find it difficult to dedicate the necessary resources, leaving gaps in their monitoring programs.

Time-Consuming Manual Processes

Traditional compliance efforts rely heavily on manual data collection, analysis, and reporting. These labor-intensive processes are prone to human error and can delay the identification and resolution of compliance issues. Automating workflows through strong compliance monitoring systems can save time and improve accuracy.

Lack of Accountability

Without clearly defined roles and responsibilities, compliance tasks may fall through the cracks. Establishing ownership and regular audits ensures that all compliance activities are properly tracked and managed.

Complex System Integration

Integrating compliance monitoring tools with existing enterprise systems is often challenging. Disparate software solutions can create data silos, inconsistent reporting, and an incomplete view of compliance risks. Seamless integration is essential to achieve comprehensive oversight.

Addressing these challenges requires a proactive approach: investing in specialized software, ongoing training, and well-structured governance frameworks.

To overcome these hurdles and streamline compliance monitoring, organizations can utilize platforms like Auditive, which integrate automated workflows, continuous vendor monitoring, and AI-driven Trust Profiles, creating a proactive and transparent compliance ecosystem.

Auditive: Streamlining Compliance Monitoring and Vendor Oversight

Effective compliance monitoring extends beyond internal policies; it also requires continuous oversight of third-party vendors. Auditive provides a modern solution through its AI-powered Trust Center and Trust Exchange, enabling organizations to monitor compliance and vendor risk proactively.

Key Benefits:

Continuous Monitoring: Real-time visibility into vendor compliance ensures your organization stays ahead of potential risks.

Seamless Onboarding: Rapidly onboard new vendors and assess their compliance posture without manual delays.

AI-Powered Trust Profiles: Vendors can share compliance information proactively, while buyers access actionable insights for informed decision-making.

Integrated Workflows: Auditive integrates with existing procurement, GRC, and workflow systems, allowing teams to streamline processes without disruption.

Flexible Access Levels: Start with AuditiveX Free for basic monitoring or upgrade to AuditiveX Plus for enterprise-level capabilities, including advanced assessments, customizable reporting, and 100+ integrations.

By using Auditive, organizations can automate compliance monitoring, reduce manual workloads, and maintain continuous oversight of both internal processes and external vendors, ultimately mitigating risk and enhancing trust.

Final Thoughts

Effective compliance monitoring systems are essential for organizations to maintain regulatory adherence, mitigate operational risks, and build trust with stakeholders. However, compliance extends beyond internal processes; third-party vendors also introduce potential vulnerabilities. Integrating vendor risk management into your compliance strategy ensures continuous oversight of vendor performance, security, and regulatory adherence.

A centralized Trust Center, like Auditive, enables organizations to monitor vendors in real-time, automate compliance workflows, and create AI-powered Trust Profiles for proactive transparency.

Protect your organization from compliance risks and streamline vendor oversight. Book a demo with Auditive today to see how the Trust Center can revolutionize your compliance monitoring and third-party risk management.

FAQs

1. What are compliance monitoring systems?

Compliance monitoring systems are tools and processes designed to track adherence to internal policies, external regulations, and industry standards across all organizational operations.

2. Why is compliance monitoring important?

It ensures organizations meet regulatory requirements, reduces the risk of fines and legal issues, and fosters operational transparency and trust.

3. Who is responsible for monitoring compliance?

Compliance responsibility typically falls on dedicated compliance officers or teams, but accountability spans across departments, including IT, legal, operations, and vendor management.

4. How does vendor risk management fit into compliance monitoring?

Vendors can introduce additional compliance risks. Incorporating vendor risk management ensures continuous monitoring of third-party performance, regulatory adherence, and security posture.

5. How can Auditive help with compliance monitoring?

Auditive provides a centralized Trust Center with AI-powered Trust Profiles, continuous vendor monitoring, automated workflows, and integrations that streamline both internal and third-party compliance management.