Creating a Successful Risk Management Business Plan

Every business carries risk, whether it's market volatility, cybersecurity threats, supply chain disruptions, or legal liabilities. The key to long-term resilience isn’t avoiding risk altogether (which is impossible), but building a solid strategy to anticipate, assess, and act on it. That’s where a robust risk management business plan comes in.

A well-structured plan not only safeguards operations but also builds stakeholder trust, drives better decision-making, and keeps your organization agile in uncertain times.

Overview

A risk management business plan helps identify, assess, and mitigate potential threats to your business operations.

It includes structured steps like risk identification, mitigation strategies, and ongoing reviews.

A strong plan boosts decision-making, minimizes financial losses, and supports long-term sustainability.

Auditive enhances this process with automated tools for Vendor Risk Management and a centralized Trust Center.

Keeping the plan updated regularly ensures you're prepared for evolving risks and compliance needs.

What is a Risk Management Plan?

A risk management plan is a structured approach that helps businesses anticipate, evaluate, and respond to potential threats before they disrupt operations. More than just a precautionary measure, it serves as a strategic framework for identifying vulnerabilities, assessing their potential impact, and defining practical steps to reduce or eliminate those risks.

By laying out clear mitigation strategies and assigning roles and responsibilities, a well-constructed plan enables organizations to act swiftly and decisively when challenges arise. It also incorporates ongoing review mechanisms to adjust for evolving risks, ensuring the business remains resilient and responsive to both internal shifts and external pressures. Ultimately, a risk management plan supports stability, compliance, and long-term success.

Why Is a Risk Management Plan Important for Your Business?

Building a resilient business isn’t just about pursuing growth or refining financial strategies, it also means planning for what could go wrong. A well-defined risk management plan acts as a strategic backbone, helping organizations identify potential threats before they evolve into costly disruptions.

When risks are assessed early, businesses can prevent financial setbacks, operational bottlenecks, and compliance issues. More than just a contingency tool, a risk management plan strengthens the company’s ability to respond with agility and clarity, especially when the unexpected strikes.

Smarter decision-making: With visibility into possible risks, leaders can act proactively instead of reactively, leading to more confident, data-driven choices.

Operational stability: Unexpected events, financial losses, system outages, or reputation hits, can be absorbed more effectively with a plan in place.

Legal & regulatory assurance: With regulations tightening across industries, a risk plan helps organizations stay compliant and avoid penalties.

Reputation protection: Credibility matters. A well-managed risk framework strengthens stakeholder trust and supports long-term brand value.

Auditive empowers businesses to bring these principles into practice at scale. By delivering centralized visibility into vendor risk, integrating real-time monitoring, and automating compliance workflows, Auditive helps build smarter, faster, and more agile risk programs.

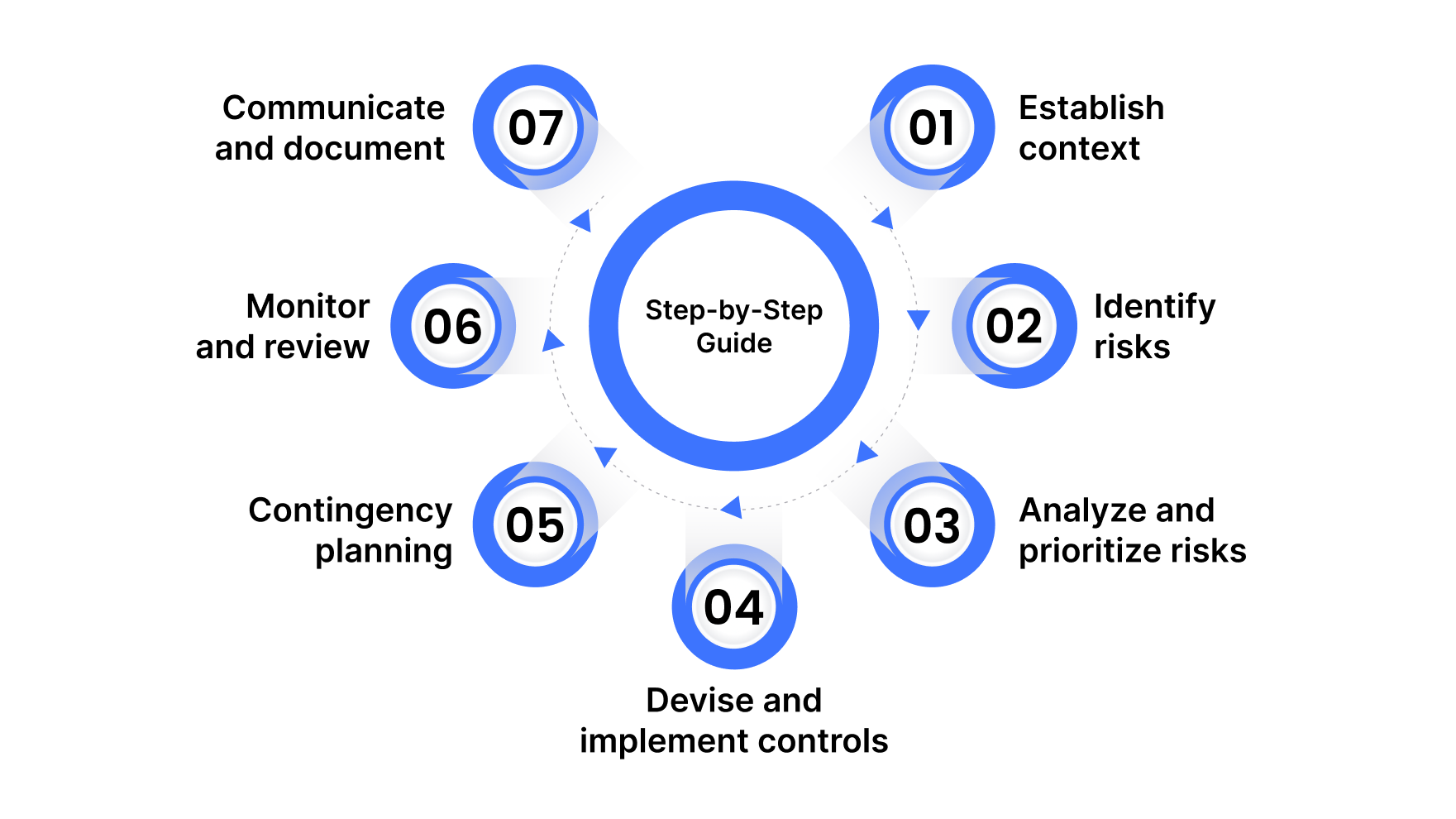

A Step-by-Step Guide to Creating a Successful Risk Management Plan

Building an effective risk management plan isn’t about checking boxes, it’s about developing a living framework that anticipates threats, adapts to change, and protects your business without slowing it down. Here's how you can approach it, step by step.

1. Establish context

Start by zooming out. Understand your organization's broader mission, core values, market dynamics, and customer base. This isn’t just about internal reflection, it includes regulatory obligations, international operations, industry standards, and unique demographic factors.

Setting the right context sharpens your view and creates a strong foundation for identifying and assessing risks later. Think of it as setting the stage before the actors come on.

2. Identify risks

Once the context is clear, begin identifying the risks that could impact your operations. These may stem from finance, operations, legal compliance, cybersecurity, environmental disruptions, or reputational factors.

Don’t rely solely on instinct. Use structured tools like SWOT analysis, stakeholder interviews, risk matrices, and team brainstorming sessions to uncover known and hidden risks, whether they’re minor supply issues or large-scale system failures.

3. Analyze and prioritize risks

With a list of potential threats in hand, the next step is to understand which ones matter most. Evaluate the likelihood of each risk occurring and its potential impact on your business goals.

For example, a scoring system based on probability (1–5) and severity (1–5) can help calculate risk exposure. Risks with higher scores become your top priorities; these are the ones that require immediate attention and strategic controls.

4. Devise and implement controls

Controls are your safeguards. These might include preventive measures, risk transfers (like insurance), or operational changes to minimize the impact. The objective is to address risks head-on without compromising agility.

Say a logistics operation faces supply chain instability. Controls could involve diversifying suppliers, investing in local inventory buffers, or improving vendor SLAs. The goal is proactive preparedness, keeping disruptions at bay while keeping business moving.

This is also where Auditive comes in. With its integrated trust center and automated vendor risk management capabilities, Auditive enables teams to build resilient control structures that scale. Whether you need visibility into third-party risks or a centralized platform for security compliance, Auditive supports every layer of this process, without manual overhead.

5. Contingency planning

Even the most well-designed controls may fall short under unexpected pressure. That’s why contingency planning is non-negotiable.

This phase is about designing backup plans and understanding the “what-ifs.” If a key control fails or a new risk emerges, your contingency plan acts as the fallback mechanism, ensuring your business keeps running and recovery is swift.

6. Monitor and review

Risk management isn’t a one-time task. It evolves alongside your business. Regular reviews ensure that your plan stays effective and aligned with current realities.

Set formal review intervals, collect feedback, audit results, and track control performance. Adjust the plan as needed when your business introduces new services, enters new markets, or shifts strategies.

7. Communicate and document

Finally, ensure your risk management framework is thoroughly documented and communicated. Transparency fosters accountability and encourages a risk-aware culture across departments.

This documentation also becomes a valuable guide during audits, stakeholder reporting, and future planning exercises.

How Auditive Strengthens Your Risk Management Plan

A well-designed risk management plan needs continuous execution, not just documentation. Auditive helps operationalize that vision with automation, visibility, and control.

Automated Vendor Risk Reviews: Complete third-party assessments up to 4× faster with built-in frameworks like ISO 27001 and SOC 2.

Continuous Monitoring: Stay ahead of issues with 24/7 alerts for compliance lapses, expired certificates, or new threats.

Smart Risk Scoring: Get clear, audit-ready insights into vendor posture, backed by real-time data, not static surveys.

Integrated Workflows: Onboard vendors quickly and enforce policies without slowing down procurement or IT.

With Auditive, your plan becomes a dynamic system, evolving with your business and reducing exposure at every step.

Conclusion

Creating a successful risk management business plan isn’t just about anticipating threats, it's about building resilience into the core of your operations. From assessing and mitigating risks to ensuring consistent updates, a well-crafted plan helps protect your business and strengthen decision-making.

Platforms like Auditive bring clarity and efficiency to this process. By enabling proactive Vendor Risk Management and offering a centralized Trust Center for third-party oversight, Auditive ensures your risk plan stays actionable, compliant, and aligned with evolving business needs.

Ready to take control of your business risks? Explore how Auditive can modernize your approach; book a demo today.

FAQs

Q1. What should be included in a business risk management plan?

A1. A complete plan should cover risk identification, impact assessment, mitigation strategies, assigned responsibilities, and periodic reviews.

Q2. How often should a risk management plan be updated?

A2. Ideally, review and update the plan quarterly or whenever there’s a major business, operational, or regulatory change.

Q3. Why is vendor risk management critical in a business plan?

A3. Vendors can introduce security, compliance, or operational risks. Monitoring them ensures your supply chain and partnerships remain secure and trustworthy.

Q4. How does Auditive support risk planning for businesses?

A4. Auditive offers intelligent tools to automate risk identification, centralize vendor oversight, and simplify compliance via its Trust Center.

Q5. What are the biggest challenges in creating a risk management plan?

A5. Common issues include underestimating risks, a lack of internal buy-in, poor visibility into third-party exposure, and failure to update plans consistently.