Everything You Need to Know About ESG Regulations

Environmental, Social, and Governance (ESG) considerations have shifted from optional talking points to critical compliance requirements across global industries. Driven by stakeholder pressure, regulatory mandates, and the growing need for transparency, ESG frameworks now influence everything from boardroom decisions to vendor contracts and investment strategies.

As regulations become more structured and enforcement more rigorous, organizations are being held accountable not just for promises but for measurable progress. ESG regulation is no longer limited to sustainability reports, it now plays a central role in risk management, corporate reputation, and long-term value creation.

This blog explores what ESG means in practice, the key factors it encompasses, the regulatory frameworks shaping global expectations, and how businesses can define, collect, and report ESG data with accuracy and confidence.

TL;DR

ESG stands for Environmental, Social, and Governance, three key factors used to evaluate a company’s sustainability and ethical impact.

ESG regulations are growing globally, with mandatory standards like the CSDR and voluntary frameworks like GRI and CDP.

Defining ESG goals and collecting accurate data across departments is crucial for proper reporting and compliance.

Platforms like Auditive simplify ESG compliance with vendor risk management and a real-time Trust Center for evaluating and monitoring third-party ESG performance.

What is ESG?

ESG, or Environmental, Social, and Governance, is the three critical pillars that reflect how responsibly and sustainably a company operates. As global expectations shift toward corporate accountability, ESG has emerged as a powerful lens through which investors, regulators, and stakeholders evaluate a business’s ethical and long-term performance.

Rooted in the “triple bottom line” concept of people, planet, and profit, ESG goes beyond financial statements to assess how companies manage their environmental impact, treat people (both inside and outside the organization), and govern themselves transparently.

Rather than being a single standard, ESG encompasses a range of frameworks and metrics that help organizations report on and improve their practices in these three areas. From climate-related disclosures to diversity initiatives and board accountability, ESG plays a growing role in shaping corporate strategy and reputation.

What Are the Three ESG Key Factors?

At the heart of ESG (Environmental, Social, and Governance) lies a simple but powerful idea: companies must be evaluated not just on financial performance but also on how responsibly they operate in relation to the environment, society, and internal governance. Each of these three pillars addresses a distinct area of risk, responsibility, and long-term value creation.

1. Environmental criteria (E)

Environmental criteria assess a company’s impact on the natural world and its preparedness for environmental risks. It’s not just about reducing pollution, it’s about building resilience in the face of climate-related challenges.

Key environmental areas include:

Climate change: Impact and exposure, including emissions, energy use, and preparedness for risks like rising sea levels.

Water usage: How much water is used in production, and whether it's sourced responsibly.

Biodiversity and deforestation: Impact on ecosystems through land use or raw material sourcing.

Resource depletion: Dependency on non-renewable resources like fossil fuels and metals.

Waste management: Handling of toxic emissions, industrial waste, and plastics.

It’s also crucial to consider how environmental risks affect business continuity. For instance, a company reliant on fossil fuels may face increased costs or disruption due to future regulations or supply scarcity.

2. Social criteria (S)

The social pillar evaluates a company’s relationships with employees, communities, and customers. It focuses on human capital, workplace practices, and social responsibility.

Key social factors include:

Fair wages and ethical labor practices: Ensuring compensation meets standards and upholds labor laws.

Workplace safety and development: Providing safe working conditions and opportunities for growth.

Community impact: Investing in or supporting the communities in which the company operates.

Diversity, Equity & Inclusion (DEI): Encouraging equal representation and treatment across race, gender, and background.

Customer privacy and data security: Safeguarding consumer data and complying with data protection laws.

Strong social policies not only boost reputation but also help build a loyal workforce and customer base.

3. Governance criteria (G)

Governance focuses on how a company is structured and managed. It examines leadership integrity, accountability, and the systems in place to uphold ethical decision-making.

Key governance indicators include:

Board composition and diversity: A diverse, independent board promotes better oversight.

Executive compensation: Aligning pay with performance and transparency, including CEO-to-employee pay ratios.

Regulatory compliance and financial transparency: Meeting legal standards and disclosing accurate financials.

Anti-corruption policies: Preventing fraud, bribery, and unethical behavior.

Stakeholder participation: Giving investors and stakeholders meaningful input into decision-making.

Robust governance practices form the foundation of a company’s ESG integrity. Without proper governance, environmental and social efforts often lack credibility and sustainability.

Why Is ESG Important?

Environmental, Social, and Governance (ESG) considerations have moved from the sidelines to the center of modern business strategy. As stakeholders, including investors, regulators, and consumers, become more focused on sustainability and ethics, ESG performance is now seen as a key indicator of long-term business value.

One of the primary drivers behind ESG’s growing importance is risk and opportunity assessment. ESG reporting helps companies and financial institutions identify potential risks, like those related to climate change, labor practices, or data governance, and align them with broader business goals. At the same time, it opens up new opportunities, from cost savings in operations to improved brand positioning.

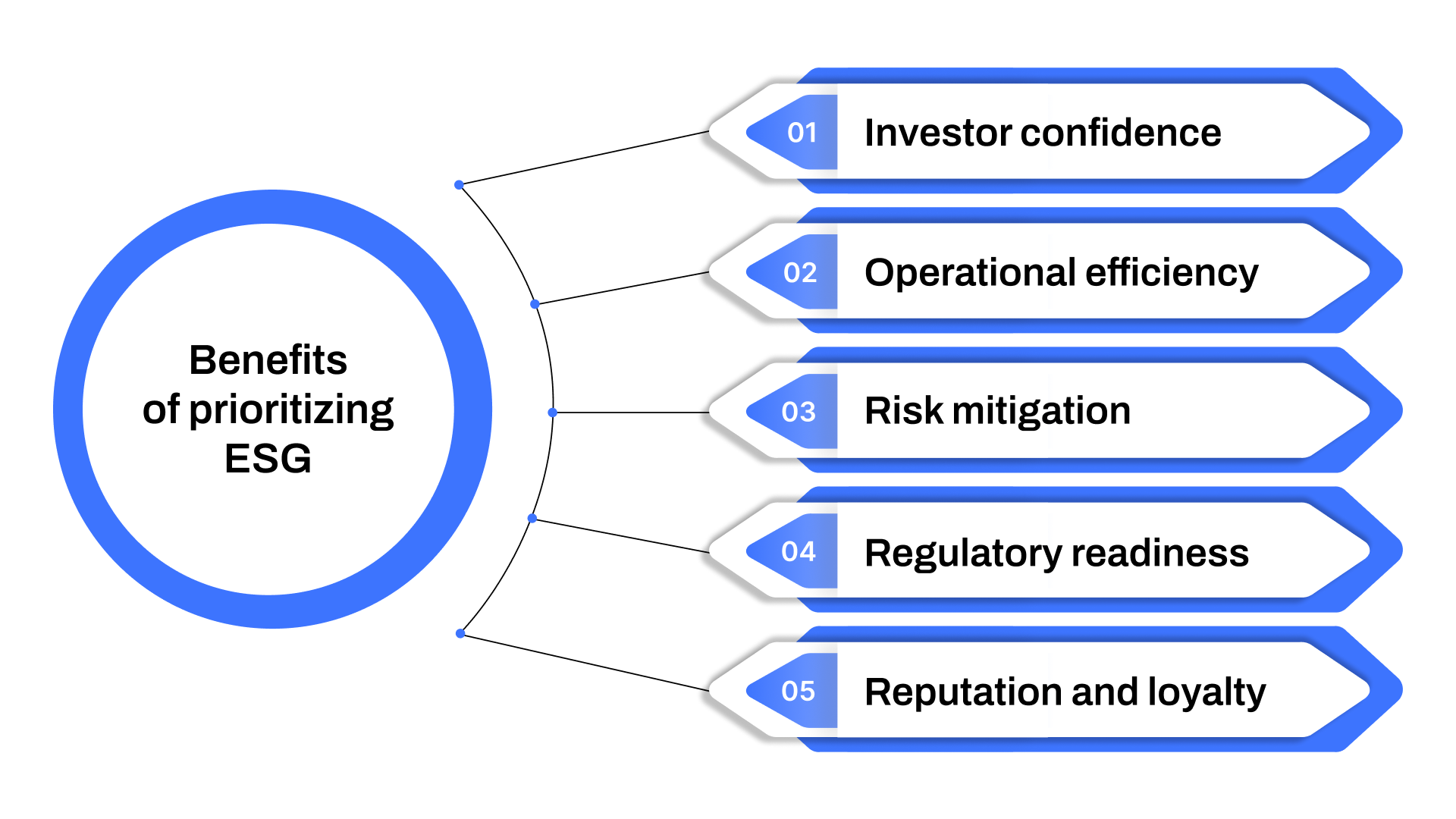

Key benefits of prioritizing ESG include:

Investor confidence: Transparent ESG reports give investors insight into a company’s values and long-term sustainability, influencing capital allocation decisions.

Operational efficiency: Many ESG initiatives, like energy efficiency or waste reduction, also reduce operational costs.

Risk mitigation: ESG frameworks allow businesses to anticipate and manage risks in areas like environmental regulation, supply chain ethics, or data privacy.

Regulatory readiness: With ESG-related regulations on the rise, having a formal ESG framework helps ensure compliance and reduces the risk of penalties.

Reputation and loyalty: Consumers are more likely to support companies that take clear stances on social and environmental issues, leading to stronger customer loyalty and brand trust.

Ultimately, ESG is not just about compliance, it's about building a business that is more resilient, responsible, and ready for the future.

How Auditive Helps You Stay ESG-Compliant Through Vendor Risk Monitoring

Managing ESG compliance across your vendor ecosystem can be challenging unless you have real-time visibility and automation on your side. Auditive empowers organizations to uphold ethical, environmental, and governance standards confidently:

1. Real-time ESG monitoring via the trust center

Auditive’s Trust Center continuously tracks vendor risk profiles, including ESG metrics, offering real‑time insights into their environmental, social, and governance postures. This proactive surveillance means you’re alerted to compliance deviations early, before they escalate.

2. Validating vendor claims against ESG benchmarks

Vendors often self-certify their ESG credentials, but how can you verify the claims? Auditive helps cross-check vendor-reported data, like emissions, labor standards, or DEI policies, against industry-recognised ESG frameworks. This ensures vendor data aligns with actual benchmarks, reducing the risk of false assurances.

3. Automated due diligence & compliance scoring

With AI-driven automation, Auditive streamlines vendor onboarding and ongoing assessments. ESG-related due diligence, such as certifications, audit reports, and policy documents, is ingested and scored, maintaining an updated compliance profile throughout the vendor lifecycle.

Combining continuous monitoring, validation against standards, and intelligent automation, Auditive transforms ESG compliance from a reactive checkbox into a proactive strategic asset.

With Auditive, ESG compliance becomes transparent, scalable, and confidently managed, one vendor at a time.

How to Define ESG Goals

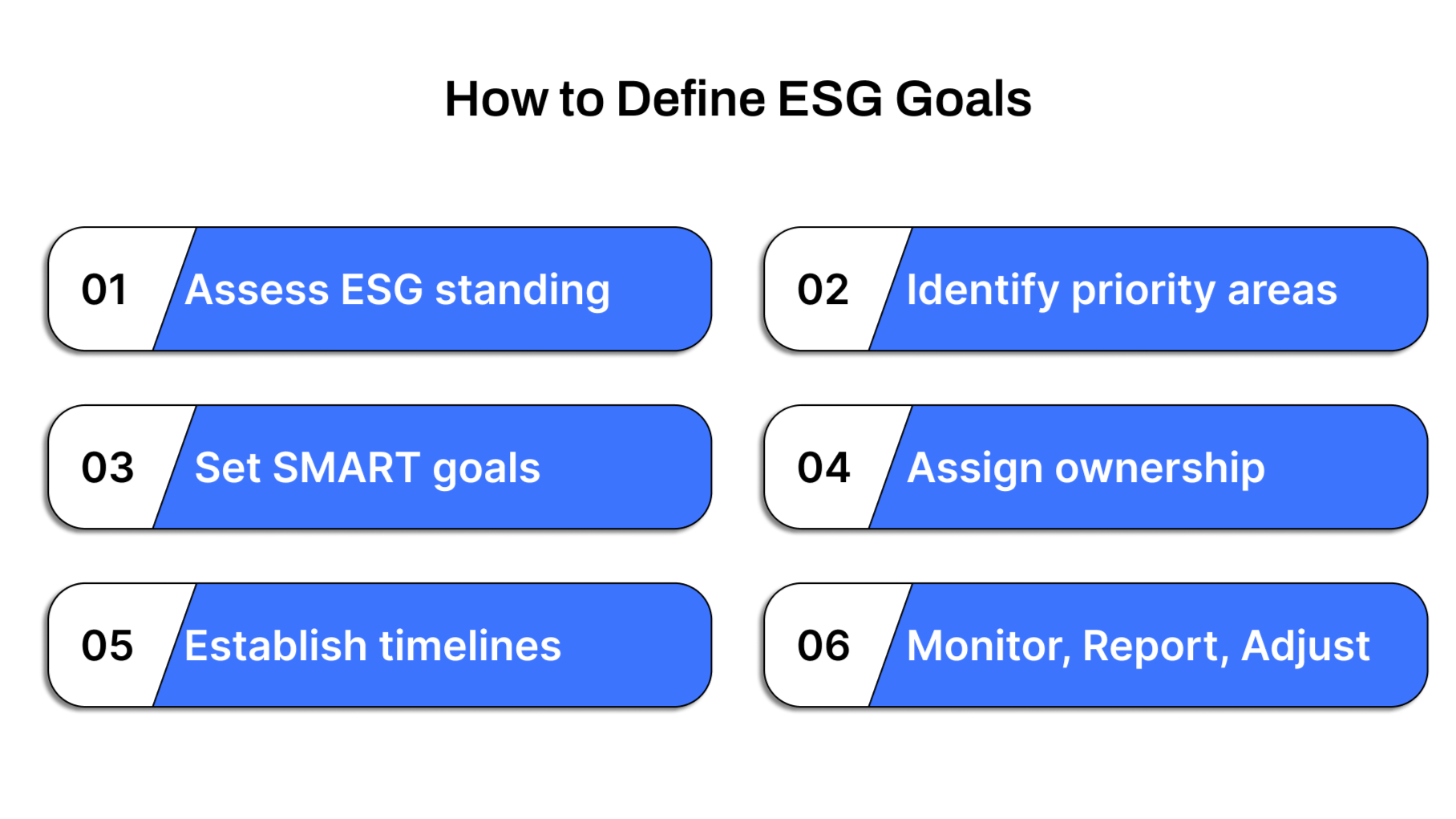

Establishing effective ESG (Environmental, Social, and Governance) goals is a strategic process that must align with your company’s core mission and long-term objectives. Here’s how to define these goals with structure and purpose:

1. Assess current ESG standing

Start with a baseline assessment to understand where your organization currently stands. This helps identify existing strengths, gaps, and areas requiring immediate attention.

2. Identify priority areas

Determine which ESG focus areas matter most to your business. This may include:

Regulatory compliance

Green IT infrastructure

Carbon offsetting and emissions goals

3. Set SMART goals

All ESG targets should follow the SMART framework, Specific, Measurable, Achievable, Realistic, and Time-bound, to ensure clarity and accountability.

Many businesses struggle to evaluate vendor alignment with ESG goals, platforms like Auditive simplify that process with built-in frameworks and continuous monitoring.

4. Assign ownership and governance

Clearly define roles and responsibilities across departments. Strong governance structures are essential to drive implementation and oversight.

5. Establish timelines

Break ESG goals into phases:

Short-term (1–2 years)

Medium-term (3–5 years)

Long-term (5+ years)

This phased approach encourages regular progress reviews and reduces the risk of missed targets.

6. Monitor, Report, Adjust

Implement systems to track ESG performance. Use these insights to adjust strategies as needed, especially for long-term initiatives like achieving net-zero emissions.

ESG Regulations and Frameworks: What Companies Need to Know

As ESG expectations grow across industries, many businesses face the challenge of determining what they’re required to report, and how. This is where ESG regulations and reporting frameworks come in. They help organizations prioritize, measure, and disclose their most relevant environmental, social, and governance impacts.

At the core of this process is the materiality assessment, which guides companies in identifying which ESG issues are most significant to their business operations and stakeholders. Many global frameworks now rely on a double materiality approach, which considers both:

Impact materiality: how the company affects people and the planet

Financial materiality: how ESG risks and opportunities affect the company

Let’s look at the key ESG regulations and frameworks shaping business reporting today:

1. Corporate Sustainability Reporting Directive (CSRD)

Launched in January 2023 under the EU Green Deal, the CSRD is currently the most comprehensive ESG regulation in Europe. It applies to large companies, all listed firms (excluding micro-enterprises), and certain non-EU entities operating in the EU. These organizations must conduct double materiality assessments and report in line with the European Sustainability Reporting Standards (ESRS).

CSRD builds on the earlier Non-Financial Reporting Directive (NFRD) and expands both the scope and depth of ESG disclosures required.

2. Carbon Disclosure Project (CDP)

Founded in the UK, the CDP focuses on environmental transparency. It invites companies to voluntarily report climate-related data, like emissions, water usage, and biodiversity, via a structured questionnaire. Companies are scored from A to F, and results are made public on CDP’s platform.

Although reporting is not mandatory, CDP is influential. Many financial institutions rely on CDP data to guide sustainable investment decisions.

3. Global Reporting Initiative (GRI)

The GRI is the most widely adopted ESG reporting framework globally, used by over 70% of reporting companies. It offers a structured set of standards across:

General disclosures (e.g., organizational structure and ESG governance)

Sector-specific standards (for industries like energy, mining, agriculture)

Topic-specific standards (covering environment, labor, human rights, etc.)

While GRI reporting is voluntary, it is widely respected for its depth and stakeholder-driven development. Companies can tailor their reporting using applicable topic or sector standards, although full GRI compliance requires broader adherence.

Regional and industry-specific ESG regulations

In addition to CSRD and voluntary frameworks like CDP and GRI, sector- and country-specific ESG regulations are emerging. For example:

Germany’s Supply Chain Due Diligence Act (LkSG)

UK’s TCFD-aligned disclosures for large businesses and financial institutions

EU Sustainable Finance Disclosure Regulation (SFDR) for investment firms

Regulatory pressure is only expected to grow. Whether mandatory or voluntary, understanding which frameworks apply to your operations and how to align with them is now a critical part of ESG strategy.

Auditive supports companies looking to operationalise ESG principles by extending risk oversight to external partners and vendors.

How to Collect and Report on ESG Data

An effective ESG strategy relies heavily on accurate, well-organized data. To achieve meaningful ESG reporting, businesses need a structured process for collecting, consolidating, and analyzing information across all relevant areas.

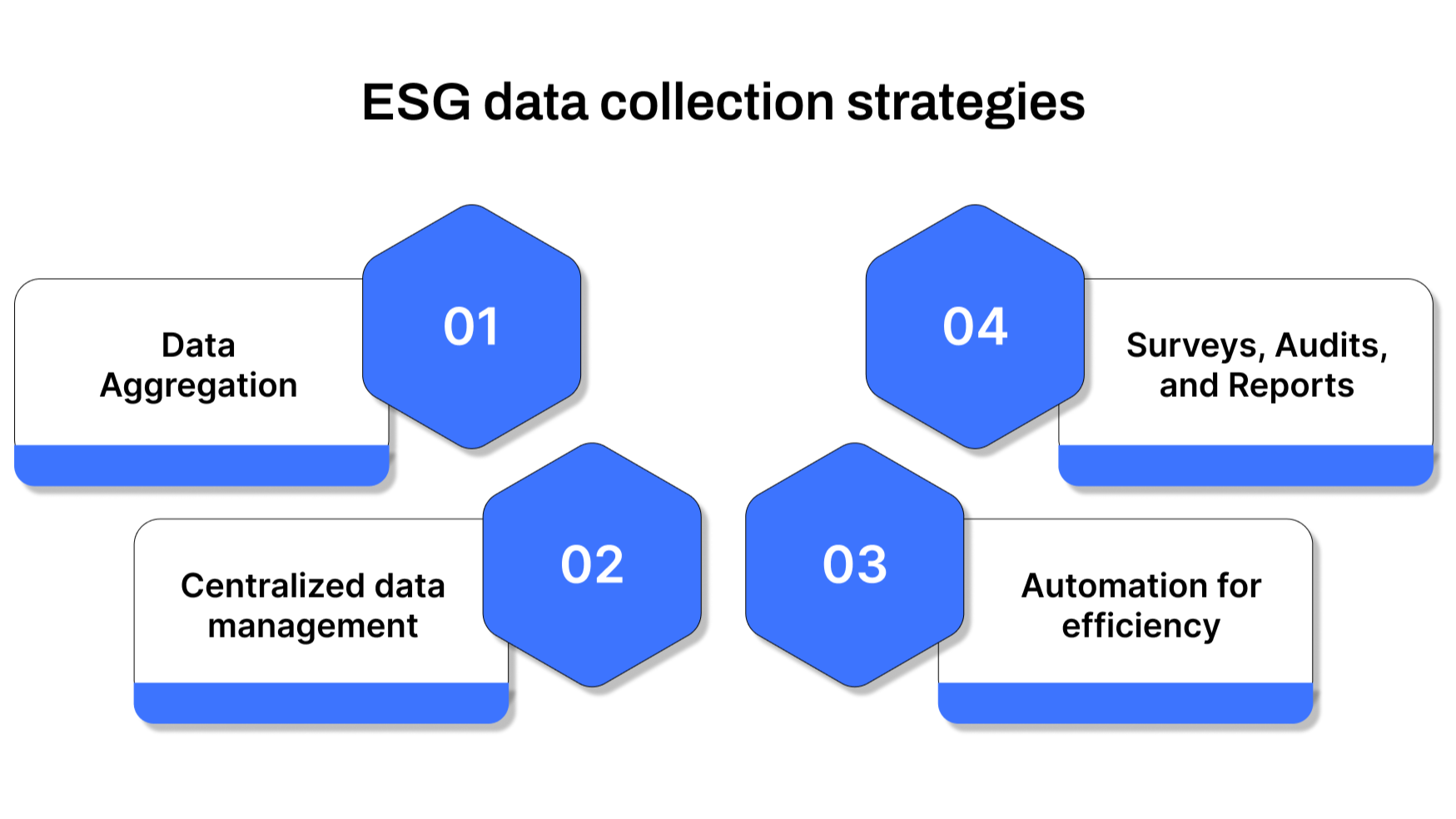

ESG data collection strategies

The specific approach can vary depending on the ESG framework you follow, but most organizations rely on a few core strategies:

Data aggregation across departments

Collect information from key internal functions like operations, HR, and finance. This ensures broad visibility into your organisation’s environmental, social, and governance impact.

Centralized data management

Using a single platform or system to consolidate ESG data improves accessibility and consistency, especially when pulling reports across business units.

Surveys, Audits, and Reports

Tools like employee feedback surveys, environmental audits, or departmental business reports can support both qualitative and quantitative ESG analysis.

Automation for efficiency

Automated tools allow for real-time tracking and reduce human error in data entry. This is particularly useful for large enterprises with dynamic ESG reporting needs.

ESG reporting: Where to start

Reporting obligations depend on your location, industry, and company size. Here's a simple guide to navigating ESG reporting standards:

If you're covered by CSDR (Corporate Sustainability Reporting Directive)

You must comply with the European Sustainability Reporting Standards (ESRS). These are mandatory for qualifying companies operating in or connected to the EU.

If CSDR doesn't apply

You can choose from voluntary standards. The Global Reporting Initiative (GRI) is one of the most comprehensive and widely used.

For issue-specific reporting

If you already know your key environmental challenges, frameworks like CDP (Carbon Disclosure Project) may be more relevant.

For product-level environmental analysis

Tools can help you conduct Life Cycle Assessments (LCA) and identify which aspects of your products have the greatest environmental impact.

Conclusion

Understanding ESG regulations is just the start; executing them effectively means managing third-party exposure, tracking real-time data, and aligning with trusted frameworks.

Auditive makes this seamless. Our platform offers advanced Vendor Risk Management and a unified Trust Center that helps you evaluate, monitor, and report on ESG compliance across your entire network faster and with more confidence.

See how Auditive transforms ESG and third-party compliance. Schedule your demo today.

FAQs

Q1. What does ESG regulation mean?

A1. ESG regulation refers to rules and frameworks that govern how companies report and manage their environmental, social, and governance responsibilities. These regulations ensure transparency and accountability in business practices.

Q2. Are ESG regulations mandatory for all companies?

A2. Not all ESG regulations are mandatory. For example, the Corporate Sustainability Reporting Directive (CSDR) applies to certain companies operating in the EU. Others may follow voluntary frameworks like GRI, CDP, or SASB, depending on their goals and industry.

Q3. What are the three pillars of ESG?

A3. The three key ESG pillars are:

Environmental: impact on the planet

Social: treatment of employees, communities, and customers

Governance: ethical leadership, compliance, and transparency

Q4. How should companies collect ESG data?

A4. Companies should collect ESG data through a combination of department-level inputs, surveys, environmental audits, and automated tools. A centralized system is recommended for consistent aggregation and analysis.

Q5. How does Auditive support ESG compliance?

A5. Auditive helps organizations assess and manage vendor ESG risk using industry-relevant frameworks. Its Trust Center offers real-time visibility into third-party performance, streamlining compliance and improving reporting accuracy.