Understanding Captive Insurance and Third-Party Risk Management

Risk is no longer confined within the walls of an organization. As businesses scale and operations become increasingly dependent on third-party vendors, suppliers, and service providers, managing risk across the extended enterprise has become mission-critical. At the same time, many forward-looking organizations are turning to captive insurance, a self-insurance model, as a strategic way to gain more control over their risk financing and coverage.

But how do these two concepts connect?

This blog explores the evolving intersection of captive insurance and third-party risk management. We’ll unpack what captive insurance is, why third-party risk matters more than ever, and how integrating the two can empower organizations to build more resilient, cost-effective, and compliant risk programs.

No matter if you're a CFO, risk officer, or procurement leader navigating complex vendor ecosystems, understanding this relationship can open the door to smarter risk strategy.

Overview

Captive insurance offers businesses control over risk and long-term cost savings, but its success depends on accurate risk data.

Third-party vendors introduce complex and dynamic risks that must be continuously assessed to align with captive strategies.

Integrating TPRM and captive insurance enables smarter underwriting, proactive mitigation, and greater ROI on captive programs.

Tools like Auditive provide the real-time visibility and centralized oversight required for effective vendor risk management.

With platforms like Auditive, organizations can transform third-party uncertainty into a strategic, insurable asset.

What Is Captive Insurance?

Captive insurance is a form of self-insurance where a company creates its own licensed insurance entity to finance and manage its risks. Instead of purchasing policies from a traditional commercial insurer, the company essentially insures itself, setting its own terms, premiums, and coverage limits.

There are different types of captives, including:

Single-parent captives owned and operated by one company.

Group captives jointly owned by multiple organizations with shared risk profiles.

Rent-a-captives are where businesses can "rent" a cell within a larger captive structure to gain coverage without forming their own.

Captive insurance offers several benefits, including:

Greater control over risk management

Improved cash flow and cost savings

Coverage for difficult-to-insure or unique risks

Transparency into claims and reserves

Potential profit from underwriting returns

In highly regulated industries or those with high exposure to third-party liabilities, captive insurance enables a more customized, strategic approach to mitigating and funding risk. It’s especially useful when traditional insurers overcharge or refuse coverage for nuanced or evolving risks, such as cyberattacks originating from vendors or regulatory violations tied to supply chains.

Why Third-Party Risk Management is Critical Today?

As organizations increasingly rely on vendors, contractors, and cloud-based services, the surface area for risk has dramatically expanded. A single third-party failure, whether it’s a supplier data breach, regulatory lapse, or operational disruption, can trigger cascading consequences across the business.

Third-party risk management (TPRM) is the structured process of identifying, assessing, monitoring, and mitigating the risks posed by external partners. These risks can fall under various categories:

Cybersecurity risks (data breaches, ransomware)

Regulatory and compliance risks (GDPR, HIPAA, SOX)

Operational risks (service interruptions, delivery delays)

Reputational risks (association with unethical or illegal practices)

Financial risks (supplier insolvency, fraud)

Why is TPRM more essential than ever?

Supply chains are global and deeply interlinked. A disruption in one vendor can impact multiple departments or regions.

Regulators are tightening third-party oversight. Non-compliance often results in legal penalties, even if the error originated with a third party.

Vendor-related cyberattacks are on the rise. Many high-profile breaches trace back to compromised third-party systems.

Business continuity hinges on vendor performance. Whether it’s SaaS downtime or supplier stockouts, third-party issues can halt operations.

This is where the synergy between captive insurance and third-party risk management becomes powerful. Companies can tailor captive policies to cover risks originating from external relationships, offering an added layer of financial protection when third-party incidents occur.

The Link Between Captive Insurance and Third‑Party Risk

As organizations expand their networks of vendors, partners, and outsourced providers, the risk exposure tied to third parties continues to grow, especially in highly regulated sectors like healthcare, finance, and manufacturing. Captive insurance offers a powerful mechanism to manage these third-party risks by internalizing the cost of potential failures while aligning incentives for proactive risk management.

Here’s how captive insurance and third-party risk management (TPRM) converge to build stronger operational resilience:

1. Customized coverage for vendor-driven risks

Traditional commercial insurance policies often fall short when it comes to covering nuanced third-party risks, especially those that stem from supply chain disruptions, vendor data breaches, or compliance violations. Captives allow organizations to design bespoke insurance programs that explicitly address gaps in vendor-related exposures, including:

Cyberattacks triggered via third-party software or APIs

Regulatory penalties arising from supplier non-compliance

Operational downtime due to key vendor outages

This flexibility ensures that organizations aren’t at the mercy of generic exclusions or limited claims processes.

2. Financial alignment with risk visibility

Captives work best when the insured party has clear, measurable insight into where risk originates. With strong third-party risk management frameworks in place, organizations can use vendor data to inform the design of captive programs, pricing premiums, setting limits, and allocating reserves based on real-world risk.

For example, if a company regularly assesses vendor security maturity or compliance levels, it can adjust captive underwriting criteria accordingly, improving cost control and risk predictability.

3. Enhanced risk retention and faster claims handling

Captives give companies control over how claims are assessed, approved, and paid. This autonomy is particularly valuable in third-party incidents where external insurance carriers might delay or deny claims due to unclear liability or limited contract visibility.

With a captive in place, businesses can act faster in recovering from supplier failures.

Claims related to vendor issues can be handled internally, avoiding lengthy dispute processes with commercial carriers.

4. Strategic leverage in risk negotiation

Companies with mature captives can leverage their own risk financing structure as a negotiation tool with vendors. By proving they’ve allocated funds to cover certain categories of third-party risk, they can demand higher standards of compliance, documentation, and transparency from suppliers.

This leads to improved contract terms, better service-level agreements (SLAs), and reduced ambiguity in case of disputes or disruptions.

Effective captive insurance relies on clear, timely vendor risk data. That’s where Auditive strengthens your strategy, offering real-time monitoring, a centralized Trust Center, and continuous compliance insights to help you quantify third-party exposure and inform smarter captive decisions.

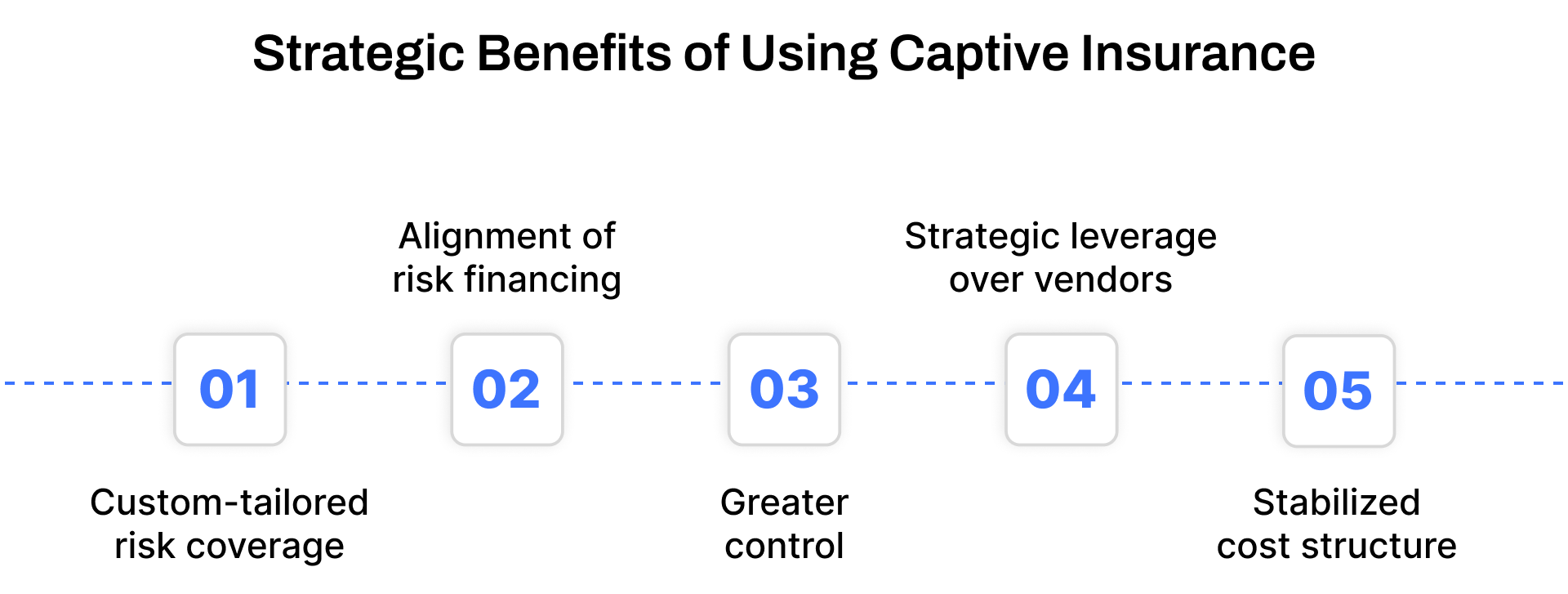

Strategic Benefits of Using Captive Insurance for Third-Party Risk

Captive insurance becomes particularly powerful when paired with a robust third-party risk management (TPRM) program. The following benefits highlight how this strategic pairing elevates corporate resilience and control:

1. Custom-tailored risk coverage

Captive programs enable organizations to design risk transfer solutions explicitly for third-party exposures that traditional insurers often exclude or price poorly. This includes vendor-related cyber breaches, supply chain disruptions, compliance violations, and service outages. Captives provide flexibility to underwrite these risks under terms that reflect actual business realities.

2. Alignment of risk financing with actual exposure

Captive premiums and reserves can be calibrated using real-time vendor risk intelligence. Organizations with mature TPRM programs feed risk ratings, compliance data, and vendor behavior trends into captive decision models, ensuring financial coverage aligns tightly with true exposure.

3. Greater control & accelerated claims resolution

When third-party incidents occur, captives allow organizations to manage claim handling and payouts directly. This reduces reliance on external insurers and minimizes delays or disputes. Faster claims decisions help mitigate downstream impacts on operations and relationships.

4. Strategic leverage over vendors

Having a captive program signals preparedness and financial capability to manage external risk. This creates leverage in contract negotiations, enabling organizations to enforce higher vendor compliance, tighter SLAs, and better documentation standards as conditions for engagement.

5. Stabilized cost structure in hard insurance markets

Captives mitigate premium volatility by internalizing risk. In hard-market conditions, such as cyber or liability insurance crunches, companies with captives maintain coverage stability and cost predictability over time.

Accurate third-party risk data is essential to maximizing captive effectiveness. Auditive bridges that gap with continuous vendor monitoring, a centralized Trust Center, and risk assessment mapped to business-relevant compliance frameworks.

Key Considerations Before Leveraging Captives for Third-Party Risk

While captive insurance offers powerful advantages, especially when paired with third-party risk management (TPRM), it's not a one-size-fits-all solution. Companies must evaluate a number of critical factors before integrating captives into their risk strategy:

1. Regulatory and Compliance requirements

Captives are subject to complex and varying regulatory frameworks depending on the domicile (onshore or offshore). Organizations must ensure compliance with local insurance regulations, tax laws, and solvency requirements. When third-party risk is involved, such as vendors or service providers, this adds another layer of compliance scrutiny that must be carefully managed.

Tip: Organizations with a strong compliance culture and mature vendor governance models are better positioned to meet regulatory expectations tied to captive use.

2. Vendor risk visibility and Data quality

A captive is only as good as the data that feeds it. Companies must have robust vendor risk assessment and monitoring systems in place before transferring that risk into a captive. This includes accurate vendor profiling, real-time risk scoring, and reliable incident tracking.

This is where platforms like Auditive offer real strategic lift by centralizing risk data, continuously monitoring vendor performance, and surfacing red flags in real time. This intelligence enables more informed decision-making when structuring or adjusting captive coverage.

3. Internal resource readiness

Running a captive involves actuarial modeling, claims processing, reporting, and governance. These responsibilities often require dedicated risk, legal, and finance professionals. Before launching a captive for third-party risk, evaluate whether internal teams have the time, tools, and expertise to handle this operational load, or whether partnerships with captive managers are required.

4. Cost-benefit justification

Captives require startup capital, ongoing operating costs, and a clear ROI narrative. When applied to third-party risk, organizations must justify how internalizing this specific risk results in financial or operational gains, such as lower total cost of risk (TCOR), faster claims handling, or fewer vendor-driven losses.

5. Alignment with broader Enterprise Risk Management (ERM)

Captive insurance for TPRM should not operate in isolation. It needs to be tightly integrated into the organization’s broader ERM framework. That means alignment on risk appetite, strategic priorities, and reporting structures. A siloed captive may miss key interdependencies between third-party exposures and other enterprise risks like cybersecurity or business continuity.

Auditive’s Role in Modern TPRM for Captive Insurance Success

When it comes to powering a data-informed captive insurance strategy, Auditive is more than just a risk management tool; it’s a strategic asset. The platform delivers continuous third-party risk visibility, enabling risk and procurement teams to make smarter, faster decisions about which vendor risks to retain, mitigate, or insure.

Here’s how Auditive aligns with captive insurance goals:

Real-Time Risk Intelligence: Auditive’s always-on monitoring identifies vendor compliance issues, financial instability, or cyber exposure before they become claims. This proactive insight helps refine actuarial models and coverage triggers inside the captive.

Trust Center Integration: With a centralized Trust Center, teams can consolidate vendor profiles, performance metrics, and compliance documentation, which is critical for quantifying risk exposure across the supply chain.

Streamlined Risk Reporting: Auditive's dashboards and alerts simplify how organizations track, measure, and communicate third-party risk trends, fueling more transparent governance and captive reporting.

Better Coverage Justification: By turning vendor risks into measurable data points, Auditive helps organizations build a clear rationale for coverage levels, premium allocations, and captive structure decisions.

Result? Your captive becomes smarter, not just a fallback for risk, but a well-informed tool to convert vendor uncertainty into operational resilience.

Conclusion

Captive insurance isn’t just about reducing premium costs; it’s about gaining control over risk and building long-term resilience. When integrated with a proactive third-party risk management (TPRM) program, captives can deliver even more value by turning vendor exposure into measurable, insurable events.

But to do this effectively, you need deep, real-time visibility into your third-party ecosystem. That’s where Auditive comes in. With its Trust Center and robust Vendor Risk Management capabilities, Auditive empowers risk and compliance teams to continuously assess, monitor, and act on vendor threats. This clarity doesn't just support your TPRM, it strengthens your captive strategy from the inside out.

Want to make smarter captive decisions with better third-party risk intelligence?

Schedule a demo with Auditive today and see how real-time vendor insights fuel smarter risk financing.

FAQs

Q1. How does third-party risk impact captive insurance programs?

Vendor-related disruptions, compliance failures, or cybersecurity events can lead to claims. Understanding these risks allows for more accurate coverage modeling and pricing in a captive.

Q2. Why integrate TPRM with captive insurance?

It enables organizations to convert vendor risk into structured data, supporting better decisions on what to insure, what to retain, and how to mitigate.

Q3. Can software improve captive risk modeling?

Yes. Platforms like Auditive offer real-time risk insights that help actuarial teams adjust coverage levels, loss assumptions, and claim forecasting.

Q4. What is the role of Auditive’s Trust Center?

It centralizes vendor data, compliance documents, performance metrics, red flags, giving teams a single source of truth to monitor and manage third-party exposure.

Q5. Is Auditive suitable for organizations without a captive?

Absolutely. Even without a captive, Auditive enhances third-party risk oversight, making your procurement, legal, and compliance operations stronger and more resilient.