Enterprise Risk Management: Integrating with Strategy and Performance

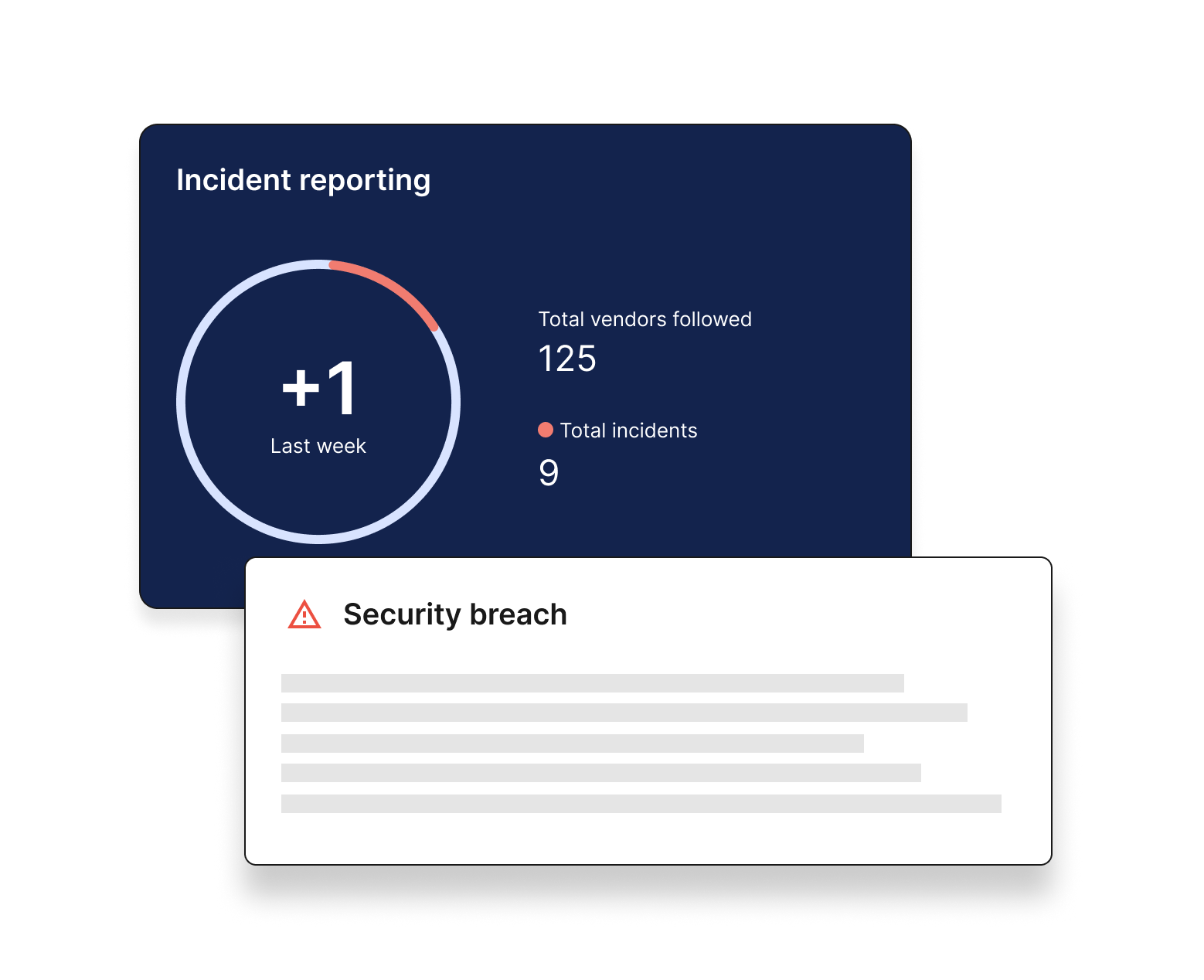

Free daily incident reporting

Monitor your partners daily for security breaches, adverse media, financial news and more

Enterprise Risk Management (ERM) is evolving into a dynamic discipline that must be smoothly integrated with strategic planning and organizational performance. Today, AI-powered tools simplify ERM processes by reducing manual workloads and enabling real-time insights. Key benefits include faster risk assessments, improved vendor data accuracy, and better documentation.

Key takeaways:

Aligning ERM with strategy fosters resilience and strategic clarity.

Embedding ERM improves agility, decision-making, and stakeholder trust.

Real-time platforms simplify the identification and tracking of risks.

Auditive is at the forefront of this shift, offering 4× faster assessments, 80% fewer security questionnaires, and up to 35% more accurate vendor responses. By automating documentation and workflows, Auditive helps organizations drive smarter, risk-informed strategies.

Organizations face immense pressure to respond swiftly to disruptions, regulatory shifts, and shifting stakeholder expectations. Enterprise Risk Management (ERM) has emerged as a strategic necessity, not only for compliance but also for achieving a competitive advantage and sustainable performance.

ERM is no longer confined to risk registers or annual audits. Instead, it must be embedded throughout the organization’s strategy, culture, and operational processes. Failing to integrate ERM with strategic decision-making leads to fragmented priorities, reactive firefighting, and missed opportunities.

This blog is a comprehensive guide to integrating enterprise risk management with strategy and performance. It outlines frameworks, provides real-world examples, offers practical advice, and outlines implementation steps to help organizations align ERM with their long-term objectives.

What is Enterprise Risk Management?

Enterprise Risk Management (ERM) is a structured, organization-wide approach to identifying, assessing, managing, and monitoring the risks that may impact strategic goals and overall performance. Unlike traditional siloed risk functions, ERM integrates risk considerations into daily business processes and long-term planning.

ERM enables leaders to manage uncertainties, capitalize on emerging opportunities, and enhance decision-making. It spans various risk domains, including operational, financial, reputational, and compliance-related risks.

Modern ERM programs emphasize dynamic risk sensing and continuous monitoring, both of which are critical in an era marked by rapid technological, economic, and geopolitical shifts. Organizations are increasingly using advanced tools to automate risk detection, reporting, and response. With ERM integrated into core decision-making, companies can stay resilient and maintain a competitive edge in uncertain markets.

Importance of Embedding ERM in Organizational Strategy

Embedding ERM into strategy enhances organizational agility and foresight. Instead of reacting to disruptions, companies can proactively shape outcomes. Here’s why this integration is critical:

Stronger strategic execution: Risk-informed strategies are more likely to succeed because they factor in potential roadblocks and prepare mitigation plans in advance. This increases the chances of strategic success.

Third-party risk management (TPRM) platforms, like Auditive, enhance this capability by providing real-time visibility into vendor and partner risks, enabling organizations to address dependencies that could derail strategic initiatives. Learn more—>Cross-functional collaboration: ERM integration promotes collaboration among departments, including finance, operations, compliance, and IT. Shared risk language and data unify efforts toward common goals.

Accelerated decision-making: By mapping risks to strategic initiatives, leaders can make faster and more confident decisions. This is especially critical in rapidly evolving industries like technology, healthcare, and financial services.

Investor and stakeholder confidence: Transparent ERM practices signal to stakeholders that the organization is well-managed and future-focused. This boosts credibility and trust.

Also read: Enterprise Risk Management Strategies for Financial Institutions

Schedule a demo

See our modern third-party risk management platform in action

Guide for Enterprise Risk Management: Integrating with Strategy and Performance

ERM and internal controls should not operate in silos. Their integration strengthens compliance, risk monitoring, and performance tracking.

Steps to achieve alignment:

Clarify risk ownership: Assign specific risk and control responsibilities to business units, ensuring there is no ambiguity or overlap. Each control should have a corresponding risk owner who understands strategic implications.

Link controls to strategic goals: Instead of generic compliance checklists, tailor controls to safeguard mission-critical initiatives and objectives. Auditive supports this by reducing manual workflows in risk identification and documentation, making it easier to design and implement controls that are both strategic and scalable.

Its automated features help map specific controls to business priorities while ensuring continuous alignment with evolving risks.Incorporate COSO principles: The COSO Internal Control-Integrated Framework provides a structured approach to embed controls throughout all levels of the organization. Use this to ensure design effectiveness and continuous improvement.

Audit and monitor continuously: Use automated tools to track control effectiveness, identify breakdowns, and implement corrective actions. Real-time monitoring improves agility.

Effective ERM Program Implementation

Implementing an ERM program involves much more than technology adoption or risk registers. It requires a cultural shift and systematic execution.

Follow these key steps:

Secure executive sponsorship: Begin by aligning ERM objectives with the CEO and board. Their support ensures budget, visibility, and organizational buy-in.

Develop a risk taxonomy: Create a standardized language for identifying and categorizing risks. This enables consistency in reporting and analysis.

Integrate with planning cycles: Sync ERM reviews with annual budgeting, strategic planning, and performance reviews to ensure seamless alignment. This avoids duplication and embeds ERM in core processes.

Deploy technology solutions: Credible TPRM platforms like Auditive offer centralized dashboards, automated workflows, and analytics that accelerate adoption and improve visibility. These capabilities simplify implementation and deliver up to 35% more accurate vendor responses, as well as 80% fewer security questionnaires, thereby enhancing efficiency across the board.

Train and communicate: Provide training for all organizational levels and maintain open lines of communication. Use real-world examples to illustrate how ERM informs daily decisions.

Common challenges include siloed data, resistance to change, and unclear metrics. Solutions include phased rollout, cross-training, and a strong change management plan.

Also read: Effective Vendor Onboarding Strategies to Minimize Security Risks

Frameworks for Aligning ERM with Strategic Objectives

To achieve alignment between ERM and strategy, organizations must shift from reactive risk identification to proactive risk-informed decision-making. The COSO ERM Framework is a widely accepted structure that provides the foundation for this integration.

Besides COSO ERM, key frameworks include Operational Risk Management, IT Risk Management, Project Risk Management, and Supply Chain Risk Management. Together, they support proactive, strategic risk management across various organizational areas.

Key elements of alignment include:

Defining risk appetite and tolerance: Organizations must clearly define the level of risk they are willing to accept in pursuit of their strategic objectives. This helps leaders make consistent and balanced decisions that align with the organization’s values and long-term vision.

Embedding risk into strategic planning: Risk considerations must be integrated at every stage of strategy development, from market analysis and goal setting to resource allocation and performance measurement. Risk-adjusted strategies create more resilient business plans.

Aligning risk with performance metrics: Traditional KPIs focus on revenue, market share, or operational efficiency. However, strategic KPIs should also account for risk exposure, mitigation effectiveness, and resilience indicators. This creates a holistic view of performance.

Establishing governance structures: Boards, executive teams, and business units must have defined roles in ERM implementation. Governance frameworks ensure accountability, transparency, and consistent execution.

Compendium of Examples: ERM Framework in Action

The theory behind ERM frameworks is best understood through real-world examples. The following organizations demonstrate how integrating ERM into strategy and performance delivers measurable results:

Multinational manufacturer: This organization embedded ERM into its global expansion strategy, using geopolitical risk assessments, supply chain resilience scoring, and scenario analysis. As a result, it avoided overexposure in politically unstable regions and secured long-term vendor contracts in advance.

Healthcare provider: In response to increased regulatory scrutiny and cybersecurity threats, the organization employed ERM to identify critical risks, integrate them into digital transformation plans, and prioritize resource allocation. Cyber incidents dropped by 40%, and compliance audit scores improved.

Technology firm: The company implemented an ERM dashboard to monitor risks related to product innovation, intellectual property, and customer data. These insights enabled them to align R&D spending with risk-adjusted return on investment (ROI), resulting in improved launch success rates.

Real-World Advice on ERM Integration

Implementing Enterprise Risk Management (ERM) establishes a framework and embeds risk thinking into everyday strategic decisions. Successful integration requires more than theory; it demands practical application. Let’s examine how industry leaders have effectively integrated ERM into their core strategies and operations:

1. Microsoft: Linking Risk with Innovation and Strategy

Industry: Technology

Key insight: Aligning ERM with product development and innovation strategy.

Microsoft’s ERM model is tightly integrated with its strategic planning and innovation cycles. Rather than treating ERM as a compliance requirement, the company uses it to assess future technology risks, geopolitical factors, cybersecurity threats, and intellectual property concerns before entering new markets or launching products.

Lesson: Invite your risk team early into strategic discussions, especially during planning or product innovation stages.

2. Marriott International: Risk Ownership and Business Continuity

Industry: Hospitality

Key insight: Decentralized risk ownership coupled with strong governance.

Marriott’s ERM program stands out for delegating risk ownership to local and regional managers, who are closest to the operational pulse. Each property or region maintains its risk register, but the data flows upward into a central governance system that evaluates enterprise-level exposure.

Lesson: Empower local leaders with risk ownership while maintaining centralized visibility and governance.

Tips for integrating ERM effectively:

Start with a high-impact business unit to pilot ERM alignment.

Establish a cross-functional ERM committee to ensure consistent rollout.

Use technology to automate risk reporting and scenario analysis.

Communicate the strategic value of ERM to gain leadership support.

These real-world case studies demonstrate that when done right, ERM protects value and helps create it. Successful integration requires both top-down sponsorship and bottom-up engagement.

Also read: Enterprise Risk Management 101 for Credit Unions

How Auditive Supports Enterprise Risk Management

Many organizations struggle with fragmented risk workflows, repetitive vendor assessments, and outdated documentation processes. These inefficiencies delay strategic planning, introduce compliance gaps, and increase operational risk exposure.

Source: Auditive

Auditive addresses these challenges by offering an AI-powered platform specifically designed to streamline and elevate ERM practices. By automating vendor risk assessments, mapping controls to strategic goals, and centralizing documentation, Auditive minimizes manual effort while enhancing visibility and accuracy.

Impact of Auditive on ERM:

4× faster risk assessments: Enables teams to conduct evaluations quickly, ensuring real-time risk insights for decision-makers.

80% fewer security questionnaires: Reduces the burden on internal and external stakeholders, accelerating third-party risk reviews.

Up to 35% more accurate vendor responses: Improves data integrity and supports better compliance and vendor performance analysis.

By integrating seamlessly with ERM frameworks and strategic objectives, Auditive transforms risk management from a reactive function to a proactive driver of business resilience and innovation.

Conclusion

Integrating enterprise risk management with strategy and performance equips organizations to thrive amid uncertainty. Rather than viewing risk as a barrier, progressive companies harness ERM as a catalyst for innovation, growth, and resilience.

By aligning ERM with strategic goals, embedding it in governance and internal controls, and incorporating real-time insights, organizations can make more informed decisions that strike a balance between risk and opportunity.

Auditive empowers organizations with Vendor Risk Management and Trust Center tools to take this next step. Auditive helps businesses operationalize ERM at scale, delivering assessments 4× faster, reducing security questionnaires by 80%, and improving vendor response accuracy by up to 35%.

Remove the guesswork from risk management. Explore how Auditive can help you move from reactive to resilient. Schedule a free demo to see how Auditive can elevate your enterprise risk management journey.

Schedule a demo

See our modern third-party risk management platform in action