Comprehensive Guide to Identifying and Managing Business Risks

“What could possibly go wrong?"

It’s a question every smart business leader learns to ask, not out of pessimism, but out of preparedness. Because in reality, things do go wrong. Supply chains break, regulations change overnight, vendors drop the ball, and cyber threats don’t take weekends off.

Identifying and managing business risks isn’t just an operational necessity; it’s a strategic advantage. The organizations that anticipate what’s coming, assess their exposure, and respond with clarity are the ones that stay standing when others falter. This guide breaks down what business risks really are, why they matter, and how to build a practical framework to stay ahead of them confidently and consistently.

Overview

Business risks can disrupt operations, damage reputation, and impact long-term growth if left unmanaged.

Effective risk management starts with identifying threats, analyzing impact, and prioritizing based on severity.

Risks can be qualitative (like reputational harm) or quantitative (like financial loss) both need tailored assessment methods.

Managing risk requires a clear treatment plan, collaboration across teams, and ongoing monitoring.

Tools like Auditive help organizations automate vendor risk management, centralize control, and build trust through a unified trust center.

What is Business Risk?

Business risk is the possibility that something, internal or external, will interfere with a company’s ability to meet its goals. It’s the uncertainty that creeps into operations, finances, strategy, or compliance and threatens performance, growth, or even survival.

These risks don’t always come with warning signs. A flawless product launch can stumble due to a supplier issue. A well-funded startup might lose momentum because of sudden market shifts. Even a minor compliance oversight can spiral into a regulatory headache. Business risks take many forms, some loud and immediate, others quiet and long-term, but all of them carry the potential to disrupt.

Understanding what qualifies as a business risk is the first step toward managing it. It’s not just about avoiding disasters; it’s about recognizing where vulnerabilities exist so decisions are informed, deliberate, and resilient.

Why is Risk Identification and Management Important?

You can’t fix what you can’t see.

Risk identification is the first real step toward business resilience, not just recognizing what could go wrong but understanding how those risks connect to operations, people, and outcomes. Without clear visibility into potential threats, even the best-laid plans are built on guesswork.

Risk management takes that awareness further. It’s not just about damage control; it’s about building stability, earning stakeholder trust, and turning uncertainty into opportunity. A business that understands its risk profile can respond faster, protect what matters, and make confident decisions when pressure hits.

The truth is, risk doesn’t wait.

Regulations shift, vendors fail, and technologies change. But with the right structure in place to identify and manage risks early, businesses are better equipped to stay on course and sometimes even ahead of it.

Benefits of Risk Identification and Management

Business success isn’t just about seizing opportunities; it’s also about spotting the threats early enough to do something about them. That’s what makes risk identification and management such a critical part of how resilient companies operate. By recognizing risks before they escalate, leaders don’t just avoid problems; they make smarter decisions, protect resources, and stay one step ahead of disruption.

Here’s what that looks like in action:

Proactive decision-making

When risks are flagged early, leadership isn’t forced into a corner. Decisions can be made deliberately, not defensively. Planning ahead becomes part of the process, not an emergency response.

Enhanced preparedness

Knowing what might go wrong allows teams to build out contingency plans and test their crisis response well in advance. This kind of preparedness helps organizations absorb shocks instead of scrambling when something breaks.

Smarter use of resources

Early risk identification helps prioritize what matters. Instead of spreading teams and budgets too thin, companies can allocate people, time, and funding where it’s needed most, reducing waste and reinforcing high-risk areas.

A competitive edge

Companies that manage risk well are simply harder to knock off balance. That steadiness appeals to customers, investors, and partners alike. It shows up in better relationships, stronger compliance, and more reliable execution under pressure.

Stronger communication and culture

When risk discussions are baked into everyday operations, not just board meetings, it builds a culture of openness and accountability. Teams become more aligned, cross-functional collaboration improves, and risk stops being “someone else’s job.”

Fewer nasty surprises

Blind spots are costly. A proactive approach means fewer fire drills, fewer sleepless nights, and a lot less guesswork when things start to shift.

Risk management isn't just about worst-case scenarios; it’s also about creating clarity and confidence in how decisions get made. And with the right tools and visibility, organizations can scale that capability across business units and supplier ecosystems.

That’s exactly where platforms like Auditive help raise the bar, by operationalizing risk visibility and building trust into the process itself.

Types of Business Risks

Business risks don’t always announce themselves with warning signs. They show up in the numbers, in small missteps, in market shifts, or in missed regulatory updates. To manage risk well, you need to understand what you’re dealing with. Here’s a closer look at the major types of business risks and how they impact organizations, along with strategies to stay one step ahead.

1. Financial risks

Finance is the lifeblood of any organization and also its most exposed nerve. Financial risks come in many forms, and even a small slip can cause a chain reaction.

Market Volatility: Price fluctuations in raw materials, currency instability, or shifts in demand can leave budgets in disarray.

Credit Defaults: When clients or partners don’t pay on time, or at all, it strains cash flow and slows growth.

Budget Mismanagement: Overestimating revenue or underestimating expenses can erode margins quickly.

The antidote? Rigorous forecasting, diversified income streams, and built-in buffers that give teams room to maneuver when surprises hit.

2. Operational risks

These are the day-to-day threats that emerge from inside the business. Often overlooked, operational risks can quietly disrupt productivity or customer experience.

Supply Chain Disruptions: A single supplier delay or logistics hiccup can throw off entire production schedules.

Process Failures: Legacy systems, poor maintenance, or gaps in internal workflows often result in wasted time and missed opportunities.

Human Errors: Lack of training, overwork, or unclear protocols can lead to costly mistakes, and they add up fast.

Operational risks aren’t exciting, but managing them well is what separates disciplined organizations from chaotic ones. Streamlined processes, cross-functional transparency, and smart automation are critical here.

3. Strategic and Reputational risks

Every growth plan is a gamble. When strategies fall flat or public trust gets shaken, the impact is long-term.

Strategic Missteps: Misreading market needs, launching too soon, or failing to pivot can stall momentum.

Failed M&A Moves: Cultural misalignment, unclear roles, or integration issues often tank potential synergies.

Reputational Damage: One viral customer complaint, unethical decision, or poor executive response can erode credibility fast.

Protecting reputation isn’t just about PR; it’s about values, consistency, and transparency at every level. The best leaders treat brand trust like capital; it takes time to earn and seconds to lose.

4. Emerging risks

Some risks don’t exist until they do. Businesses today must deal with threats that barely registered on the radar a few years ago.

Cybersecurity Threats: Sensitive data, digital infrastructure, and customer privacy are under constant attack.

Environmental Factors: From extreme weather to shifting compliance demands, sustainability is now a business imperative.

Technological Obsolescence: New platforms and tools emerge fast. What works today may be outdated by next quarter.

Anticipating these risks requires more than instinct; it demands real-time intelligence, scenario planning, and adaptive strategies that evolve with the environment.

5. Cultural and compliance risks

Some risks aren’t loud, but they’re deeply corrosive if left unchecked.

Cultural Risks: A toxic workplace, lack of inclusivity, or unclear leadership can damage morale and retention.

Compliance Risks: Falling short of legal, ethical, or regulatory standards isn’t just a legal issue; it’s a strategic one.

Both of these are signals of broader operational health. And when ignored, they affect everything, from hiring to investor confidence.

Business risks don’t exist in isolation. A financial slip can stem from an operational flaw, and a compliance error can spark reputational fallout. Auditive connects these dots, offering continuous monitoring across vendor, financial, and cyber domains. It gives teams the visibility they need to act early, not after the damage is done.

How to Identify Business Risks

Knowing that risks exist is only half the battle. The real challenge is recognizing them early, before they spiral into something costly. Risk identification is an ongoing discipline, not a one-time checklist. It’s about peeling back each layer of your business to uncover where weaknesses lie and how they might expose you to disruption.

1. Internal vs. External risks

Every organization deals with a mix of internal and external threats. Understanding which is which helps teams focus their energy and plan more effectively.

Internal Risks originate inside the organization, typically tied to processes, people, or technology. Examples include:

Inefficient workflows that cause delivery delays

Employee errors due to a lack of training or oversight

Legacy systems that fail under modern demands

External Risks stem from outside forces and often require rapid adaptation. These include:

Market shifts caused by inflation or recession

Cyberattacks targeting customer data

Regulatory updates that force operational changes

Classifying risks in this way enables better prioritization and makes mitigation strategies far more targeted.

2. Tools and techniques to uncover business risks

Successful organizations blend traditional methods with modern tools to surface risk early and respond decisively.

SWOT Analysis: A classic framework for exposing internal weaknesses and external threats.

Risk Mapping: Visual tools that chart risk likelihood versus impact, helping you focus on the highest-consequence items first.

Stakeholder Brainstorming: Inviting feedback from across departments ensures blind spots don’t stay hidden.

These techniques build a solid foundation, but today’s risk landscape demands more than static assessments.

3. Leveraging technology for better risk visibility

Organizations are now turning to smarter, faster ways of seeing risk before it materializes.

Predictive analytics surfaces patterns in historical data to flag future vulnerabilities.

AI-powered risk engines detect anomalies in real-time, processing volumes of data beyond human capacity.

IoT Monitoring in industries like logistics and manufacturing enables real-time tracking of environmental, supply chain, and equipment health signals.

With the right tech stack, risk detection becomes less reactive and more anticipatory.

4. Behavioral and cultural risk signals

Not all threats wear a name badge or come from the outside. Internal culture and employee behavior can quietly seed serious business risks.

Behavioral Monitoring: Unexpected spikes in file access, system changes, or policy violations may point to insider threats.

Workplace Culture Audits: A disengaged, unsupported workforce can lead to compliance issues, turnover, or misconduct. Regular assessments keep a pulse on cultural health.

It’s not just about systems; it’s about the people operating them.

5. Proactive risk identification: staying ahead of trouble

Waiting until something breaks isn’t a strategy. The most resilient businesses anticipate change and build safeguards into the process.

Scenario Planning: “What if” exercises prepare teams for everything from supply chain disruption to regulatory crackdowns.

Regular Risk Audits: These keep your view of threats updated as your business scales or shifts.

Industry Trend Monitoring: Watching emerging risks in your sector, be it AI regulation, ESG expectations, or geopolitical uncertainty, keeps you ahead of the curve.

Clear visibility is the first step toward control. Once risks are on the radar, organizations can take bold, focused action to reduce their exposure. That’s where effective risk management begins, and where platforms like Auditive help bridge the gap between awareness and action.

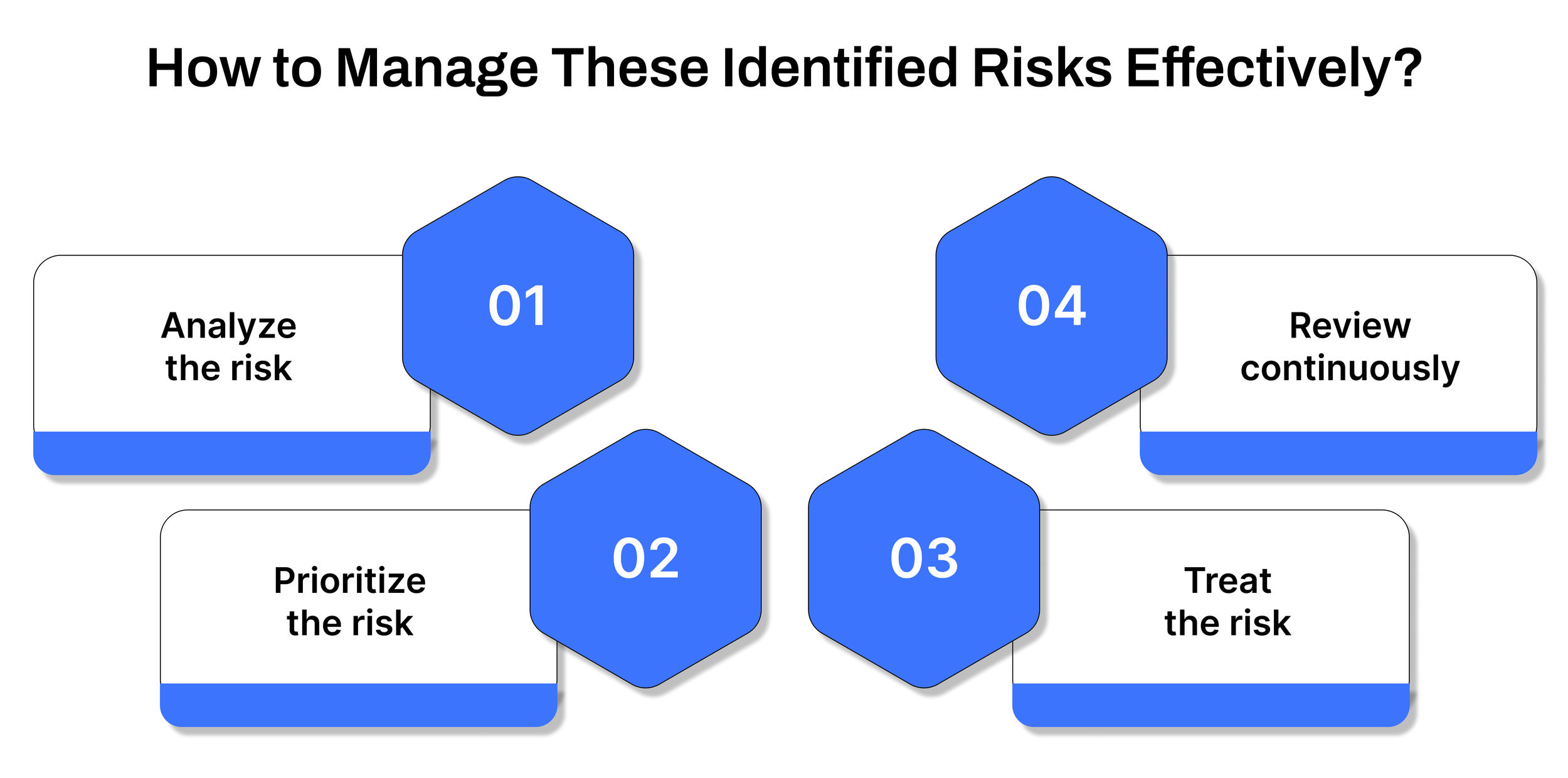

How to Manage These Identified Risks Effectively

Spotting risks is just the beginning; what truly matters is what you do next. Managing business risks isn’t about eliminating every threat. It’s about knowing which ones deserve your attention, how they connect to your operations, and how to respond before they escalate.

Here’s a practical breakdown of how to manage identified risks with clarity and consistency:

1. Analyze the risk

After a risk is identified, the first step is to understand its scope. Which systems, teams, or processes could it impact? How far could the disruption spread?

This is where risk mapping becomes essential. Organizations need to evaluate how the risk connects with internal policies, procedures, and business functions. Some risks, like a compliance breach or a major supplier failure, can bring operations to a halt. Others may cause minor delays or reputational ripples.

Without the right structure, this analysis becomes a manual, fragmented effort. But with a dedicated risk management platform, risks can be pre-mapped across documentation, workflows, and business functions. This helps teams quickly visualize impact zones and take smarter actions.

2. Evaluate and prioritize the risk

Not all risks are equal, and treating them as such leads to resource misalignment. That’s why prioritization is key.

Categorizing risks based on severity—low, moderate, or high—gives leaders a clearer picture of the organization's overall exposure. A single high-impact risk can outweigh dozens of minor ones.

There are two standard methods to evaluate risks:

Qualitative Risk Assessment:

Most risks, especially those related to reputation, strategy, or environment, can’t be fully quantified. But they still need to be assessed with objectivity. This method relies on expert judgment, experience, and predefined criteria to rank potential consequences and likelihood.

Quantitative Risk Assessment:

For financial and technical risks, numbers tell the story. These risks are assessed using data-driven models, metrics, and probability-based outcomes. Quantitative analysis is more structured and easier to automate, making it an ideal approach for finance-heavy sectors.

Bringing both approaches together, qualitative for nuance and quantitative for precision, forms the backbone of enterprise risk evaluation.

3. Treat the risk

Once you’ve sized up the risk, it’s time to act.

Risk treatment involves choosing how to respond, accept, mitigate, transfer, or eliminate. This isn’t a solo decision. It requires cross-functional input from the teams closest to the issue.

In a traditional setup, this means long email threads, scattered spreadsheets, and too many meetings that go nowhere. But a centralized risk platform simplifies everything. Stakeholders are looped in automatically, conversations are logged in one place, and leadership gets real-time visibility into proposed actions and progress.

Treatment doesn’t have to be slow. With the right structure, response times improve, miscommunications drop, and the right people are always in the loop.

4. Monitor and review continuously

Some risks evolve. Others never go away. That’s why ongoing monitoring is non-negotiable.

Manually tracking shifting risks is both exhausting and error-prone. A digital approach, on the other hand, continuously monitors signals, changes in context, and control effectiveness. This helps your team stay ahead of disruptions instead of constantly reacting to them.

Monitoring is more than just oversight; it’s about protecting business continuity, preserving trust, and ensuring accountability across all levels.

How Auditive Supports Smarter Risk Management

Manual risk workflows can’t keep up with fast-moving threats. Auditive helps you cut through the noise.

It connects risk, compliance, and procurement teams in one platform, mapping risks to actual business impact, automating third-party assessments, and surfacing the insights that matter.

With built-in vendor risk management tools and a trust center sellers can reuse across customers, Auditive reduces review cycles, improves collaboration, and keeps leadership in control, all without chasing spreadsheets.

It’s how modern teams stay ahead of risk, without the mess.

Conclusion

Business risks aren’t always avoidable, but how you identify, assess, and respond to them defines your resilience. The most successful organizations don’t wait for disruptions to strike. They build systems that reveal risks early, prioritize action, and foster alignment across teams and vendors.

If your current approach to risk feels reactive or scattered, it’s time to rethink the process.

Auditive helps companies streamline vendor risk management, strengthen cross-functional accountability, and maintain a real-time view of what matters most. With a centralized trust center, you get more than compliance; you build confidence with every stakeholder.

See how Auditive simplifies risk. Schedule a demo →

FAQs

Q1. What is a business risk?

A1. A business risk is any potential threat that could negatively affect a company’s ability to achieve its goals. This includes financial loss, operational disruption, compliance violations, or reputational damage.

Q2. Why is identifying and managing risks important?

A2. Risk management helps prevent small issues from becoming large-scale failures. It improves decision-making, ensures compliance, protects assets, and supports long-term business stability.

Q3. What are the main types of business risks?

A3. Common types include operational, financial, strategic, compliance, and reputational risks. Each requires a different response based on its nature and severity.

Q4. What’s the difference between qualitative and quantitative risk assessment?

A4. Qualitative assessments rely on expert judgment and experience to evaluate non-numerical risks (like brand damage). Quantitative assessments use data and models to measure risks numerically, especially in finance or technical operations.

Q5. How does Auditive help with business risk management?

A5. Auditive simplifies risk workflows by automating third-party evaluations, mapping risks to business processes, enabling real-time monitoring, and centralizing collaboration through its vendor risk management platform and trust center.